Australia Raises Forecast Commodity Export Income for This Year

(Bloomberg) -- Australia boosted its forecast for income from commodity exports for this year, but maintained its outlook for drops to continue until the end of this decade as lower global demand pushes prices down.

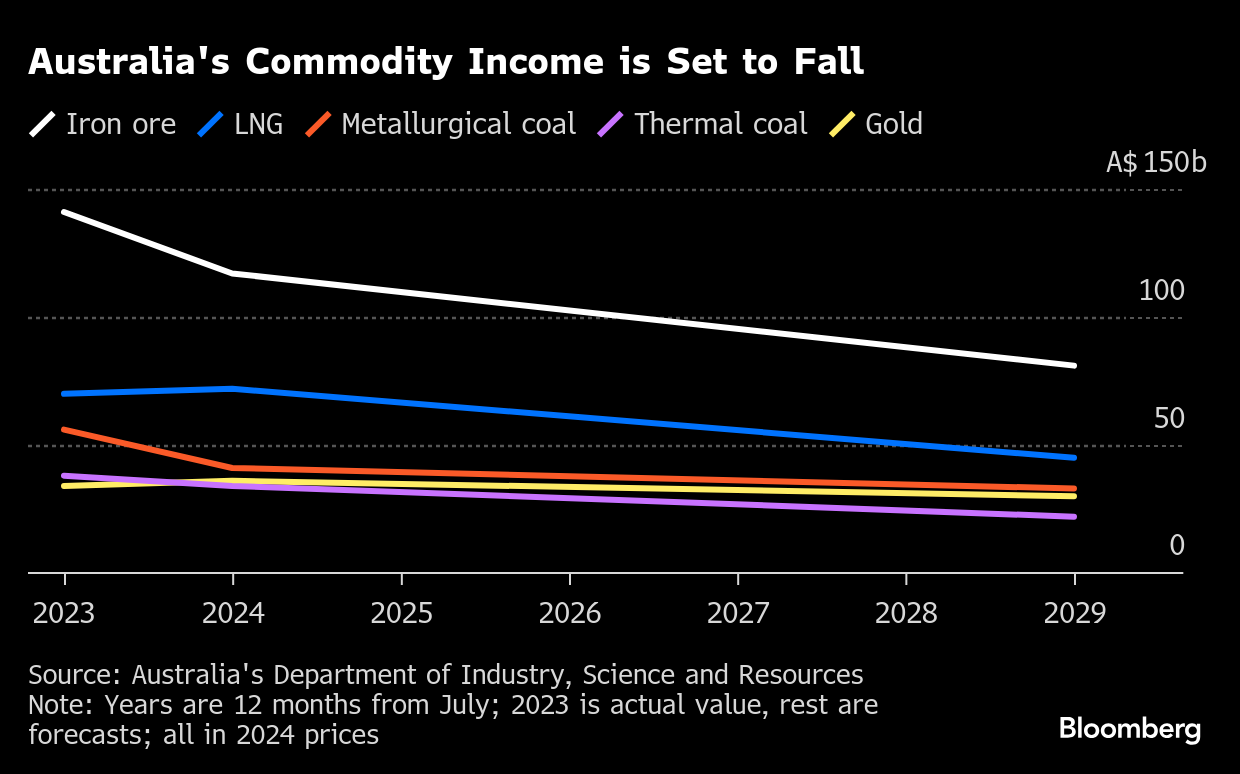

Resource exports from the major supplier of iron ore, liquefied natural gas and coal are seen at A$387 billion ($243 billion) in the 12 months through June 2025, 4% higher than forecast three months ago but down almost 7% from a year earlier, the Department of Industry, Science and Resources said in a quarterly report on Monday. They are set to plummet further to A$343 billion in the period through June 2030.

The revisions were driven by expectations of a weaker Australian dollar versus its US counterpart and higher prices for iron ore and liquefied natural gas, the department said. Trade wars may lower global growth but fuel geopolitical tensions, boosting safe haven demand for gold and increasing commodity price volatility, it said.

“With trade barriers still being negotiated, and the possibility of retaliatory measures, it will take time for the full impact on the world economy to become apparent,” the report said. “The impacts of trade and retaliatory actions on supply chains and trade patterns will likely be larger than on growth.”

Export volumes are expected to remain largely unchanged until the end of the decade, but income from iron ore, coal and LNG will each slump around 40%. Copper is set to buck the trend, with volumes and income from the key metal for the energy transition to rise 7% each year to the end of the decade.

Thermal coal prices are set to drop to A$98 a ton by 2030, from A$135 per ton last year, as countries continue to roll out alternative energy sources, including renewables, and as major importers increase domestic production to reduce import reliance. New LNG supply from the US and Qatar is set to lower prices to $9 a million British thermal units in 2030 from $15 a million Btu at the start of this year.

Gold prices are expected to remain high from strong demand, with export earnings remaining stable until the end of the decade, while iron ore prices will likely fall as global supply rises, according to the report.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Malaysian Gas Pipeline Fire Injures Dozens, Shoots Flames Skyward

PetroChina’s Profit Climbs to Record on Rise in Production

EU Nations Weigh New Tools to Make Gas Storage More Flexible

Judge Rules Against Sale of Gulf of Mexico Oil Drilling Rights

XRG continues global expansion with entry into Mozambique’s Rovuma basin LNG projects

Cnooc Profit Rises on Increased Oil and Gas Drilling Output

European Gas Slips as Ample LNG Flows Help Ease Storage Worries

Aramco completes acquisition of 50% stake in Blue Hydrogen Industrial Gases Company

UK North Sea Oil Regulator Raises Investment and Output Outlook