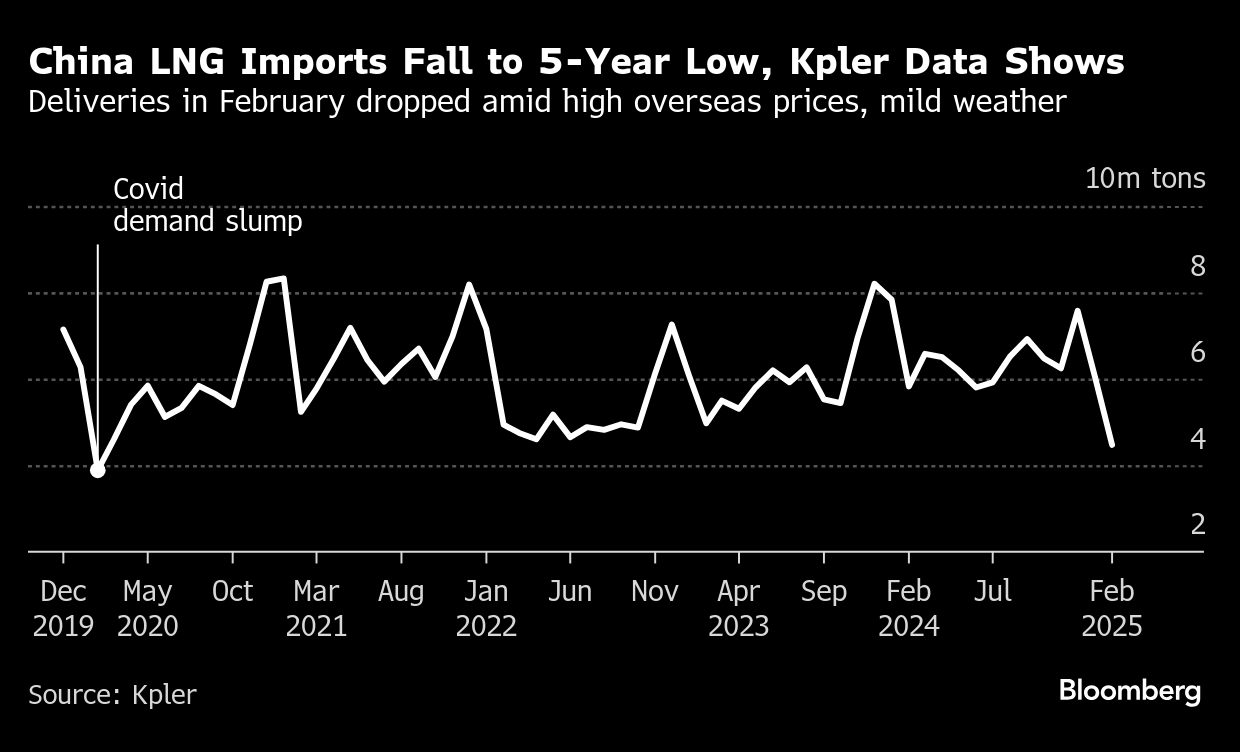

China LNG Imports Fall to Lowest Since Covid Hit Demand in 2020

(Bloomberg) -- China’s liquefied natural import gas imports fell to a five-year low last month on weak demand and higher European prices luring cargoes there.

Inward shipments were at 4.5 million tons for the month, according to Kpler data, resulting in China coming in behind Japan as the biggest importer for the second month in a row. Asia’s largest economy took the least LNG since early 2020 when Covid-19 shut down many factories and curbed demand, forcing Chinese buyers to declare force majeure.

It’s been a relatively warm winter in China, and there are ample supplies in storage and industrial demand is fairly low, said Wei Xiong, head of China gas research at Rystad Energy. The brimming inventories are likely to continue to weigh on imports through the end of the heating season, she said.

Some Chinese gas firms have been reselling spot cargoes over the past few months to take advantage of more attractive prices abroad, particularly in Europe.

Reselling activity is expected to remain high in 2025, following the imposition of the 15% tariff by China on US LNG, Xiong said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

BP’s Turnaround Plan Tested by Weak Earnings, Falling Shares

Woodside gives green light to massive Louisiana LNG project

China Re-Exports Record Monthly Volume of LNG on Weak Demand

Alaska LNG project aims to transform US energy exports to Asia

US Eyes Post-War Joint Business With Russia in Energy, Metals

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

China May Exempt Some US Goods From Tariffs as Costs Rise

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers