European Gas Prices Pare Gain on Russia-Ukraine Truce Hopes

(Bloomberg) -- European natural gas pared gains in another roller-coaster day driven by geopolitics, amid news that Russia is willing to discuss a temporary truce in Ukraine.

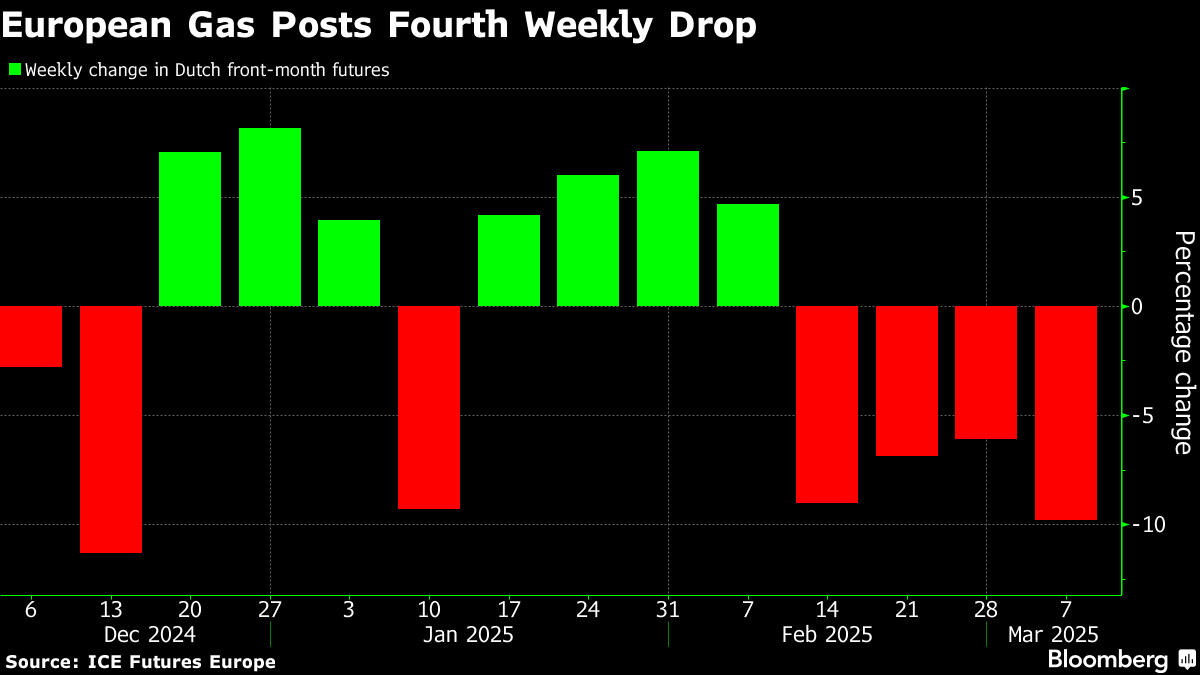

Benchmark futures swung on Friday, before closing up 4.5%, though still ended the week down almost 10% to cap a fourth straight weekly decline. There’s rising speculation that some Russian gas may return to the continent, which is struggling with high energy bills, and prices remain prone to sharp moves.

Earlier Friday, gas hit a five-month low before US President Donald Trump said he is strongly considering banking sanctions and tariffs on Russia until a cease fire and final peace agreement is reached. That briefly pushed prices almost 9% higher.

Speculators closing bullish bets on European gas have also added to the recent selloff, amplifying price swings. High levels of algorithmic trading and rapid political shifts “don’t make nice bedfellows for a calm orderly market,” said Nick Campbell, a managing director at Inspired Plc. “Given the ever-changing narrative regarding the start of peace talks, I expect it to continue.”

Russia is ready for talks on a truce if there’s progress toward a final peace settlement, according to people familiar with the matter in Moscow. The US and Ukraine plan to meet in Saudi Arabia next week for their first direct talks since Trump’s Oval Office bust-up with President Volodymyr Zelenskiy last week.

Meanwhile, the situation on the front line remains intense. An overnight Russian barrage damaged private company DTEK’s gas production facilities in central Ukraine, the firm said on Telegram. Ukraine, facing gas shortages, has been turning to the European markets for fuel imports, further tightening supply.

It may be difficult for Russian pipeline gas to make a comeback after the European Union went to great lengths to diversify supplies. Yet the bloc still imports large quantities of liquefied natural gas from Russia and appears less intent on phasing those out for now as it focuses on defense priorities.

Read Also: EU Leaders Call for Ukraine Gas Solution on Slovakia’s Push

For now, the continent looks well supplied and milder weather has eased pressure on the market. But some LNG vessels have been diverting away from Europe after the recent price drop, while price-sensitive buyers in India are looking to make spot market purchases.

Europe’s reliance on volatile LNG cargoes has increased after higher-than-expected gas consumption this winter caused a rapid depletion of the region’s fuel stockpiles.

Dutch front-month futures, Europe’s gas benchmark, closed at €39.97 a megawatt-hour.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar