European Gas Slips as Ample LNG Flows Help Ease Storage Worries

(Bloomberg) -- European natural gas headed for a second day of declines as ample supply of LNG and warmer weather ease pressure on the region’s fuel inventories after a rocky start to the year.

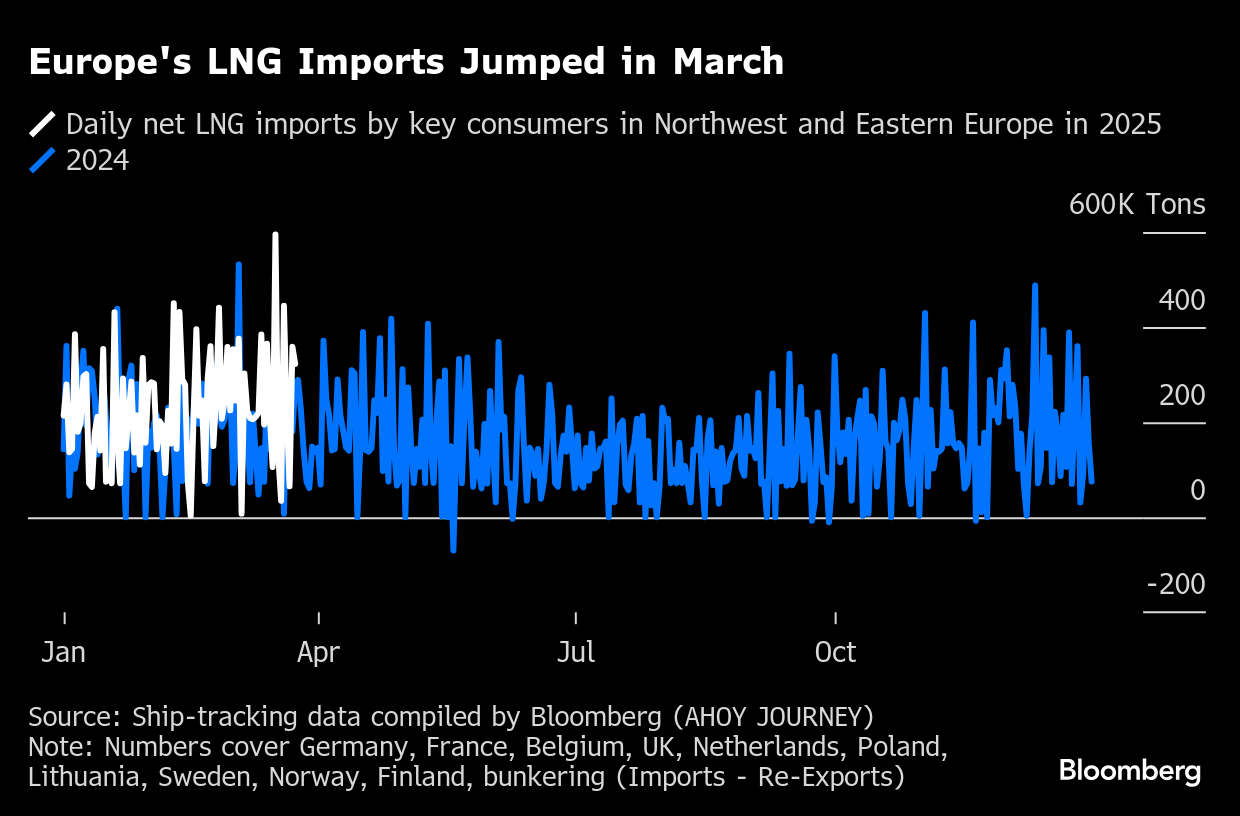

Benchmark futures fell as much as 2.7% before paring some of the losses. Imports of liquefied natural gas into northwest Europe are set to jump more than 25% in March from a year earlier, even though some cargoes were recently diverted elsewhere amid price swings.

Lower LNG demand from China is also providing near-term relief for European buyers competing for shipments. The Asian country’s purchases are forecast to fall this year for the first time since 2022, according to BloombergNEF.

Improving supply prospects are good news for Europe’s gas market, which is coming to the end of a testing winter that has seen stronger-than-usual withdrawals from reserves.

First steps to contain fighting between Russia and Ukraine have boosted optimism that some flows from the continent’s former top supplier could eventually return, though that’s unlikely to occur in time for Europe’s stockpiling efforts in the coming months.

With just a few days left until the official end to the European heating season, some countries have already been adding gas into underground storage sites thanks to rising temperatures.

Heating demand is forecast to be lower than usual across much of Europe for the next week. A measure of consumption known as population-weighted heating demand days will drop to 43, compared with a long-term norm of 54, according to Matthew Dross, a meteorologist at WeatherDesk.

Still, uncertainty over peace talks remains, with gas prices prone to sharp moves depending on developments. On Tuesday, the US said Russia and Ukraine agreed to a ceasefire in the Black Sea, although the Kremlin said its involvement would depend on a series of preconditions including sanctions relief.

Investment funds increased their net-long bets on European gas last week by more than 20%, according to data released by Intercontinental Exchange Inc. on Wednesday. But overall bullish wagers are still far below near-record levels reached earlier this year, after several weeks of declines.

Dutch front-month futures, Europe’s gas benchmark, traded lower at € a megawatt-hour as of in Amsterdam.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal