Saudi Aramco Follows Big Oil Rivals With Profit Surge

(Bloomberg) -- Saudi Aramco followed its Big Oil competitors with bumper earnings, boosted by a recovery in oil and chemical prices.

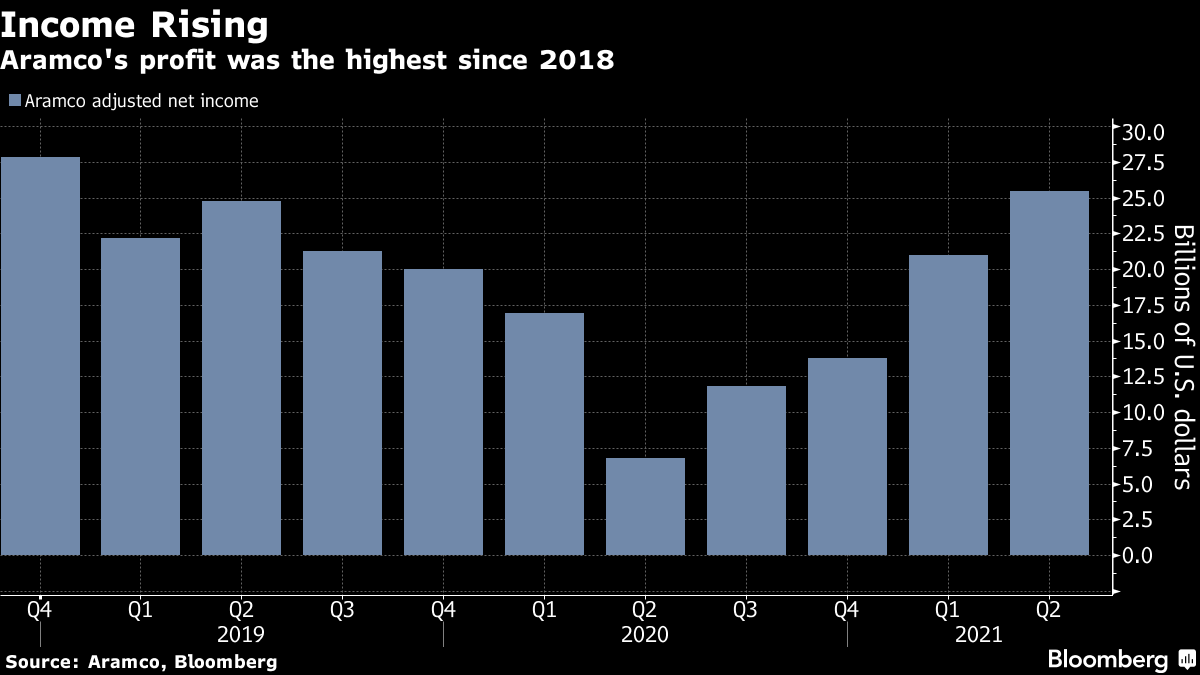

The world’s biggest energy company made of 95.5 billion riyals ($25.5 billion) in the second quarter, the highest level since the end of 2018. Free cash flow rose to $22.6 billion, above the state-controlled firm’s quarterly dividend of $18.8 billion for the first time since the start of the coronavirus pandemic.

The reopening of major economies has triggered a surge in commodity prices, with crude up around 40% this year. In the past two weeks, oil companies such as BP Plc, Chevron Corp. and Royal Dutch Shell Plc have said they will increase share buybacks and payouts, confident the worst of the pandemic is over.

Aramco’s annual dividend of $75 billion, the world’s largest, is a crucial source of funding for Saudi Arabia. The government, which owns 98% of the company, is trying to narrow a budget deficit that ballooned last year as energy prices tanked with the spread of the virus.

The results “reflect a strong rebound in worldwide energy demand and we are heading into the second half of 2021 more resilient and more flexible, as the global recovery gains momentum,” Chief Executive Officer Amin Nasser said in a statement on Sunday. “I remain extremely positive about the second half of 2021 and beyond.”

Still, the pandemic is “clearly far from over,” Nasser said later on a call with reporters. Oil just had its worst week since October as the spread of the delta variant, especially in China, clouds the short-term outlook. Brent crude fell 7% to $70.70 a barrel.

Global oil demand remains below pre-Covid levels, but should reach near-record levels of 100 million barrels a day next year, Nasser said.

Debt Down

Aramco’s gearing, a measure of net debt to equity, fell to 19.4% from 23% at the end of 2020, though it remains above management’s preferred cap of 15%. It declined thanks to higher cash flow and the Dhahran-based firm using some proceeds from the sale of a stake linked to oil pipelines to pay down debt. In June, Aramco completed the $12.4 billion deal with a consortium led by U.S. group EIG Global Energy Partners LLC.

Capital expenditure was $15.7 billion in the first half of the year and Aramco expects it to be around $35 billion for all of 2021, in line with earlier guidance.

Part of that money will go toward boosting daily crude-production capacity to 13 million barrels from 12 million.

“With less investment that we see from other producers globally, this creates an opportunity,” Nasser said.

At current capex levels and oil prices, most analysts expect Aramco will be able to cover its dividend commitment with free cash flow. Those at Bank of America even suggested the payout needs to be raised for Aramco to stay competitive now Western oil firms are shareholder returns.

“We’ll advise later this year whether we’ll be sticking to the ordinary dividend or doing otherwise,” Ziad al-Murshed, Aramco’s chief financial officer, said on the same call.

Reliance Deal

Aramco is continuing to do due diligence on a proposed investment in Reliance Industries Ltd.’s oil-to-chemicals refining business, al-Murshed said. In 2019, Aramco discussed buying a 20% stake for roughly $15 billion, but the deal was delayed by the pandemic. It should be finalized this year, India’s Reliance said in June.

The Saudi firm is scheduled to release more detailed financial statements on Monday, including a breakdown of the performance of its upstream and downstream units. The company’s chemicals arm, Saudi Basic Industries Corp., reported its best results in almost a decade last week as demand for products from plastics to paint and packaging booms.

Nasser will also hold an investor call on Monday. Aramco’s stock price rose 0.3% to 35.15 riyals in Riyadh on Sunday.

(Updates with stock price in final paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge