Chevron Revives Buyback of Up to $3 Billion After Oil Rally

(Bloomberg) -- Chevron Corp. is reviving share buybacks that were suspended more than a year ago, signaling confidence that strong cash flows from high commodity prices will be sustained well into the future.

The repurchases will begin during the current quarter and range between $2 billion and $3 billion a year, around half the amount it devoted to the program before it was suspended in early 2020. Chevron’s move followed similar steps by Royal Dutch Shell Plc and TotalEnergies SE, which reinstated buybacks on Thursday.

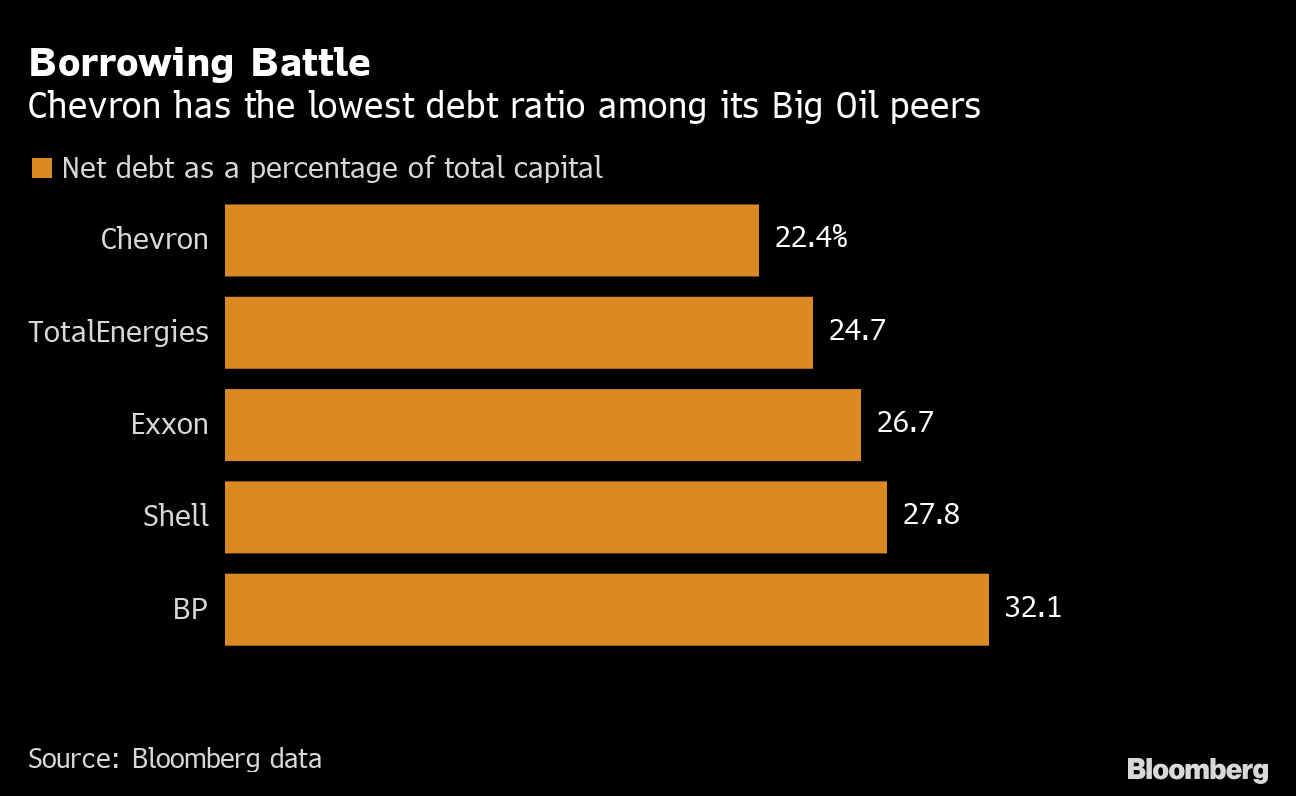

“It says we’re confident in the future,” Chief Financial Officer Pierre Breber said in an interview. The level was chosen because “it really is a range that allows us to also continue to pay down debt.”

Stock repurchases are being revived or raised across the board as sectors as diverse as steelmakers, retailers and manufacturers ride the crest of economic expansion. In particular, Big Oil executives are seeking to reward shareholders as commodity prices rise, a turnabout from previous booms when excess cash was poured into costly growth projects.

Faced with enormous climate challenges, the industry is attempting to entice investors by offering strong returns at a time when the dividend yield of the S&P 500 Index is at the lowest in almost two decades.

The stock advanced 1.5% to $104.15 7:03 a.m. in New York, despite a drop of as much as 0.9% in international crude prices.

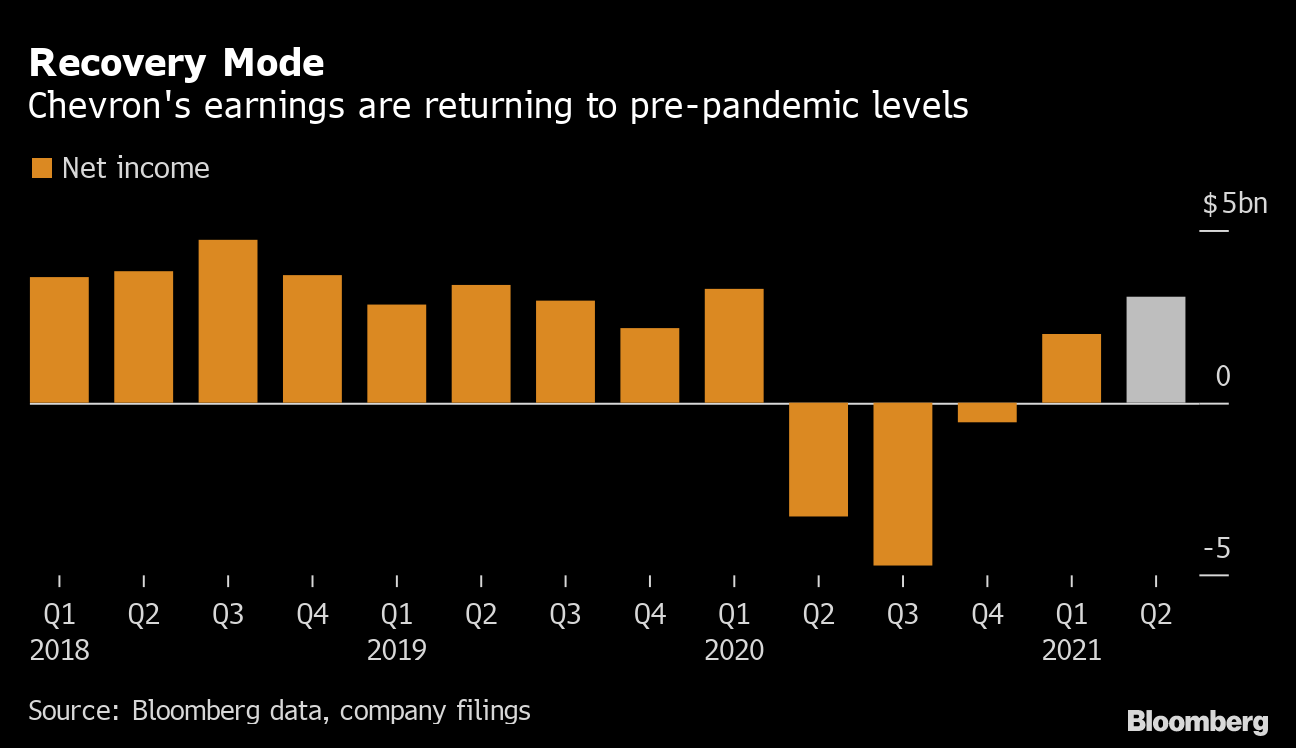

Chevron earned $1.71 a share, on an adjusted basis, during the second quarter, the company said in a statement, trouncing the $1.60 average estimate among analysts in Bloomberg survey. Capital spending in the first half dropped by a third compared with a year earlier while crude prices rallied more than 50%, flooding the explorer with more than enough cash to resurrect buybacks.

The repurchasing program comes on top of Chevron raising its dividend earlier this year, becoming the only Western oil supermajor to lift the payout above pre-pandemic levels.

Even with recent increases, Shell’s and BP Plc’s dividends still lag pre-Covid-19 payouts. Exxon Mobil Corp. held its dividend steady earlier this week and is expected to devote excess cash to debt reduction rather than buying back shares. Key to Chevron’s strength is that it entered the pandemic in a stronger financial position than rivals, with a low debt burden.

The buyback also signals a bullish outlook. CFO Breber said the repurchases will be sustained even during periods of lower oil prices. “I was clear on last quarter’s earnings call that we would start a buyback when we were confident we could sustain it over the cycle,” he said. “We’d want to sustain it for multiple years.”

Key macroeconomic indicators watched by Chevron -- such as the global economic recovery, crude stockpiles, and co-ordination by the Organization of Petroleum Exporting Countries and its allies -- all have improved in recent weeks. Still, with Brent crude futures above $70 a barrel and OPEC sitting on ample spare-production caapcity, there’s reason to be cautious about higher oil prices, he said.

READ: Chevron Is ‘Cautious’ on Oil Prices Over $70, Citing OPEC, Virus

Chevron’s adjusted second-quarter profit was $3.3 billion, compared with a $2.9 billion loss a year earlier. The main profit drivers were higher oil and natural gas prices, while the company also benefited from a chemical boom and a rebound in U.S. refining. International refining still showed signs of weakness due to the pandemic.

Breber and upstream boss Jay Johnson are scheduled to address analysts during a conference call beginning at 11 a.m. Eastern time.

(Updates with CFO’s comment starting in third paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge