Oil Extends Losses as Investors Turn Focus to Crucial OPEC+ Meet

(Bloomberg) -- Oil declined for a third day as investors turned their focus to an OPEC+ meeting on production policy after U.S. crude stockpiles expanded.

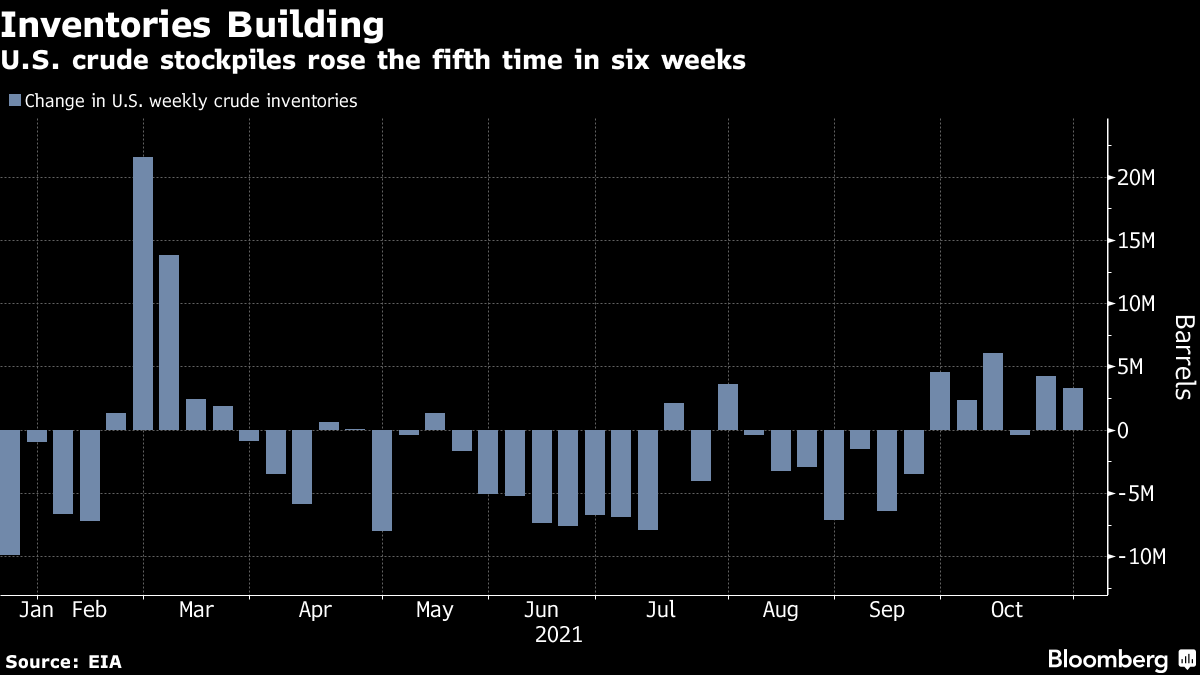

Futures in New York slid near $80 a barrel after losing almost 4% over the past two sessions. OPEC+ is gathering later Thursday and the group is expected to stick to its planned gradual output hike for December, despite calls from consumers to pump more. In the U.S., crude inventories climbed for the fifth time in six weeks, according to Energy Information Administration data.

The U.S. and Iran, meanwhile, will resume talks later this month on reviving an agreement that imposed limits on Tehran’s nuclear program. A return of the accord would likely lead to increasing crude flows from the OPEC producer.

Oil recently rallied to the highest since 2014 as an economic rebound from the pandemic combined with an energy crunch to drive up demand for crude. U.S. President Joe Biden has led calls from major consumers for OPEC+ to increase output to cool elevated prices, but Saudi Arabia and others in the alliance have pushed back, citing risks from ongoing coronavirus outbreaks.

OPEC+ is set to ratify a monthly increase of 400,000 barrels a day, continuing the gradual revival of production halted during the pandemic, according to a Bloomberg survey. While that’s been a consistent target for the alliance, some members -- particularly Angola and Nigeria -- have struggled to boost output.

“Prices are likely to remain choppy as speculation gains on OPEC+’s next move,” said Will Sungchil Yun, senior commodities analyst at VI Investment Corp. “If OPEC+ decides to push forward with a 400,000-barrels-a-day increase as per initial expectations, then prices will be boosted once again.”

Nationwide U.S. crude stockpiles rose by 3.29 million barrels last week, the EIA said. That’s more than the median forecast in a Bloomberg survey. Inventories at Cushing fell for a fourth week to 26.4 million barrels. Shrinking supplies at the hub -- the delivery point for WTI futures -- have sent gauges of market health, known as timespreads, soaring to the most bullish levels in years.

See also: U.S. Crude Output Back to Where It Was Before Hurricane Ida Hit

The U.S. and Iran will resume nuclear talks Nov. 29, with discussions taking place through European and Russian intermediaries, rather than face-to-face. It’s the first indication that President Ebrahim Raisi’s government is willing to test the waters with the U.S. over easing sanctions.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge