Vale Earnings Disappoint With Rising Costs Adding to Iron Rout

(Bloomberg) -- Vale SA reported lower-than-expected earnings as the world’s No. 2 iron-ore producer grappled with a pullback in prices of the steelmaking ingredient at a time of rising energy and transport costs.

Adjusted earnings before items came in at $6.94 billion in the third quarter, the Rio de Janeiro-based company reported Thursday. That beat the year-ago result but was down from the second quarter and trailed the $8.83 billion average estimate.

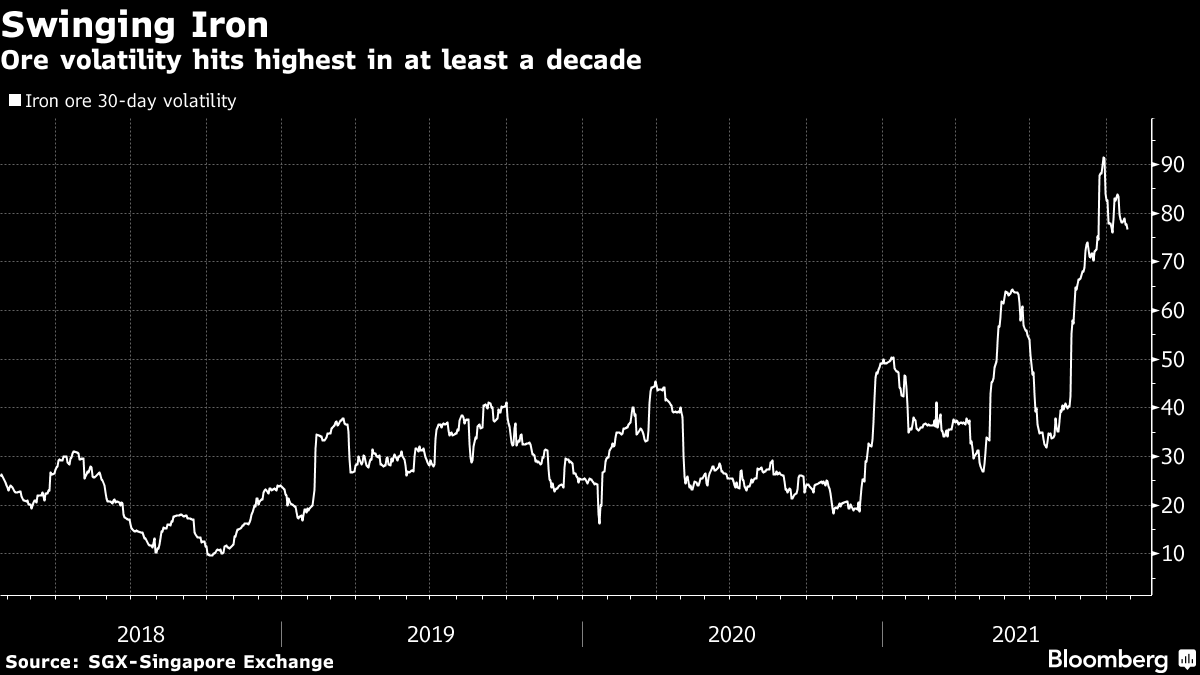

After recovering economies sent prices and profits surging earlier this year, iron ore miners are coming back down to earth. Futures are down about 50% since mid-July as China curbs steel output to contain pollution and power use while costs are rising along with freight and bunker oil prices. Vale is starting to trim supply of lower-quality ores to defend margins.

Still, the average third-quarter iron ore price stayed above year-ago levels, helping push up net income by 34% to $3.89 billion. Separately, Vale announced a new program to buy back as many as 200 million shares, which at current prices would be worth $2.6 billion. That follows the repurchase of almost all shares in a 270 million program.

Vale’s Sao Paulo shares have fallen 16% this year in line with the average among peers. Its New York-listed shares were little changed after the close of trading Thursday.

Vale and peers Rio Tinto Group and BHP Group were cut to hold from buy at Jefferies due to “near-term downside risk to iron ore and to consensus forecasts, declining capital returns, accelerating cost pressures, and increased operating risk.”

While Vale produced more than analysts expected last quarter as part of an ongoing recovery from a 2019 tailings dam disaster, sales lagged production. Analysts will be looking out for more details on the “value-over-volume” strategy on calls with analysts Friday.

For Vale’s base metals business, the challenges are more operational than market focused, with a prolonged strike in Canada restricting output. While Vale sees downside demand risks for nickel in the fourth quarter due to power cuts at stainless-steel mills, the long-term outlook remains positive on electric-vehicle demand.

Investors may also seek an update on Vale’s base metal plans. Spinning off its nickel and copper mines has been a long standing goal, with management recently opening the door to merging assets with those of another company.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge