U.K. Energy Firms Stretched to Limit as New Customers Cost

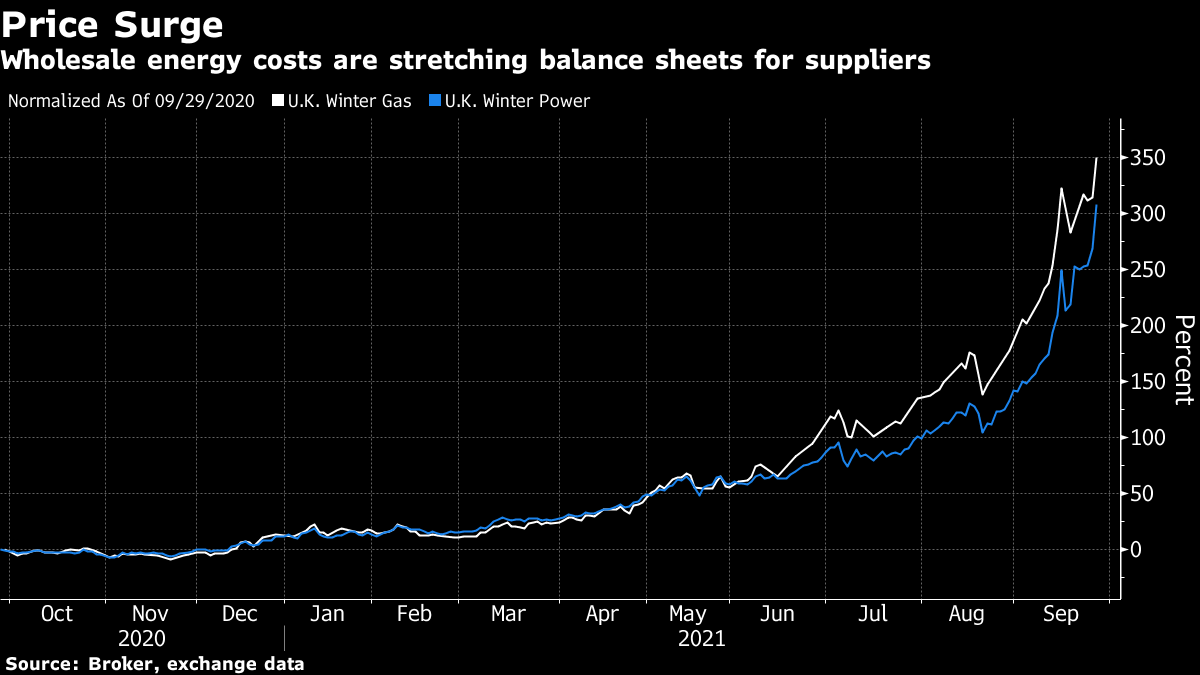

(Bloomberg) -- Soaring gas and power prices will make it harder for the U.K. to find energy suppliers willing to take on customers from failed rivals without government funding. And such support looks remote for now.

Energy regulator Ofgem is looking for a supplier to absorb the 233,000 customers of three power retailers that collapsed on Wednesday. That takes the total number of companies going under to 10 since the start of August. The cost of other suppliers taking on these new customers is rising every day as wholesale prices climb to fresh records.

A global energy crunch is causing a shakeout of the U.K. industry, with some 1.7 million homes forced to switch providers after their suppliers collapsed. Government officials have warned more will likely go out of business, but with companies from Shell Energy to British Gas already taking on thousands of additional clients, the ability of big firms to absorb new accounts is stretched to the limit.

The total upfront costs for utilities is estimated at about 1,000 pounds ($1,350) per household, according to people familiar with the matter. While the government initially studied offering state-backed loans, the idea is now on the back-burner, the people said, speaking on condition of anonymity.

“Pressure on the government will increase for it to intervene,” said Simon Ede, vice president at the energy practice of consultants Charles River Associates Inc. “There will be a decreasing capacity for the remaining suppliers to absorb customers, both from an economic and from an operational perspective.”

When a provider fails, the regulator appoints a new one in a process known as Supplier of Last Resort, or SoLR. If a larger firm or several smaller ones fold, the government can step in as a special administrator. It’s a move reserved for companies deemed too important to fail, according to Michael Fiddy, a restructuring lawyer at Mayer Brown LLP. While it’s never been used in the energy industry, there’s concern that the efficacy of SoLR is being severely tested by the current crisis.

“A special administrator is very seldom used,” Fiddy said. “It potentially requires an unquantifiable pot of cash and points to a structural failing in the regulatory process, so it’s not what the government wants to do. If it’s uneconomic to supply people with energy then we have a problem.”

Still, Business Secretary Kwasi Kwarteng stressed last week that the government has the option to appoint a special administrator if needed. When asked about the potential for state-backed loans for suppliers, he insisted the current strategy of redistributing accounts is working.

Pressure for Loans

Utilities are still pushing for some sort of financial solution, according to the people with knowledge of the talks between industry bosses and government.

Suppliers who step in to take new customers have to purchase gas and power at current prices, as most of the failed firms weren’t well hedged. While they can recover some costs later through levies on customer bills, that process takes about eight months to a year, and any loans or funding underwritten by the government would help utilities to cover that, the people said.

These costs, plus the administrative burden, will make it difficult for the U.K.’s remaining energy retailers to absorb thousands or even millions of new accounts. With about a quarter of suppliers at risk of collapse, some 5 million customers may be in need of a new utility, a person with knowledge of the matter said.

Read more: U.K. Energy Crisis Research From BNEF

The crisis will also be a headache for the government down the road, when the levies start hitting customer bills at a time when wholesale costs may have started to decline. Just the 1.5 million customers from failed suppliers prior to Wednesday translates to a cost of more than 800 million pounds that will have to be added to bills, according to Investec Bank Plc.

The energy crisis is going to cause an “inflationary shock,” said Dan Monzani, a managing director at Aurora Energy Research and former director at the Department for Business, Energy and Industrial Strategy. “There are tools at a macro level to help customers deal with bills, but we’ll have to see how winter plays out to see if the tools are enough.”

(Adds new supplier failures in second paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge