U.K. Gets Closer to Blackouts After Fire Knocks Out Cable

(Bloomberg) --

Winter blackouts are now a real possibility after a fire took out a key cable that ships electricity to the U.K. from France.

Electricity is now so scarce in Britain that any more grid mishaps or unexpected plant outages could leave millions without power. Even before the fire, National Grid Plc’s buffer of spare winter capacity was set to be the smallest for five years.

“If anything goes wrong, we might not have anything left in the back pocket,” said Tom Edwards, a consultant at Cornwall Insight Ltd., an adviser to the government and utilities. “If a nuke trips offline or something else big, that could cause issues because we might not have anything to replace it.”

Beyond the immediate chaos a blackout would cause, a prolonged shutdown could have severe economic consequences. Just as Britain emerges from the pandemic, power outages would send energy prices even higher, compounding concerns about inflation and adding to the rising costs businesses are already shouldering for raw materials.

What’s Behind Europe’s Skyrocketing Power Prices: QuickTake

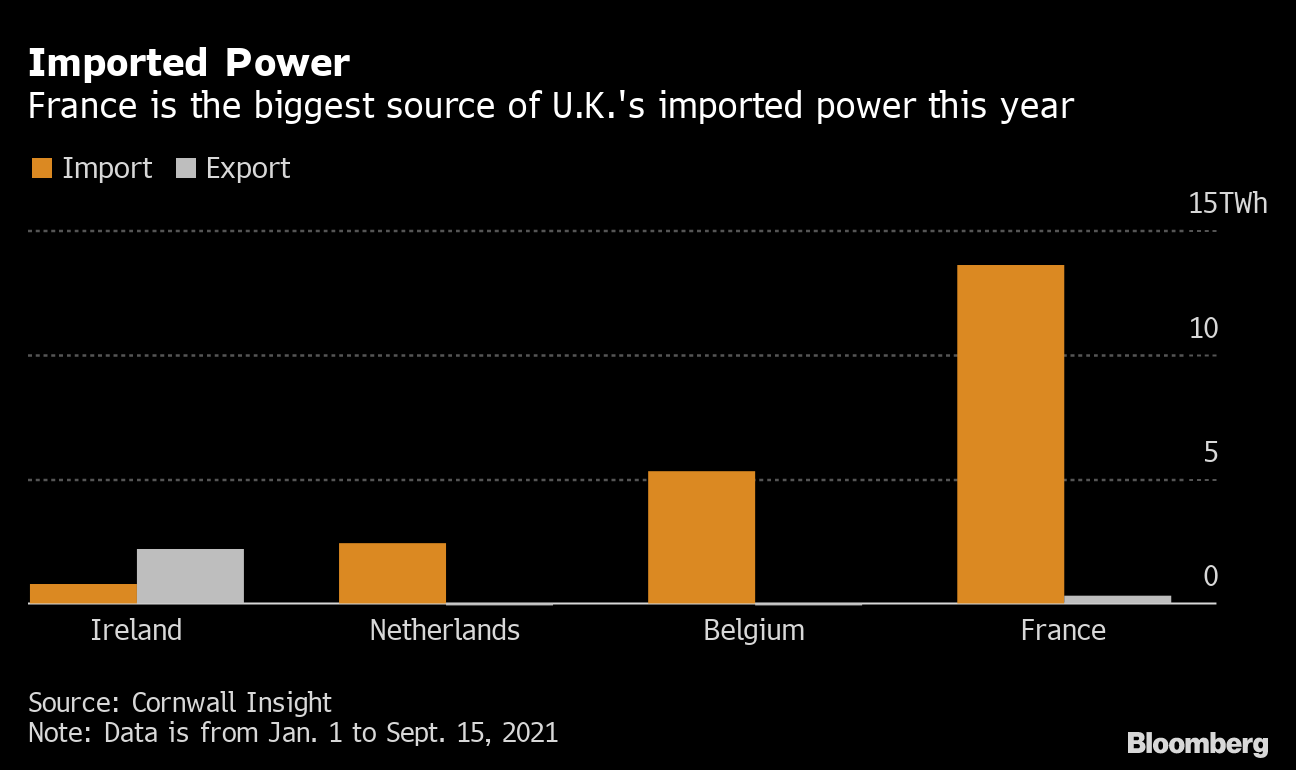

Britain imports and exports power along six huge cables, and two of them are connected to France. The electricity flows to the market with highest price. On average, about 7.5% of U.K.’s demand has been met by power from France’s 56 nuclear plants this year.

Now supply from France is set to be diminished. With half of the cable’s capacity set to be cut off until the end of March 2022, the shortage will impact prices well into next year. The rest of the capacity is set to come online Sept. 25, but that will depend on the extent of the damage and whether the cable can be operated safely.

Goldman Warns of Blackout Risk for European Industry This Winter

“The outage is going to lift the potential for price volatility as long as its offline,” said Glenn Rickson, head of power analysis at S&P Global Platts.

Power prices have sailed through records this month as a period of calm weather reduced wind generation at the same time as nuclear outages were extended. The unprecedented rally in gas prices in the U.K. and Europe also pushed up the cost of using the fuel to make power.

National Grid sounded an early warning back in July that the U.K.’s ability to meet peak demand would be more strained this year. For now, the situation looks manageable.

“We’ll have a clearer view on any longer term impact of the IFA-1 outage in the coming days,” a spokesman said. “Currently we’re still forecasting that we’ll have sufficient margin to continue securely supplying electricity over winter.”

The interconnector outage doesn’t necessarily mean a blackout today but as the weather gets colder and demand picks up in October and November, the system will get even tighter, Andreas Gandolfo, an analyst at BloombergNEF said.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge