Russian Crude Shipments to Asia Slump to Lowest Since March

(Bloomberg) -- Russia’s seaborne crude shipments to Asia have fallen by more than 500,000 barrels a day in the past three months, with flows to the region hitting their lowest levels since late March.

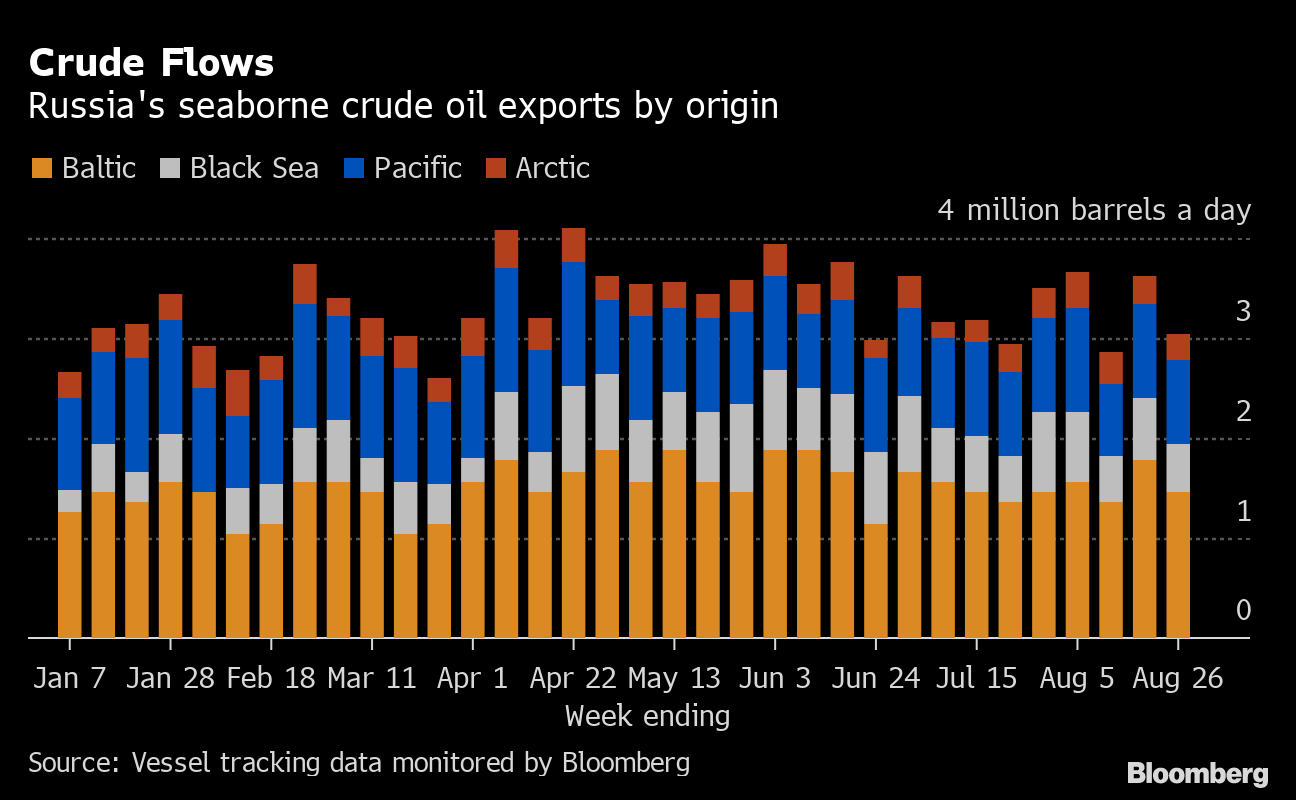

Shipments from Russia in the week to Aug. 26 gave up most of the previous gains on both a weekly and four-week average basis, according to vessel-tracking data monitored by Bloomberg.

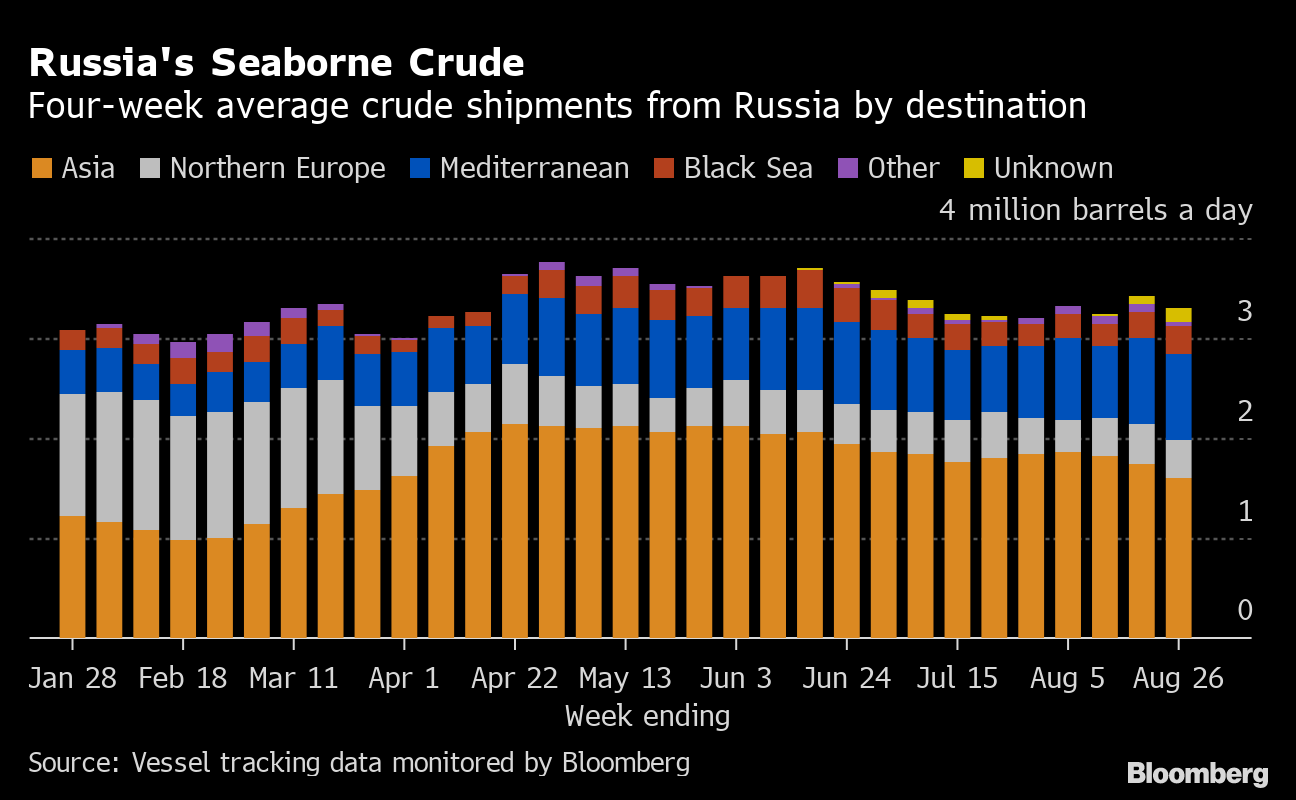

Total flows fell to 3.04 million barrels a day in the seven days to Aug. 26. That compares with 3.62 million the previous week. Using a four-week moving average to smooth out variability in the figures, shipments fell to 3.3 million barrels a day in the four weeks to Aug. 26, down from 3.41 million barrels a day in the period to Aug. 19.

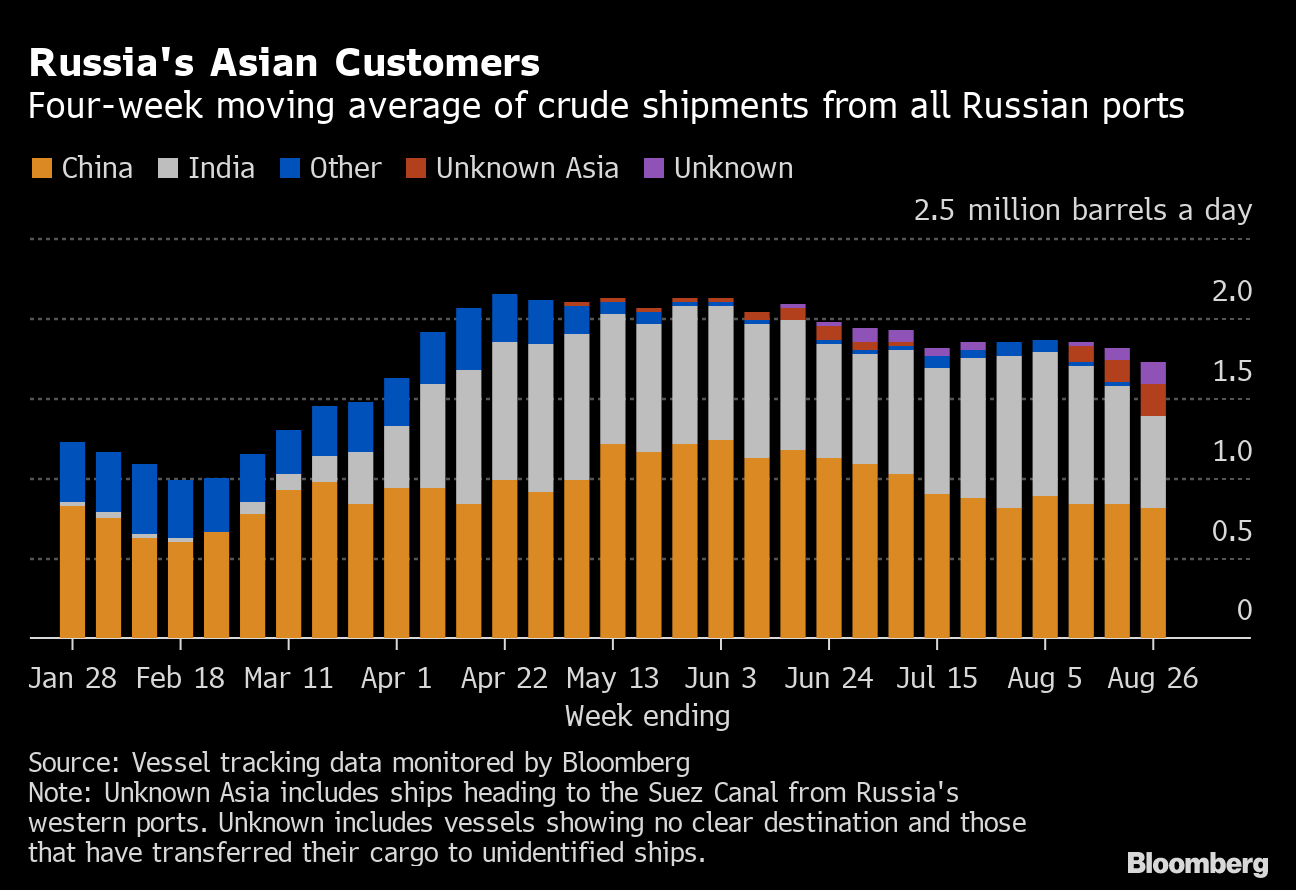

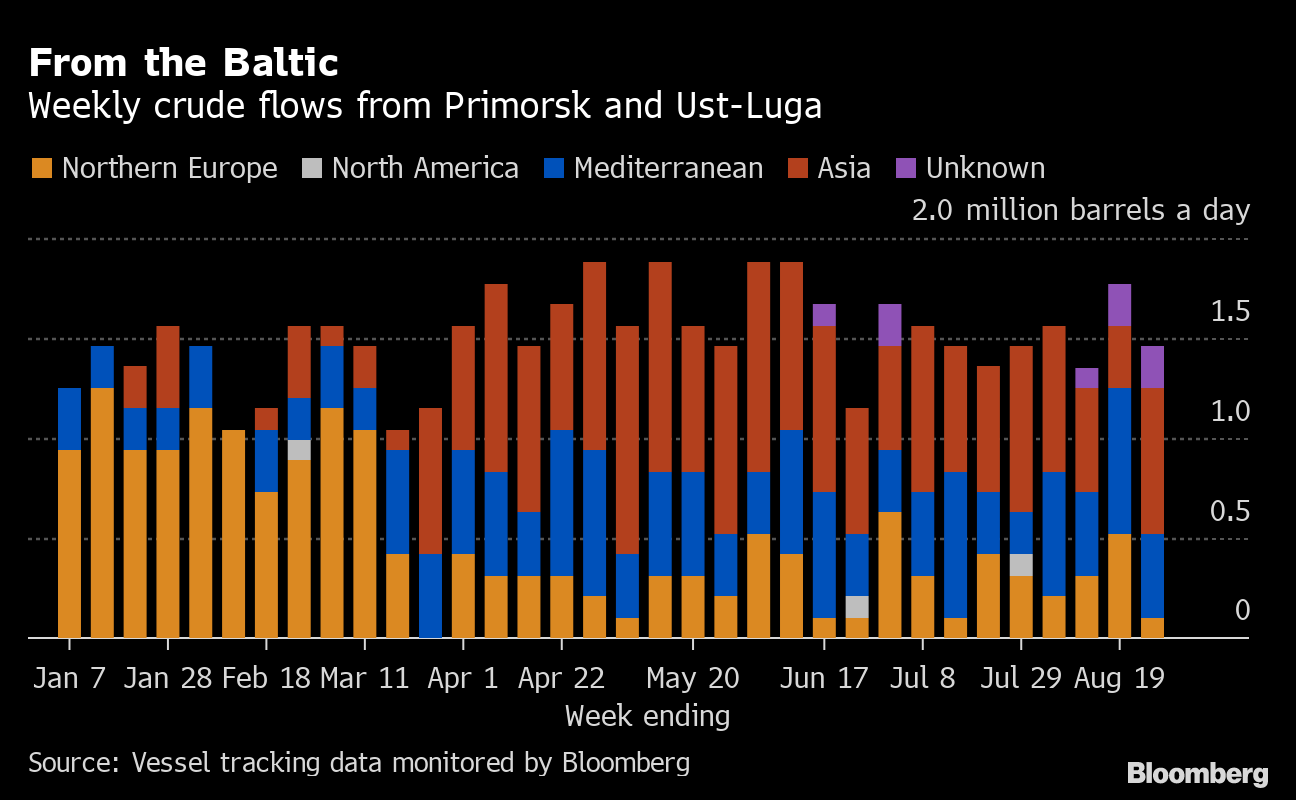

Shipments to Asia, where India stepped in to provide a market for crude shunned by European buyers after Russia’s invasion of Ukraine, have drifted lower since June. The region, which also includes Russia’s single biggest customer, China, is now the destination for about half of Russia’s seaborne crude exports, down from about 60% in April. Prior to the invasion in February, Asia received about a third of the shipments.

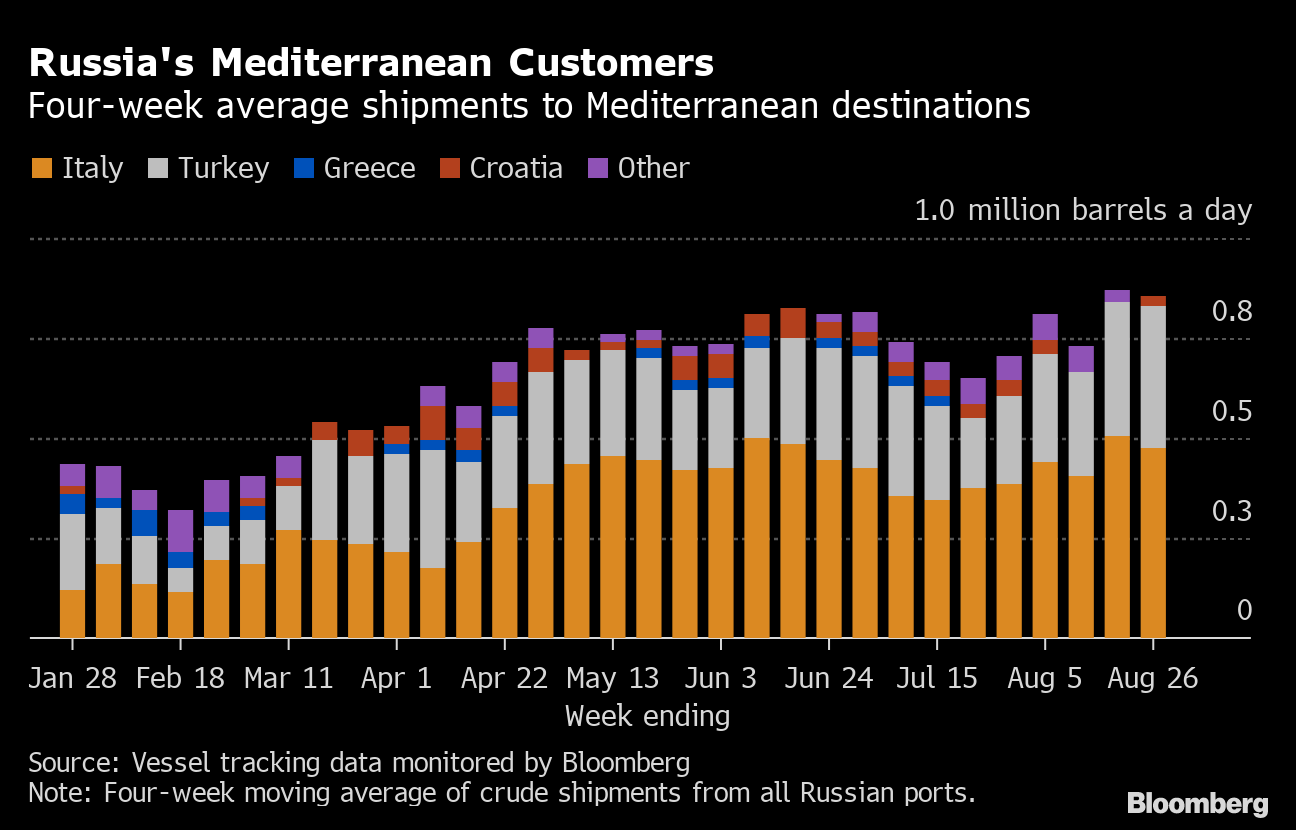

In the west, Turkey has been the lifeline for Russian oil sales into the Mediterranean market, and its role is likely to become even more important when additional European Union sanctions come into effect in December, cutting off buyers in Italy.

India has been Moscow’s one big success in developing new markets for its crude, with other buyers that it has picked up taking only very small quantities. Three cargoes have been delivered to cash-strapped Sri Lanka and two vessels have now discharged at El Hamra on Egypt’s Mediterranean coast. Few other countries have expressed an interest in buying Russian crude.

Based on current destinations, the average flow of Russian crude to Asia continued to slide, dropping to 1.59 million barrels a day in the four weeks to Aug. 26, from more than 2.1 million barrels a day in April and May.

Crude Flows by Destination:

-

Europe

Exports to Mediterranean countries remained close to their highest level this year in the four weeks to Aug. 26.

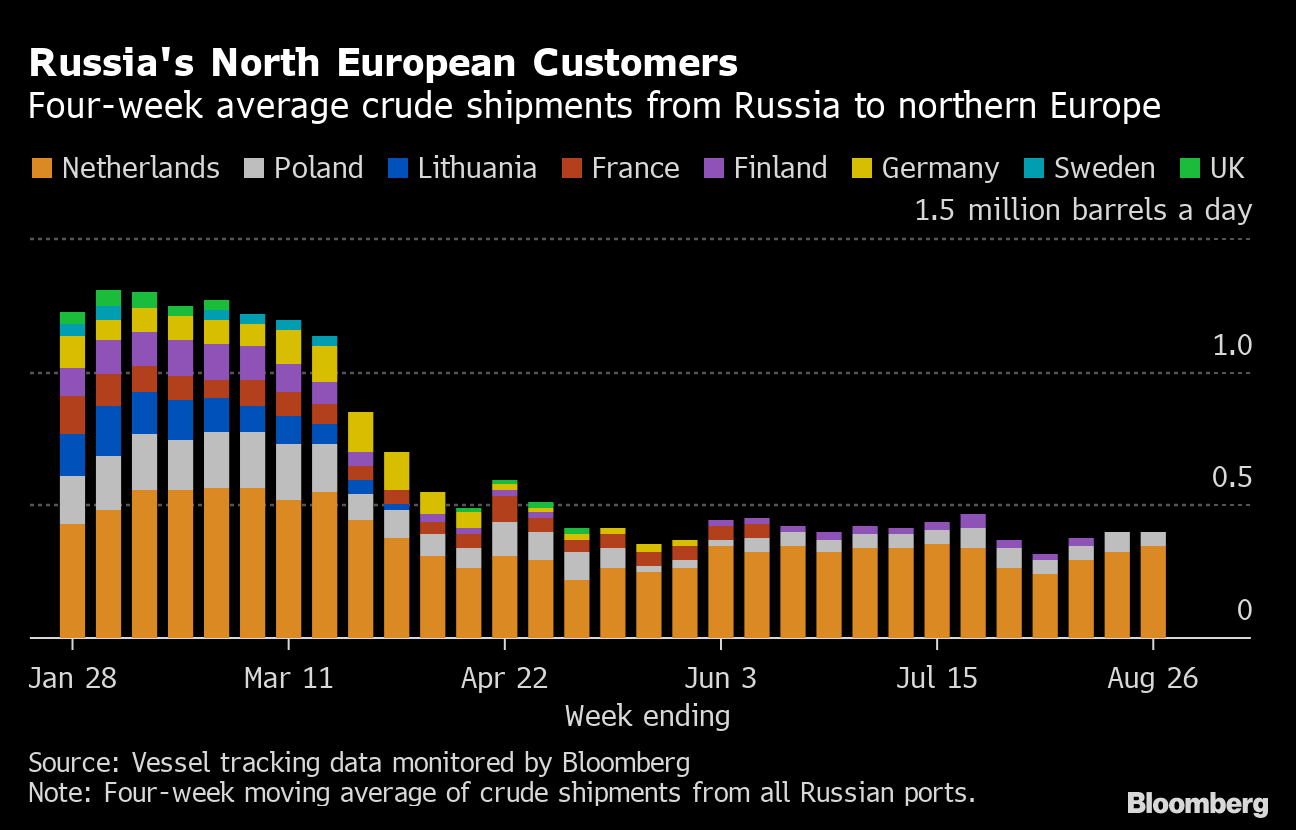

The volume shipped from Russia to northern Europe was little changed, with the shipments to storage tanks in Rotterdam at their highest level in six weeks.

Combined flows to Bulgaria and Romania rose for a second week, reaching their highest level since the period ending July 1.

-

Asia

The volume of crude on tankers heading for Asian destinations last week dropped to its lowest since the period ending March 25. Even if all the vessels showing no clear destination eventually head to Asia, the flow would still be the lowest since the period ending April 1. Most of the tankers carrying crude to unidentified Asian destinations are signaling the Suez Canal, with final discharge points unlikely to be apparent until they have passed through the waterway into the Red Sea, at the earliest.

Flows by Export Location

Aggregate crude flows from Russian ports fell by 587,000 barrels a day, or 16%, in the seven days to Aug. 26, compared with the previous week. Flows were lower from all export regions.

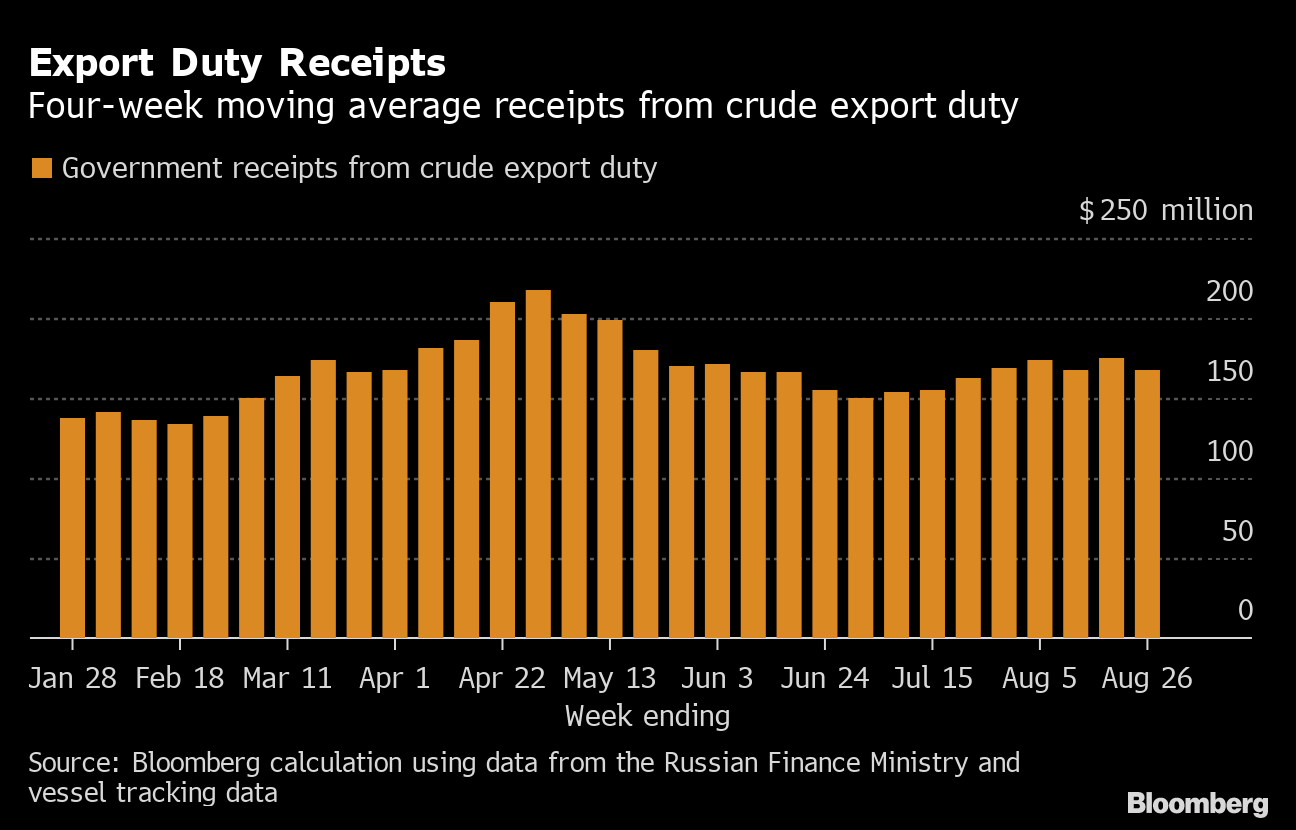

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty remain higher than they were before the war, with average weekly income at $167 million, according to the most recent figures. On a four-week average basis, income slipped to $154 million a week, down from $183 million a week in the period to Aug. 19.

Russia is set to cut its export duty for crude exports by about 2% in September, due to a lower price realized for sales of its flagship Urals crude between mid-July and mid-August. The discount for Urals against Brent crude during that period narrowed to about $18.68 a barrel, down from a high of about $34.39 a barrel from mid-April to mid-May, according to Bloomberg calculations using figures published by the Russian Ministry of Finance.

Origin-to-Location Flows

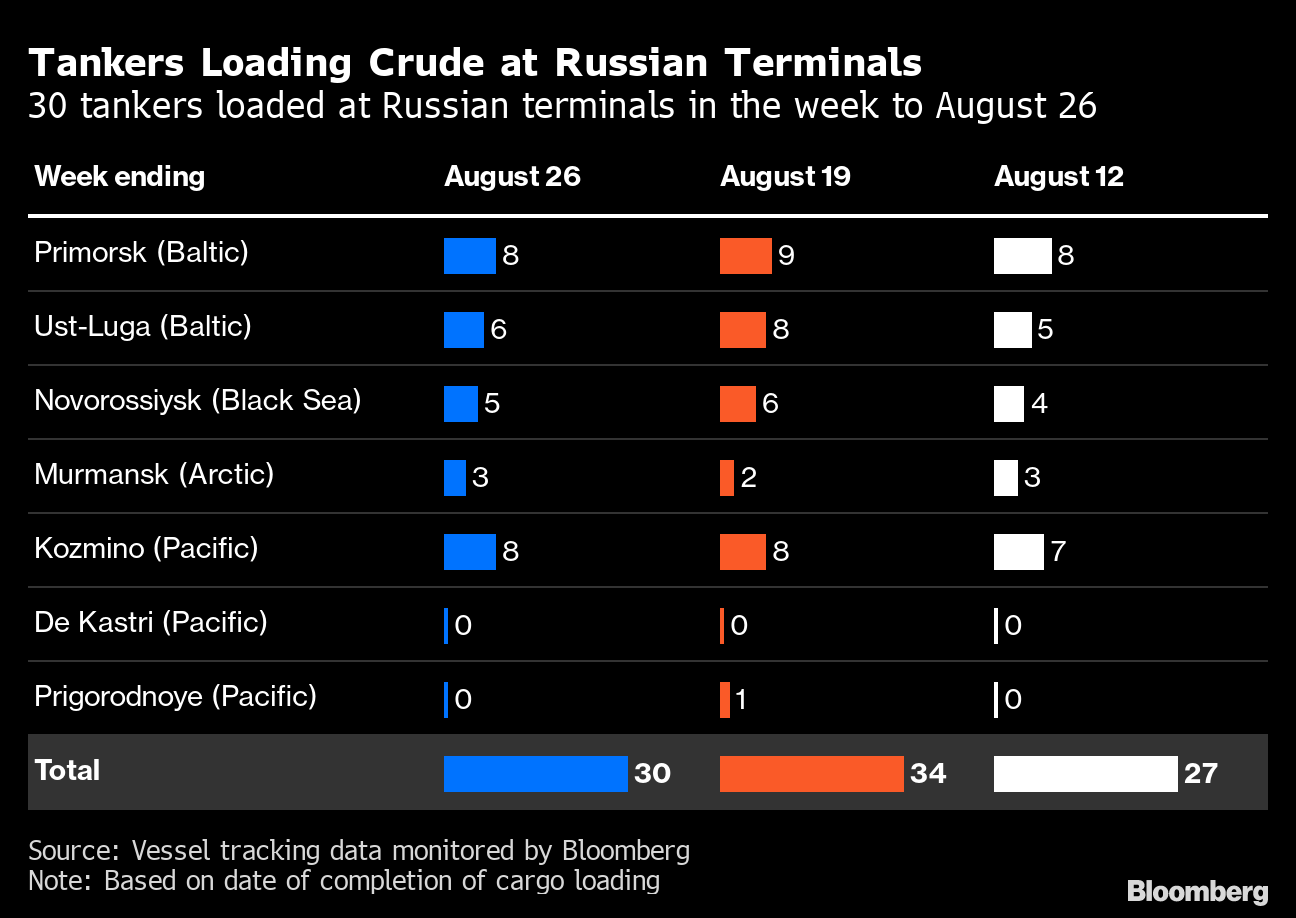

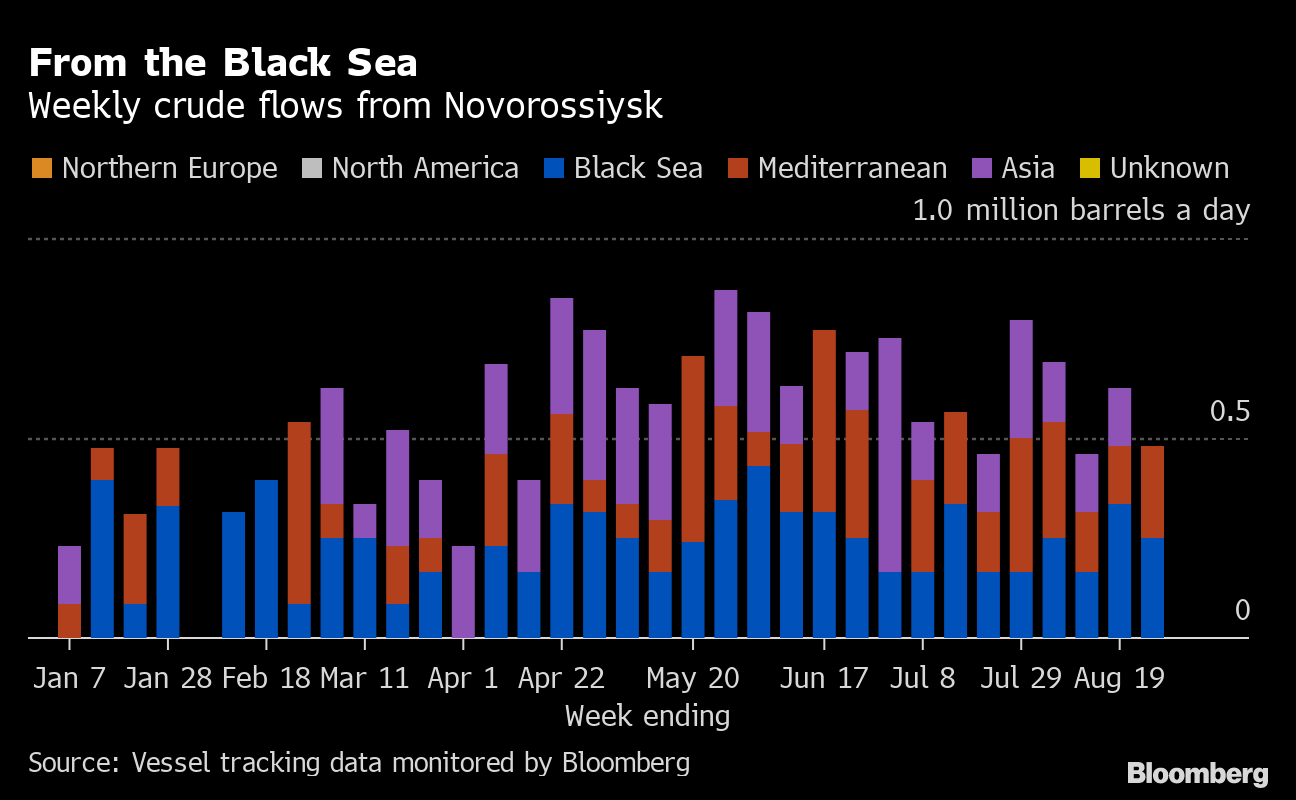

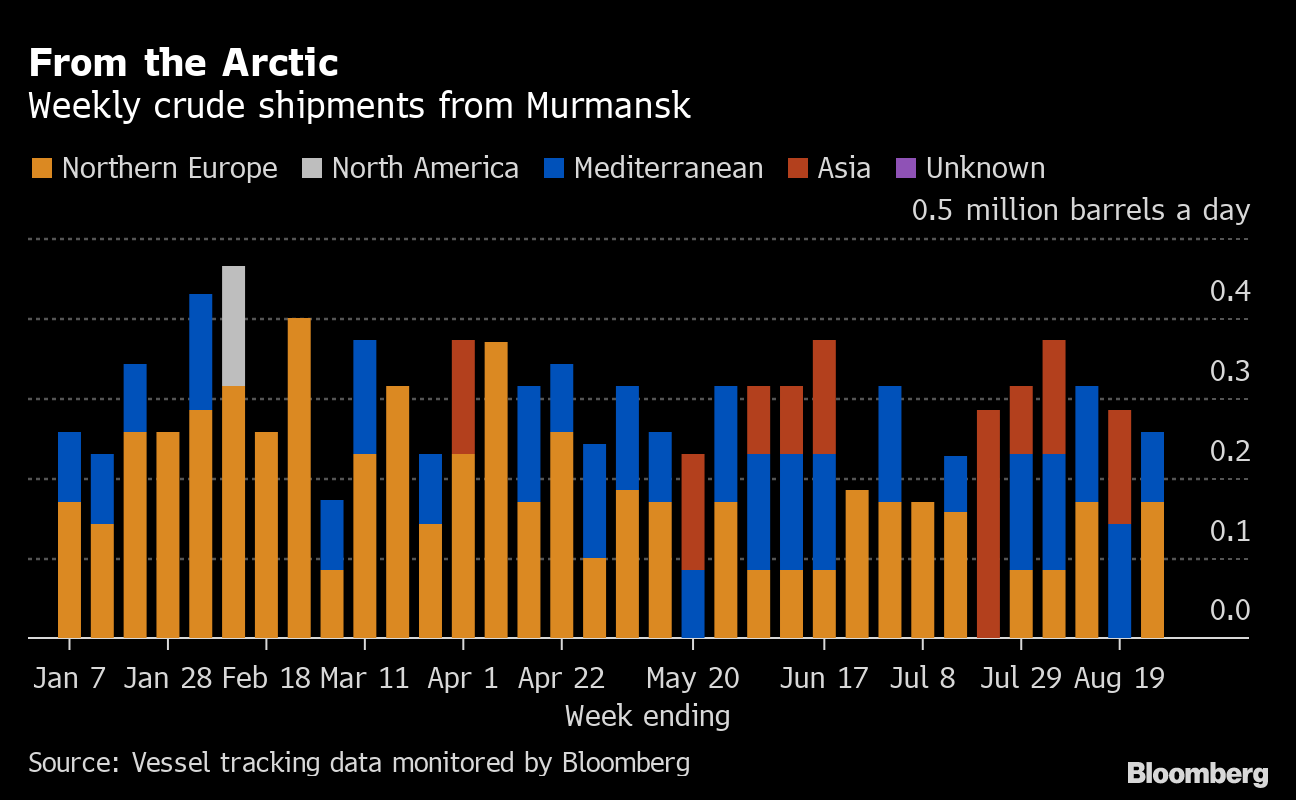

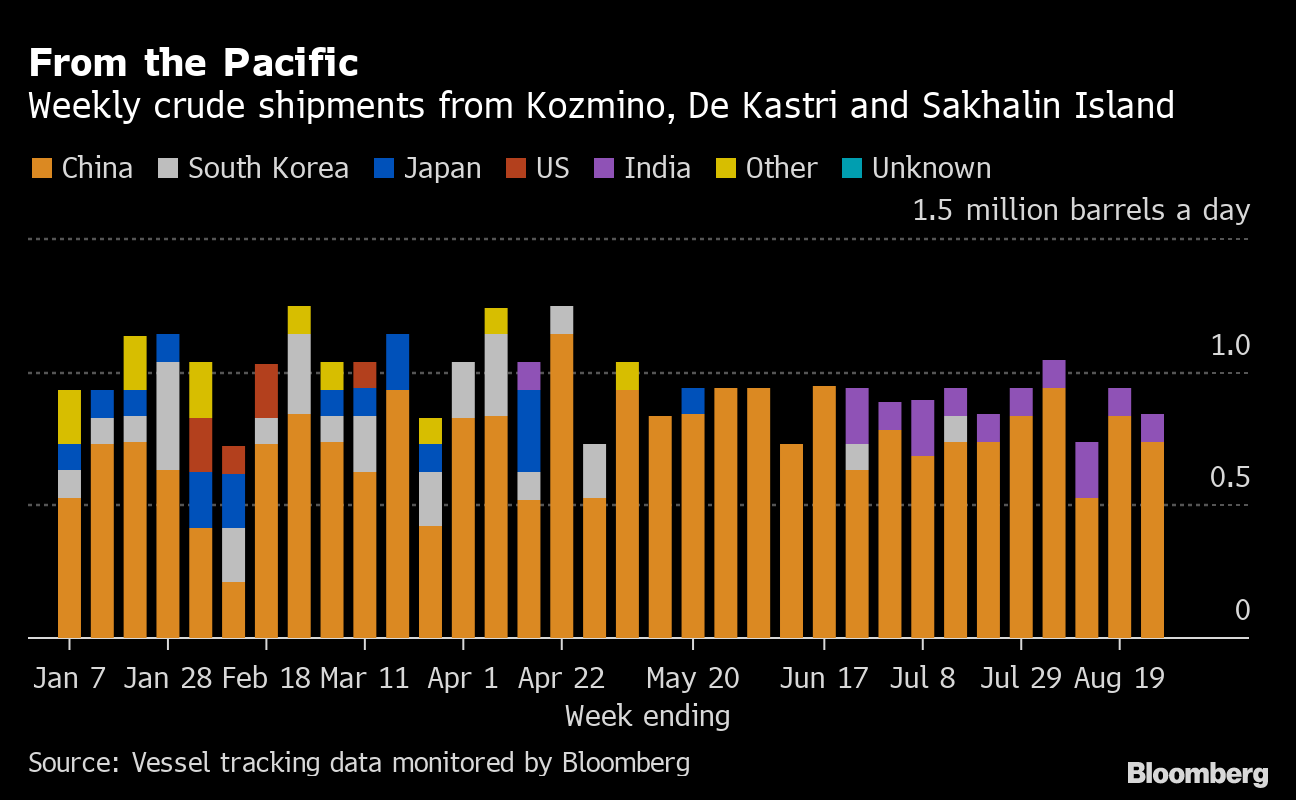

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 30 tankers loaded 21.2 million barrels in the week to Aug. 26, vessel-tracking data and port agent reports show. That’s down by 4.1 million barrels, wiping out much of the the previous week’s gain. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress.

The total volume of crude on ships loading from Russia’s Baltic terminals fell back after the previous week’s surge, with shipments to northern Europe falling to equal their lowest since March.

Shipments from Novorossiysk in the Black Sea gave up almost all of the previous week’s jump, with all flows from the region remaining in the Mediterranean/Black Sea region.

Arctic shipments fell for a third week, dropping to their lowest in six weeks.

Crude flows from Russia’s eastern oil terminals gave up about half of the previous week’s gain, with all shipments leaving Kozmino.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: Figures include cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge

Trump to Create White House Council to Drive Energy Dominance