Stocks, Futures Up as Post-Powell Slide Subsides: Markets Wrap

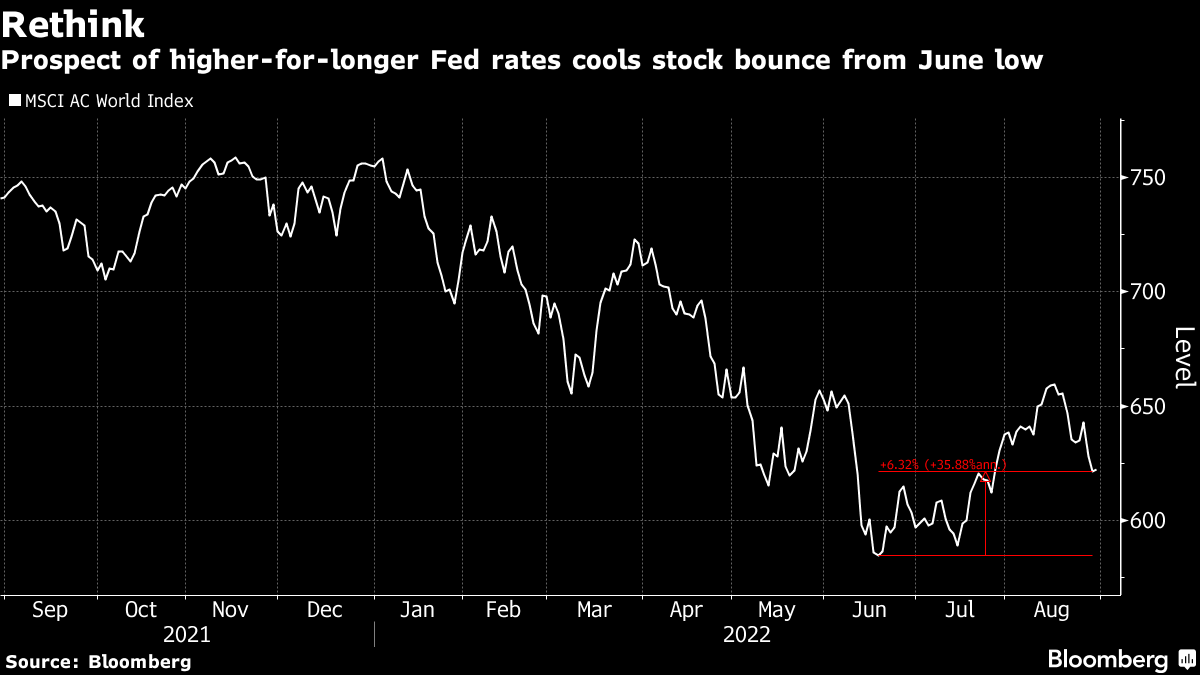

(Bloomberg) -- An Asian stock gauge rose Tuesday as investor sentiment stabilized following a rout sparked by the Federal Reserve’s signal of a sustained period of restrictive monetary policy to quell inflation.

The regional index added 0.5% as a climb in Japan helped to counter a retreat in Chinese tech shares. US and European futures were in the green, signaling a break in the equity slump that began Friday when Chair Jerome Powell stressed the Fed is willing to let the economy suffer to cool price pressures.

Treasury yields dipped and the dollar was steady. Oil remained in sight of the highest level since late July on potential Libyan production outages. Gold inched lower while Bitcoin made modest gains.

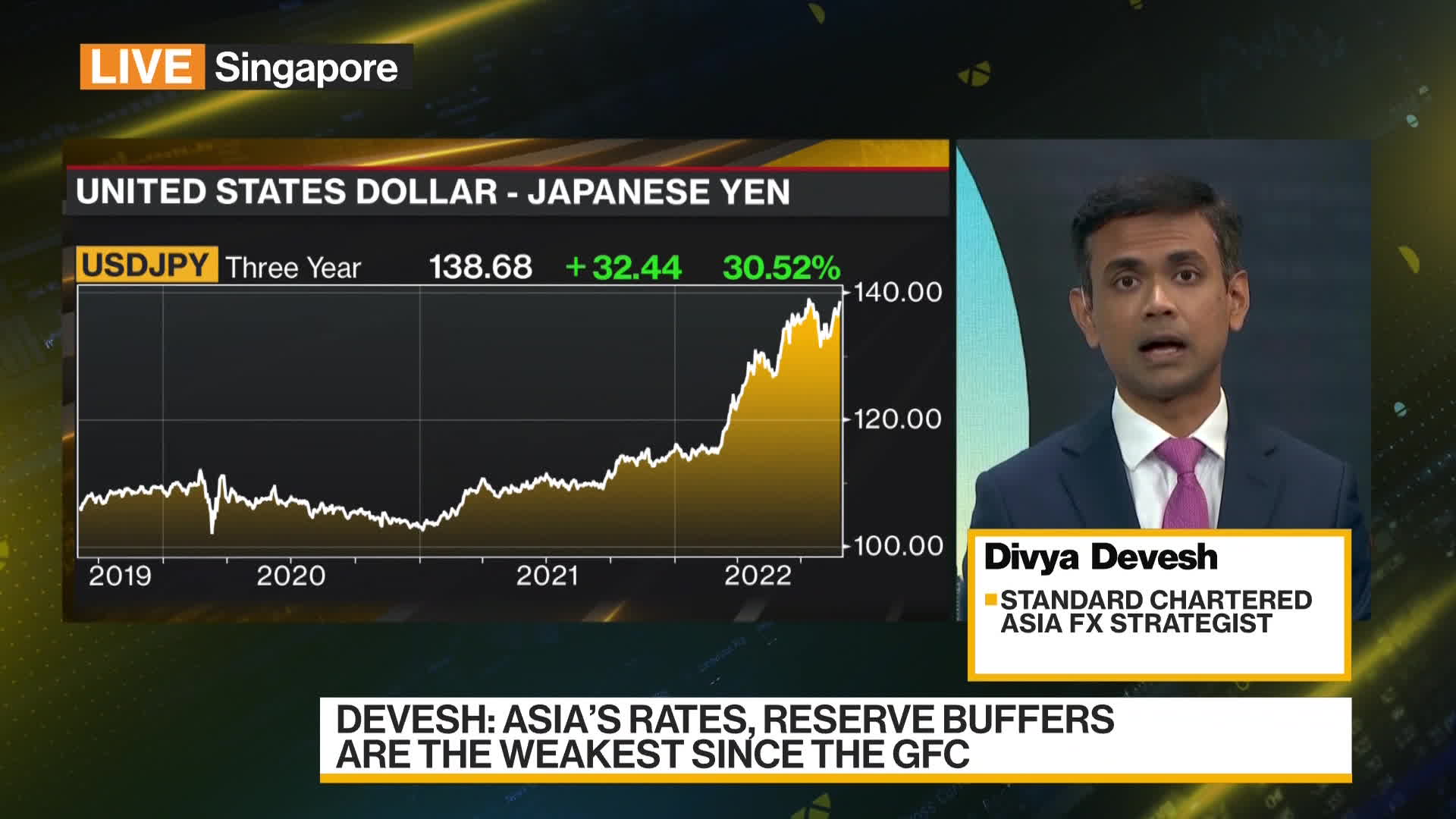

In China, the central bank set a stronger-than-expected yuan fixing for a fifth day, a sign it doesn’t want an excessively weak currency. The move highlights how greenback strength is a challenge for Asia as the region’s currencies slip.

There’s “more pain ahead” for the yuan and a fall to 7 per US dollar looks likely, Divya Devesh, a foreign exchange strategist at Standard Chartered Plc, said on Bloomberg Television.

Powell’s push back against market hopes for a pivot to interest-rate cuts next year is the latest setback in a challenging year for investors. The Fed this week is also set to step up the unwinding of its near-$9 trillion balance sheet. Other risks range from China’s economic slowdown to Europe’s energy crisis as Russia continues its war in Ukraine and chokes gas supplies.

“The markets are spooked because they are afraid that the Fed could create a hard landing -- that they’ll raise rates into a recession and that will be really painful for the economy and for corporate profits,” Terri Spath, chief investment officer at Zuma Wealth LLC, said on Bloomberg Television

Minneapolis Fed President Neel Kashkari said sharp stock-market losses show investors have got the message that the US central bank is determined to contain inflation. “People now understand the seriousness of our commitment to getting inflation back down to 2%,” he said.

In Europe, natural gas and power prices plunged after Germany said its stores of the fossil fuel are filling up faster than planned. But Germany remains vulnerable in the winter if Russia halts gas flows. The European Union is preparing to step into its energy market to damp soaring power costs.

Here are some key events to watch this week:

- US consumer confidence, Tuesday

- New York Fed President John Williams due to speak, Tuesday

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- China PMI, Wednesday

- Euro-area CPI, Wednesday

- Russia’s Gazprom set to halt Nord Stream pipeline gas flows for three days of maintenance, Wednesday

- Cleveland Fed President Loretta Mester due to speak, Wednesday

- China Caixin manufacturing PMI, Thursday

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 1:19 p.m. in Tokyo. The S&P 500 fell 0.7%

- Nasdaq 100 futures rose 0.4%. The Nasdaq 100 fell 1%

- Japan’s Topix index rose 1.3%

- South Korea’s Kospi index gained 0.9%

- Australia’s S&P/ASX 200 Index climbed 0.6%

- China’s Shanghai Composite index fell 0.6%

- Hong Kong’s Hang Seng index fell 0.9%

- Euro Stoxx 50 futures added 0.6%

Currencies

- The Bloomberg Dollar Spot Index was steady

- The euro was at $1.0005, up 0.1%

- The Japanese yen was at 138.49 per dollar, up 0.2%

- The offshore yuan was at 6.9212 per dollar, down 0.1%

Bonds

- The yield on 10-year Treasuries fell two basis points to 3.08%

- Australia’s 10-year bond yield fell four basis points to 3.63%

Commodities

- West Texas Intermediate crude was at $96.76 a barrel, down 0.3%

- Gold was at $1,735.61 an ounce, down 0.1%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge