US Stocks, Yields Drop as Markets Stay on Edge: Markets Wrap

(Bloomberg) -- US stocks fell on Thursday after the Bank of England joined global central banks in driving interest-rate hikes to quell inflation. The US yield curve remained inverted as recession fears persisted.

The S&P 500 and the Nasdaq 100 pushed lower, after swinging between gains and losses as thin liquidity in the summer amplified market moves. Both indexes were dragged down by the slump in Apple Inc. and Fortinet Inc.’s shares. The latter fell after trimming its service-revenue forecast. However, Alibaba Group Holding Ltd.’s strong report drove a rally in its tech peers, pushing up some of the Nasdaq 100’s constituents such as JD.com Inc. and Pinduoduo Inc.

Treasury yields fell after wobbling earlier in the session, with the 10-year rate around 2.67% after pushing past 2.80% on Wednesday. US initial jobless claims rose slightly and are holding near the highest level since November, data showed Thursday.

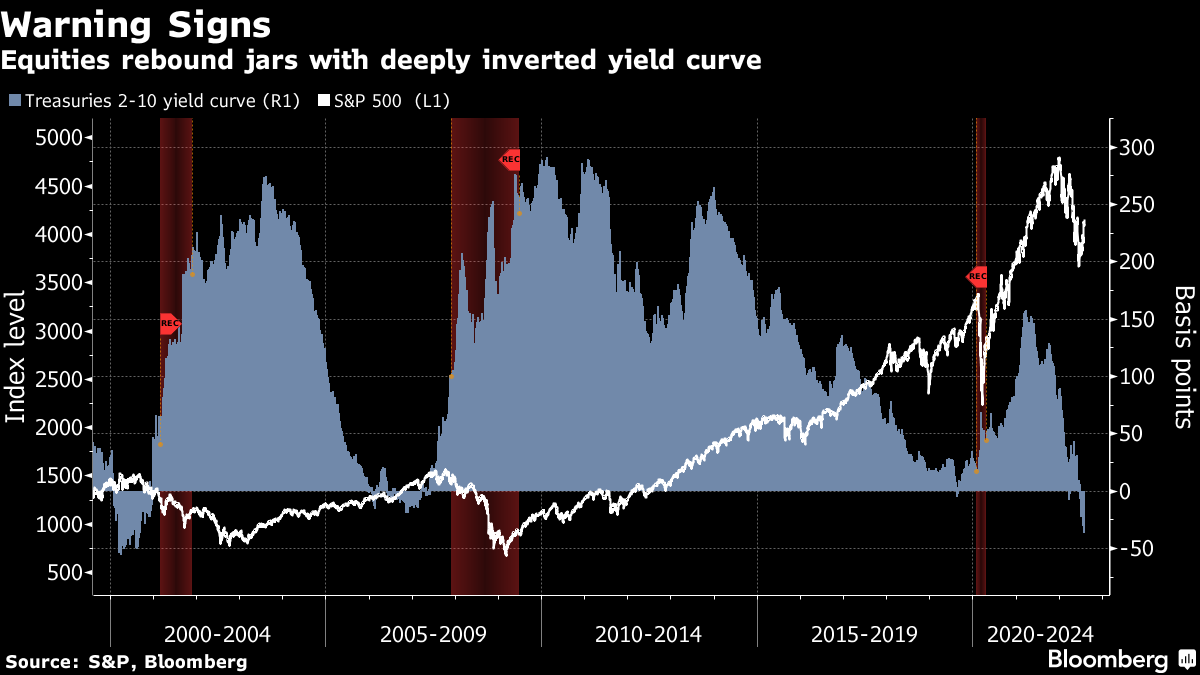

The bond market, especially the persistently inverted Treasury yield curve, is flashing warnings on the economy amid a global wave of monetary tightening. But a rebound in equities, with the S&P 500 enjoying its best start to an earnings season since 1997, has defied the drama in Treasuries.

“There is a mismatch between what the Fed is saying and what the markets are doing,” said Matt Maley, chief market strategist at Miller Tabak + Co. “One of them is terribly wrong. If it’s the markets who are wrong, the next few months are going to be quite ugly.”

A flurry of economic data that released this week assuaged fears of a downturn while hinting at stabilizing growth. All eyes will be on the US jobs report on Friday for further clues about the Fed’s path of rate hikes.

“There’s an intense tug-of-war happening in the economy and markets,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “On one side, you have a narrative that reasonable growth is going to support continued inflation pressure and keep the Fed hiking. The other narrative is that slowing growth is going to ease inflation and allow the Fed to stop hiking.”

Benchmark gilt yields tumbled after UK policy makers warned of a long recession and said its rate path was not pre-set.

US-China tension remains among the uncertainties clouding the outlook. Taiwan braced for the Chinese military to start firing in exercises being held around the island in response to US House Speaker Nancy Pelosi’s visit.

Oil fell as investors weighed weaker US gasoline demand and rising inventories against a token supply increase from OPEC+. Gold advanced and Bitcoin oscillated near $23,000.

This week’s MLIV Pulse survey is asking about your outlook for corporate bonds, mergers and acquisitions and health of US corporate balance sheets through the end of the year. It takes one minute to participate in the MLIV Pulse survey, so please click here to get involved anonymously.

What to watch this week:

- Cleveland Fed President Loretta Mester due to speak, Thursday

- US employment report for July, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4% as of 10:40 a.m. New York time

- The Nasdaq 100 fell 0.6%

- The Dow Jones Industrial Average fell 0.4%

- The Stoxx Europe 600 rose 0.2%

- The MSCI World index rose 0.9%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.0198

- The British pound fell 0.3% to $1.2112

- The Japanese yen rose 0.6% to 133.10 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 2.67%

- Germany’s 10-year yield declined seven basis points to 0.81%

- Britain’s 10-year yield declined six basis points to 1.85%

Commodities

- West Texas Intermediate crude fell 1% to $89.77 a barrel

- Gold futures rose 1.4% to $1,802.10 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge