Oil Steadies After Three-Day Decline as Demand Concerns Multiply

(Bloomberg) -- Oil was steady after a three-day decline as warnings from major US banks of a tough outlook for 2023 stoked concern over demand prospects and dented appetite for risk assets including commodities.

West Texas Intermediate traded near $74 a barrel after futures sank almost 9% over the previous three sessions despite optimism surrounding China’s move to loosen strict virus curbs. Among the predictions, Goldman Sachs Group Inc. Chief Executive Officer David Solomon said that he saw “bumpy times ahead.”

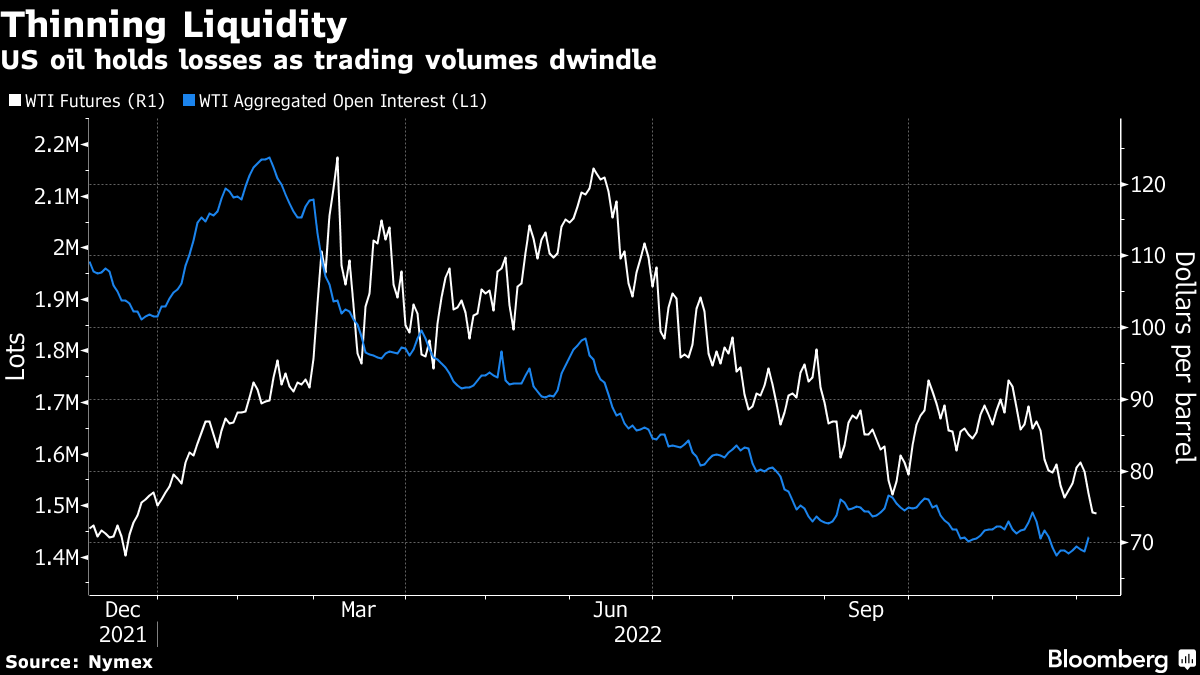

Crude is limping into the end of the year, with the US benchmark heading for the first back-to-back quarterly drop since mid-2019 as central banks tighten monetary policy. The latest leg down comes at a complex moment, with traders assessing the fall-out from Group of Seven curbs on Russian oil, including a price cap that’s meant to punish Moscow for the war in Ukraine. The slump comes against a backdrop of dwindling liquidity, stoking volatility.

Recession fears have “gripped the market as traders ponder monetary-policy tightening,” said James Whistler, managing director of brokerage Vanir Global Markets Pte in Singapore. “We are also seeing an early pull back in liquidity, with traders exiting positions after a highly volatile year.”

In response to the cap, which has been set at $60 a barrel, Russia is considering setting a price floor for its international oil sales. Moscow may either impose a fixed price for the nation’s barrels, or stipulate maximum discounts to international benchmarks at which they can be sold.

Traders are also tracking a visit by China’s President Xi Jinping to Saudi Arabia this week, during which he will take part in a summit with Saudi Crown Prince Mohammed bin Salman. China is the world’s largest crude importer, while Saudi Arabia is the driving force behind the Organization of Petroleum Exporting Countries. OPEC and its allies left supply unchanged last weekend.

Time spreads are signaling ample near-term crude supplies. The three-month spread for global benchmark Brent slipped further into contango — when later-dated futures trade at a premium to prompt contracts. The gap was at 56 cents a barrel in contango, compared with more than $4 a barrel in the opposite backwardated structure a month ago.

The American Petroleum Institute, meanwhile, reported that US stockpiles decreased by more than 6 million barrels last week, according to people familiar with the figures. Official inventories data follow later Wednesday.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge