Russia’s Asian Oil Flows Show Signs of Wobbling on Price Cap

(Bloomberg) -- There are tentative signs that key Russian oil exports from a port in Asia are dipping following G-7 sanctions targeting Moscow’s petroleum revenues.

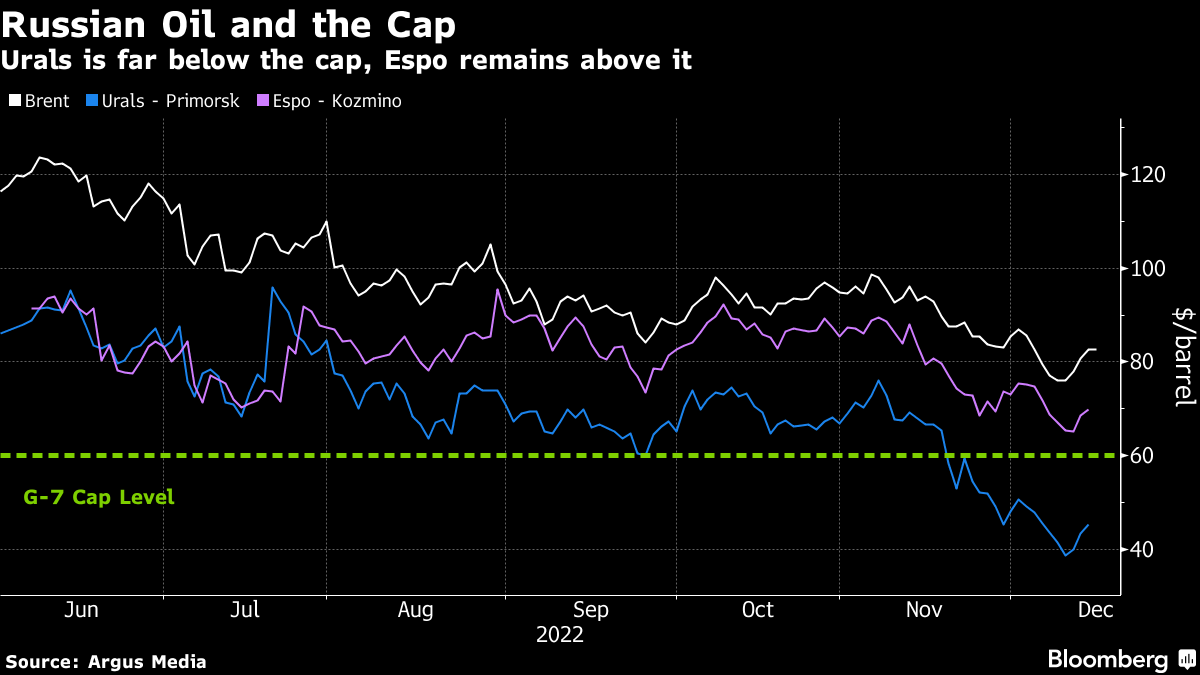

Since Dec. 5, buyers of cargoes from Russia have only been allowed to access industry standard insurance and an array of trade-critical services if they pay $60 a barrel or less. Shipments from the Asian port of Kozmino are about $10 above that, meaning they need to make alternative arrangements.

But there are signs they might be struggling to do that. In the 10 days since the measures began, 4.4 million barrels have been loaded onto tankers at Kozmino, tanker tracking compiled by Bloomberg shows. That’s exactly half the month-ago level and there’s nothing due to load Thursday.

The crude in question is called ESPO, which stands for the initials of the pipeline that takes the oil from east Siberia to the Pacific.

People involved in trading the grade said it’s too soon to be confident that the observed drop in flows reflects something structural. However, weather conditions haven’t been particularly bad and there doesn’t appear to be many candidate ships in place to collect cargoes in the coming few weeks. Tanker tracking data is always volatile, depending on the timings of loadings, and the comings and goings of individual tankers.

Big Shipowners

Shipbrokers and traders also said that said there are signs that ESPO sellers are struggling to secure tankers for cargoes purchased at more than $60 a barrel.

At least two large and well-known shipowners, China Cosco Shipping Corp. and Greece-based Avin International Ltd. have stepped back from moving ESPO crude since Dec. 5, according to shipbrokers. Emails sent to both companies weren’t answered.

Their absence has taken at least five tankers out of the regular pool of ships that move the grade, they said. That leaves charterers to work with smaller independent owners who’re still willing to handle the trade. If charterers continue to face headwinds with the booking of tankers, flows could be impeded, they said.

ESPO and Sokol, another grade that’s exported from eastern Russia, currently trade above the $60 a barrel threshold that gives access to insurance and G-7 services.

Urals Normal

Shipbrokers said tanker bookings for Russia’s flagship Urals crude from western ports are proceeding more normally. The grade is below $60, according to data provided by Argus Media. Tanker tracking also suggests no obvious disruption to exports of the grade.

Traders are watching closely to see if Russian crude exports can be maintained and how Moscow will respond if supplies do get disrupted.

The stability of Russian exports is crucial as the US and rest of G-7 work on ensuring security of global oil supplies ahead of the Northern hemisphere winter while simultaneously attempting to deprive the Kremlin of funding for its war in Ukraine. A sharp loss of output could backfire on the west if it boosts wider oil prices and reignites inflation.

About half the ESPO cargoes scheduled for loading in the rest of this month have yet to secure tankers, according to shipbrokers. That’s a bit slower than usual, they added, attributing it to the smaller pool of willing tankers operated by a smaller number of owners.

It’s possible that tankers which previously handled oil from sanctioned regimes such as Iran and Venezuela — the so-called dark fleet — would be booked, shipbrokers said.

The vessels that loaded ESPO at Kozmino sailed toward China, according to the tracking data. Some are owned by Russian, Indonesian and Turkish firms, while others don’t disclose their ownership.

Several cargoes of Sokol, which loads from the eastern Russian port of De Kastri, underwent ship-to-ship transfers off Yeosu in South Korea.

--With assistance from .

(Updates with Cosco, Avin stepping back from ESPO trade in 7th paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Advances in Risk-On Mood as China Weighs Tariff Exemptions

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus