Oil Drops From Seven-Year High After Fed Flags Tighter Policy

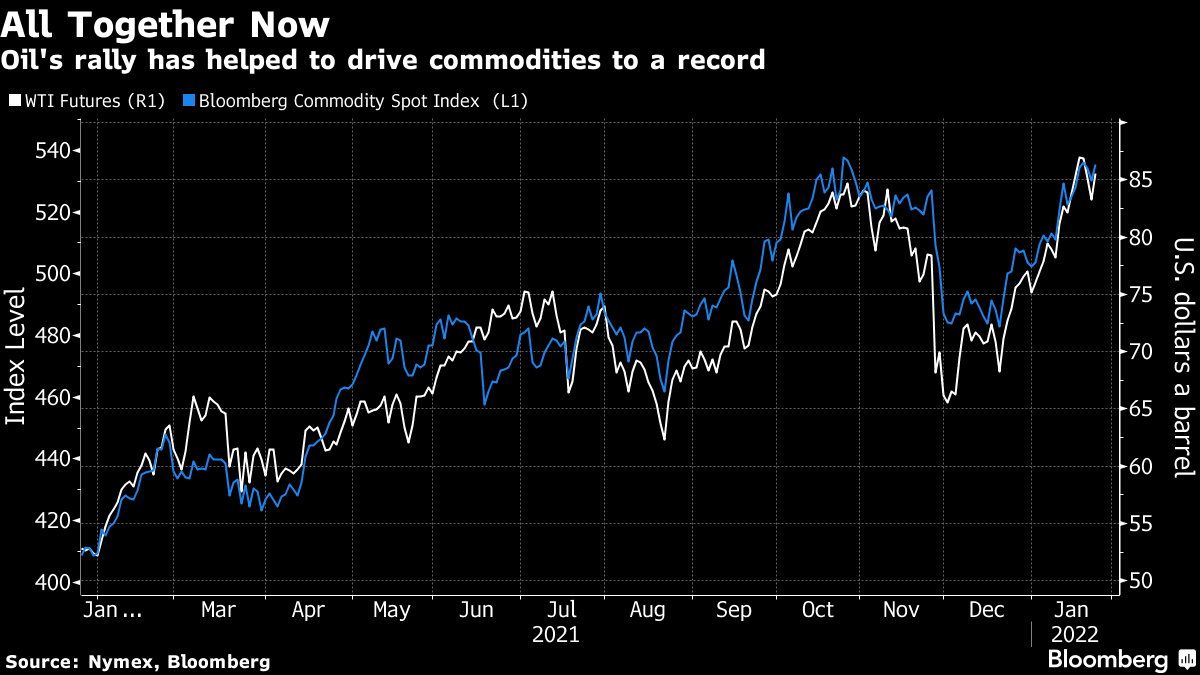

(Bloomberg) -- Oil fell from a seven-year high after the U.S. Federal Reserve signaled that it would soon start raising interest rates to quell inflation, denting investors appetite for risk assets including commodities.

West Texas Intermediate declined after rallying to the highest level since October 2014 on Wednesday, when global benchmark Brent topped $90. That surge came as inventories at the key U.S. storage hub at Cushing fell again last week to hit the lowest level for this time of year in a decade.

Crude traders are also tracking events in Ukraine on concern that Russia may launch an invasion after massing thousands of troops on the border, potentially disrupting energy supplies. Amid the high-stakes standoff, the U.S. has handed Russia its written response to Moscows security demands.

Oil has rallied in the opening weeks of 2022 on the continued recovery in energy consumption from the ravages of the coronavirus pandemic. The sustained surge has stoked inflationary pressures worldwide, and the Fed signaled that it will start boosting borrowing costs from March. Its action helped to strengthen the dollar, weighing on raw materials.

What we are seeing today is probably just a technical move, some profit-taking after the recent gains, said Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore.

Oils market structure is still flashing signs of tighter supplies, with backwardation -- a bullish indicator marked by near-term contracts above those further out -- widening significantly. Brents prompt timespread was at $1.21 a barrel in backwardation, up from 41 cents at the start of the month.

The momentum still looks strong, said OCBC's Lee, adding that OPEC+ has faced difficulties in meeting scheduled output increases. Supply challenges are the drivers behind this surge in oil prices and the tightness in the market will persist in the near term, maybe this quarter. I see little reason why oil wont go to $100.

Among the other U.S. inventory figures, nationwide crude supplies expanded for a second week and gasoline inventories rose to the highest level in nearly a year. Still, gasoline stockpiles remain seasonally low as U.S. Gulf Coast refiners are undergoing a heavier-than-usual maintenance season, and demand is expected to bounce back during the summer driving season.

The Organization of Petroleum Exporting Countries and its allies including Russia will get a chance to weigh in next week when they meet Feb. 2. The coalition will probably rubber-stamp a hike of 400,000 barrels a day for March, according to officials from about half of the group's members.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge