Oil Heads for Fourth Weekly Advance as Traders Shrug Off Omicron

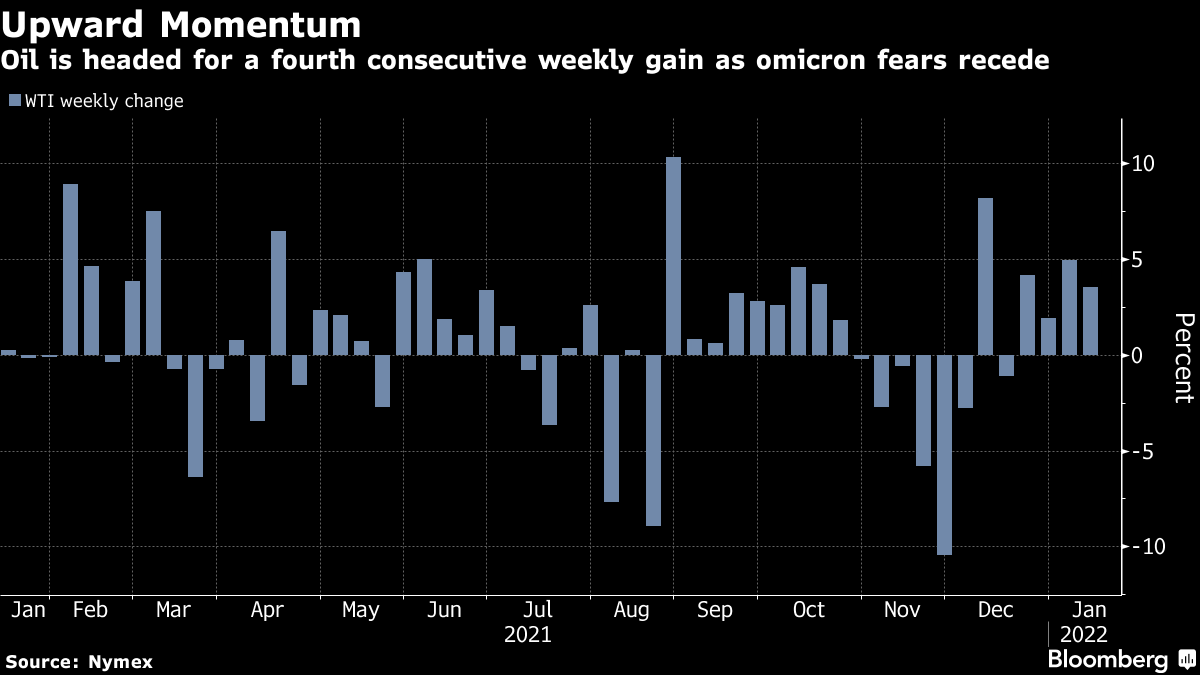

(Bloomberg) -- Oil headed for a fourth straight weekly gain, the longest winning streak since October, on signs that the market is tightening as global consumption withstands the impact of the omicron virus variant.

West Texas Intermediate dipped below $82 a barrel in Asian trading, but was more than 3% higher this week. The American benchmark has made a strong start to the year as U.S. nationwide inventories fell to the lowest since 2018.

Crude has now clawed back most of the losses late last year that were driven by omicron and the White House-led releases from national reserves. Although it’s proved to be fast-spreading, the variant is also milder, lessening the impact on energy consumption. The International Energy Agency said earlier this week that global oil demand has proven stronger than expected.

Oil prices have benefited from a confluence of other supportive factors, including interruptions to supplies in producers such as Libya and Kazakhstan. There’s also concern the Organization of Petroleum Exporting Countries and its allies are unable to deliver their planned monthly increases in output in full.

“Oil will hold up close to $80 to $85 in the near term,” said Suvro Sarkar, a Singapore-based energy analyst at DBS Bank Ltd. Demand continues to be very strong and there’s no real impact from omicron so far, but the market could see “some correction” once the Libya issue is resolved, he added.

Goldman Sachs Group Inc. said the demand impact on oil from omicron “has been modest,” according to a Jan. 13 report from analysts including Jeffrey Currie. In addition, the bank said OPEC production increases this year will likely test spare production capacity for the first time since 2004.

Optimism about the outlook is reflected in the market’s bullish backwardated pricing structure, with near-term contracts above those further out. The spread between WTI’s two nearest December contracts has expanded for six weeks and is now well above $6 a barrel, up from less than $3 in early December.

Despite the broadly positive mood, there are notes of caution. China has maintained its strict approach to the virus, while India and some other Asian countries have introduced partial curbs and seen a drop in mobility. On Monday, China is likely to confirm its weakest economic growth in more than a year, after reporting a drop in annual crude imports on Friday.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge