Oil Slips as Investors Weigh Demand Outlook Ahead of Fed Meet

(Bloomberg) -- Oil advanced in a thin trading session, buoyed by tight physical crude supplies while broader financial markets braced for a widely expected rate hike.

West Texas Intermediate futures climbed near $98 a barrel amid a rally in commodities. Time spreads are indicating scarce supply and Morgan Stanley noted in a recent report that the market remains tight. Still, the investment bank trimmed its crude oil price forecasts this year and into 2023, citing reduced demand projections. The Federal Reserve is expected to raise rates Wednesday in an effort to tame inflation, which could translate into an economic slowdown and reduced demand.

“The market seems to be in more of a corrective phase reacting to the tighter near-term physical market,” said Dennis Kissler, senior vice president of trading at BOK Financial. “In the longer term, fuel demand will remain key and for the last two weeks we have seen a definite decrease.”

Sign up here for Elements, Bloomberg’s daily energy and commodities newsletter.

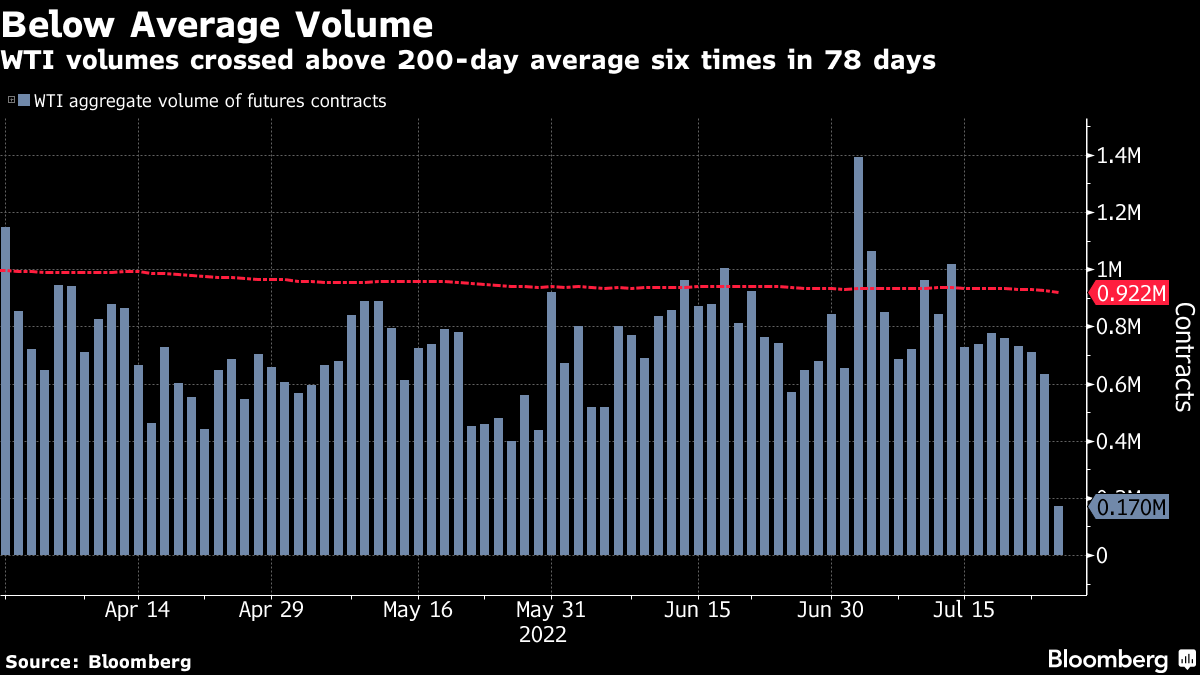

Oil has been gripped by bouts of volatility amid low liquidity in recent months as investors juggle competing supply and demand outlooks. In 78 trading days since the start of April, WTI volumes have only been above the 200-day average on six occasions, underscoring the relative lack of activity in the market.

WTI is still up almost 30% this year, in part due to upended trade flows from Russia. The gap between the US benchmark and Brent has widened to almost $9 a barrel, indicating supply tightness is more pronounced in Europe than the US. American gasoline demand has declined in the height of the typical driving season as expensive gasoline prices have caused Americans to alter their habits.

Expensive Gasoline Is Altering US Driving Habits, AAA Says

The market is steeply backwardated, a bullish pattern marked by near-term prices commanding a premium to later-dates ones. Brent’s prompt spread was $4.77 a barrel in backwardation, compared with $3.83 at the start of July.

The tight market may get some relief from recovering Libyan output but the country’s contribution will probably be volatile given the potential for conflict and unrest to flare quickly. Supply from the OPEC producer has climbed back above 1 million barrels a day.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge