US Equity Futures Drop With Stocks as Dollar Jumps: Markets Wrap

(Bloomberg) -- Most Asian stocks dropped along with US equity futures Monday and the dollar jumped as the risk of more Covid curbs in China exacerbated overarching worries about the global economic outlook.

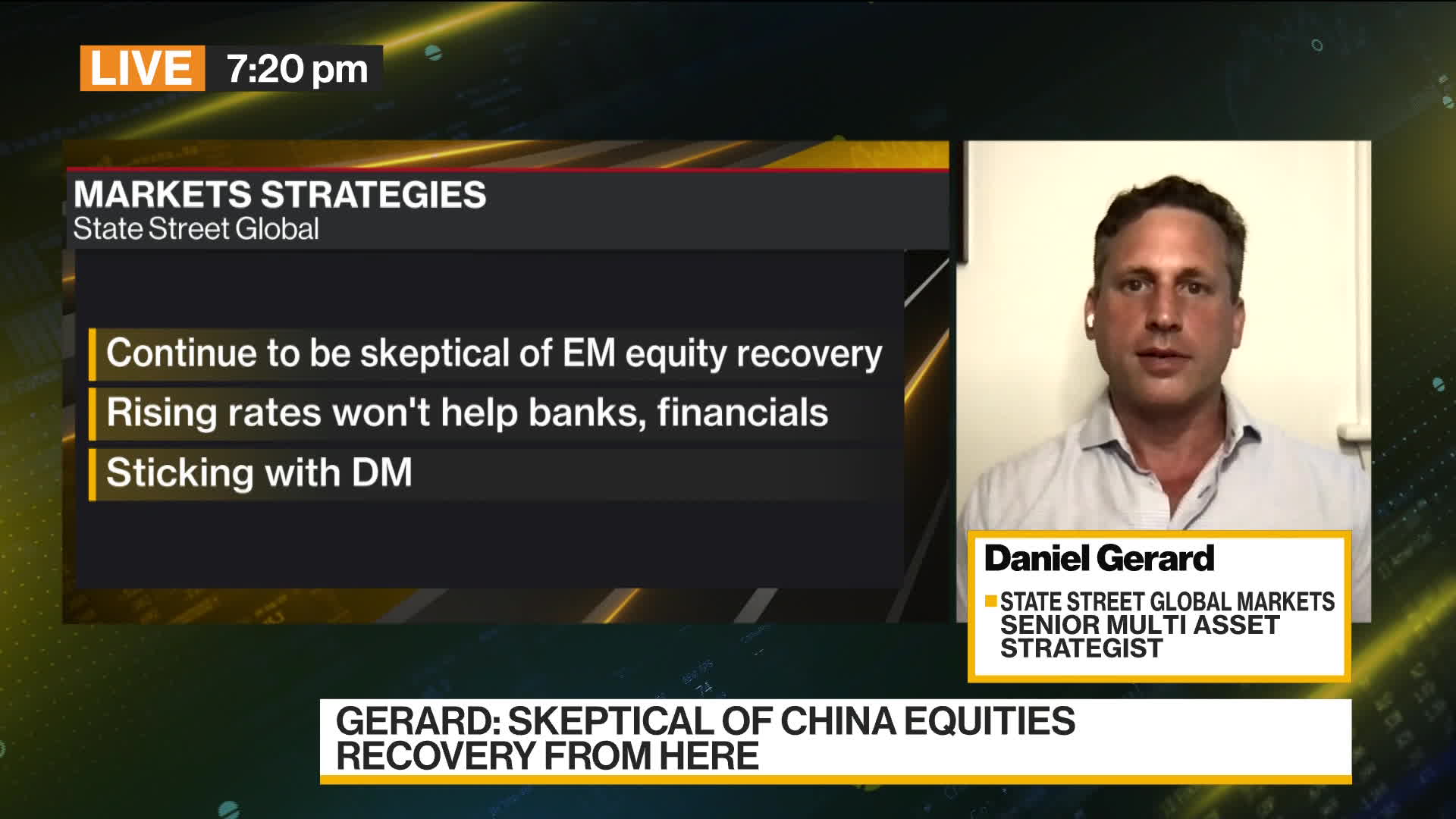

An Asian equity gauge shed about 1% amid declines in Hong Kong and China. Japan was a bright spot, buoyed by the prospect of administrative stability after the ruling coalition expanded its majority in an upper house election.

A dollar gauge was back around the highest level since 2020. The yen was the weakest Group-of-10 performer, possibly because investors viewed the poll result as an endorsement of Japan’s super-easy monetary policy.

Shanghai reported its first case of the highly infectious BA.5 omicron sub-variant Sunday and warned of “very high” risks, stoking fears of more lockdowns given China remains wedded to stamping out the pathogen. Casino shares sapped Hong Kong after Macau announced the closure of almost all businesses for a week from Monday due to a virus outbreak.

Commodity-linked currencies were under pressure and oil suffered losses. Treasuries were steady, leaving the US 10-year yield at 3.08%. Inversions along the yield curve are potential signs of economic retrenchment ahead.

Price pressures, a wave of monetary tightening and a slowing global economy continue to shadow markets.

A US inflation reading later this week is expected to get closer to 9%, a fresh four-decade high, buttressing the Federal Reserve’s case for a jumbo July interest-rate hike. Company earnings, meanwhile, will shed light on recession fears that contributed to an $18 trillion first-half wipeout in global equities.

“The real earnings hit will come in the second half as we’re hearing from companies, especially retailers, saying they’re already seeing weakness from consumers,” Ellen Lee, portfolio manager at Causeway Capital Management LLC, said on Bloomberg Television.

Elsewhere, the pound fell as the race to replace Boris Johnson as UK premier heats up. Over in Europe, the main conduit for Russian gas down for 10-day maintenance on Monday. Germany and its allies are bracing for President Vladimir Putin to use the opportunity to cut off flows for good in retaliation for the West’s support of Ukraine following Russia’s invasion.

The US consumer-price index data will be “the core driver of risk this week” and a 9% print is possible, which “should keep US bond yields headed higher,” Chris Weston, head of research at Pepperstone Group, wrote in a note.

Bitcoin caught a downdraft from the cautious start to the week in wider markets, falling as much as 2.5% but holding above $20,000.

What to watch this week:

- Earnings due from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- New York Fed President John Williams speaks in Libor talk, Monday

- BOE Governor Andrew Bailey speaks, Monday and Tuesday

- South Korea, New Zealand rate decisions, Wednesday

- Federal Reserve Beige Book, Wednesday

- China trade, Wednesday

- US PPI, jobless claims, Thursday

- China GDP, key economic data, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Atlanta Fed President Raphael Bostic speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.7% as of 12:14 p.m. in Tokyo. The S&P 500 fell 0.1% Friday

- Nasdaq 100 futures retreated 1%. The Nasdaq 100 rose 0.1% Friday

- Japan’s Topix index rose 1.1%

- Australia’s S&P/ASX 200 fell 0.7%

- South Korea’s Kospi index shed 0.4%

- Hong Kong’s Hang Seng Index fell 2.9%

- China’s Shanghai Composite Index fell 1.5%

- Euro Stoxx 50 futures fell 1.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was at $1.0153, down 0.3%

- The Japanese yen was at 136.95 per dollar, down 0.6%

- The offshore yuan was at 6.7074 per dollar, down 0.3%

Bonds

- The yield on 10-year Treasuries was at 3.08%

- Australia’s 10-year bond yield rose six basis points to 3.54%

Commodities

- West Texas Intermediate crude fell 0.9% to $103.79 a barrel

- Gold was at $1,742.09 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge