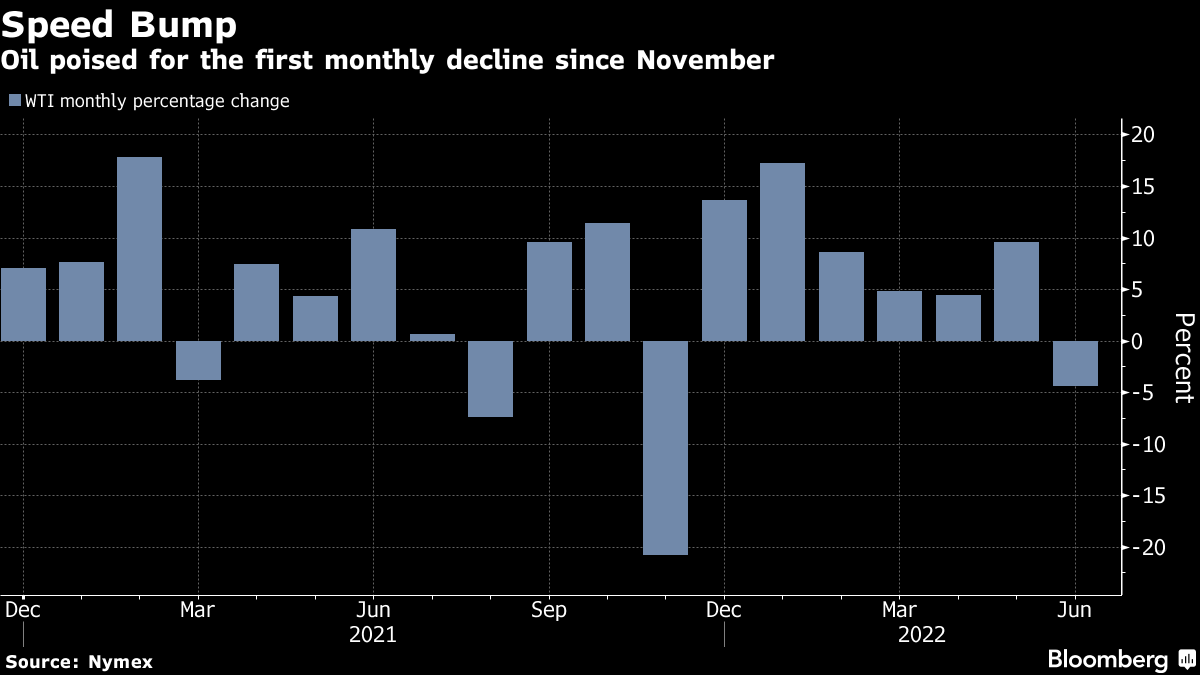

Oil Set for First Monthly Decline This Year Before OPEC+ Meeting

West Texas Intermediate futures traded near $110 a barrel after closing almost 2% lower on Wednesday. Escalating fears over an economic slowdown as central banks aggressively raise interest rates to combat surging inflation have dented oil this month. That’s overshadowed rapidly tightening energy markets.

OPEC+ is expected to rubber-stamp a modest increase in supply for August, but the group has struggled to meet its production targets this year. The US has repeatedly called on the cartel to pump more, and President Joe Biden is set to visit the Middle East next month as he seeks to tame surging fuel prices.

US gasoline demand is showing signs of softening just three weeks into the peak driving season, with near-record prices likely encouraging people to stay closer to home. The four-week moving average of gasoline supplied fell below 9 million barrels a day, or about 600,000 barrels less than typical seasonal levels, according to the Energy Information Administration.

“The higher price environment appears to be doing its job when it comes to demand,” said Warren Patterson, the Singapore-based head of commodities strategy at ING Groep NV. “As for OPEC+, I am not expecting any surprises from the group. I would imagine it will be a fairly quick meeting.”

Oil is still up around 45% this year as the global economic recovery coincided with upended trade flows from Russia after its invasion of Ukraine in late February. US crude inventories at the key storage hub at Cushing, Oklahoma, have reached critically low levels as refineries produce as much fuel as possible, while the pull for barrels from overseas remains strong.

The world is heading for a “turbulent period” as tightening supplies of oil and liquefied natural gas exacerbate a global energy crunch, Shell Plc Chief Executive Officer Ben van Beurden said in Singapore on Wednesday. “Spare capacity is very low, demand is still recovering,” he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge