Stocks, Bonds Falter on Gloomy Inflation Outlook: Markets Wrap

(Bloomberg) -- Stocks fell Thursday and bonds were again on the back foot, weighed down by the impact of high inflation.

A fizzling rally in Chinese tech shares contributed to a drop in an Asia-Pacific equity index. US futures dipped after Wall Street snapped a two-day climb.

An advance in oil past $122 a barrel has stoked worries about rising costs and monetary tightening. Sentiment also took a knock after Shanghai said it will lock down a district on Saturday morning for Covid testing -- the first major movement restriction since the city exited curbs earlier this month.

Benchmark Treasury yields pushed further above 3%, while New Zealand’s 10-year yield touched the highest level in seven years.

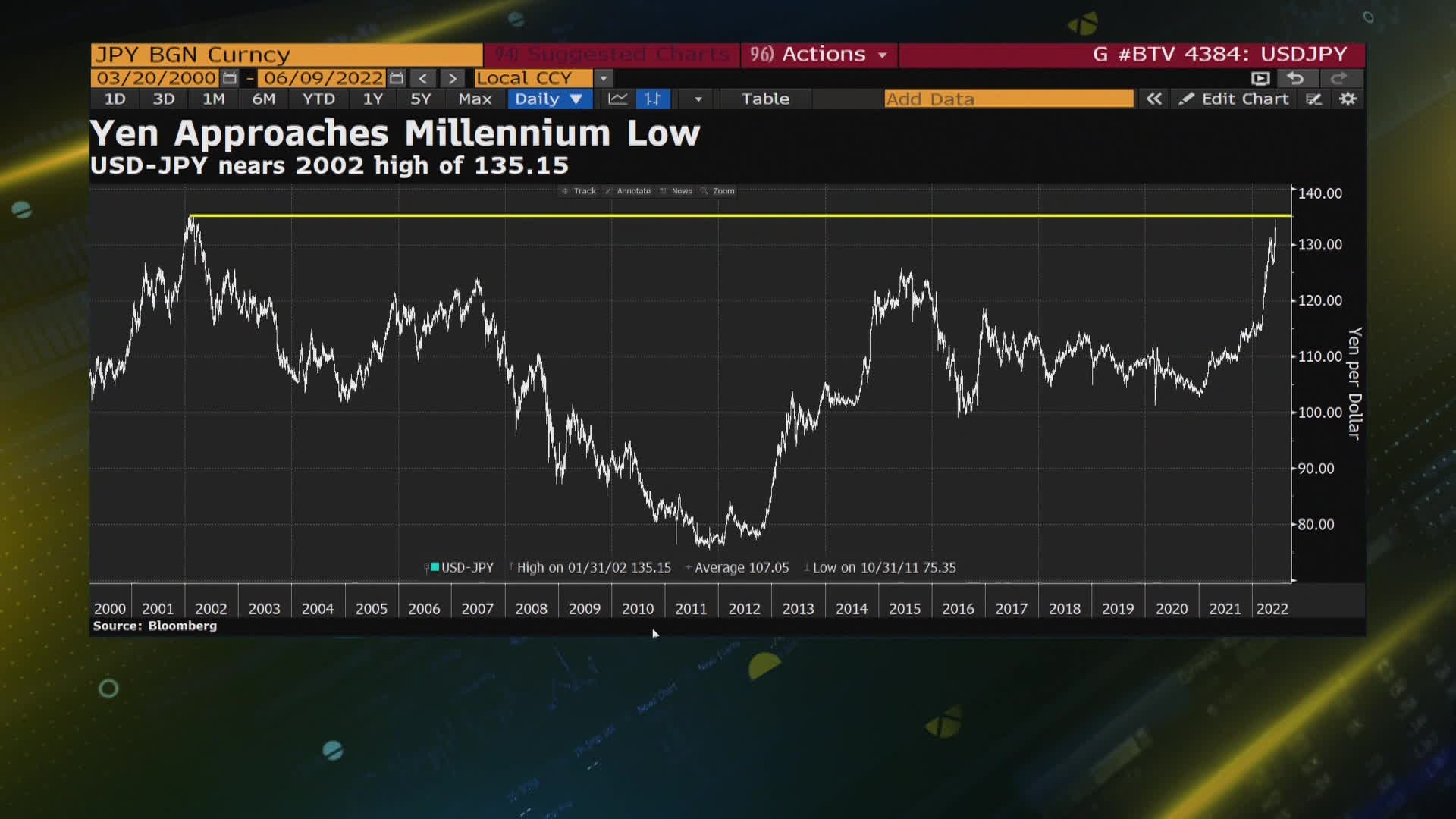

The dollar-yen pair is dominating foreign-exchange markets, with the weakness in Japan’s currency putting the 2002 high of 135.15 in play. China could see the trend as an unfair competitive advantage, said Jim O’Neill, former chair of Goldman Sachs Asset Management.

Data in China showed exports grew at a faster pace in May than the previous month as Covid-related disruptions eased. The offshore yuan strengthened.

Markets remain fixated on the risk of a downturn triggered by interest-rate hikes across much of the world to quell price pressures.

The OECD added to the gloom with a warning that the global economy will pay a “hefty price” for Russia’s war in Ukraine in the form of weaker growth, stronger inflation and potentially long-lasting damage to supply chains.

“Our view is that the chance of recession by the end of 2023 is 40% or so,” Anna Han, equity strategist at Wells Fargo Securities LLC, said on Bloomberg Television. An “upward surprise” from the US consumer-price index release Friday could flatten the Treasury yield curve, she added.

Meanwhile, the European Central Bank Thursday is set to wind down trillions of euros of asset purchases in a prelude to a rate hike expected in July that would cement a path toward exiting eight years of negative rates. The euro edged up, while European equity futures retreated.

“Chances are that the ECB will have a hawkish pivot today,” Carol Kong, a strategist at Commonwealth Bank of Australia, said on Bloomberg Television. “If we do see Christine Lagarde leaning toward a 50 basis-points hike in July, that’s going to be very supportive of the euro-dollar.”

Which commodities will outperform into year-end? Raw materials is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Key events to watch this week:

- European Central Bank rate decision, Christine Lagarde briefing, Thursday

- China trade, new yuan loans, money supply, aggregate financing. Thursday

- US CPI, University of Michigan consumer sentiment Friday

- China CPI, PPI Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures shed 0.1% as of 12:34 p.m. in Tokyo. The S&P 500 fell 1.1%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 0.8%

- Japan’s Topix index rose 0.3%

- Australia’s S&P ASX/200 index lost 0.9%

- South Korea’s Kospi index declined 0.5%

- Hong Kong’s Hang Seng index fell 0.5%

- China’s Shanghai Composite index declined 0.5%

- Euro Stoxx 50 futures fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index was steady

- The euro was at $1.0725, up 0.1%

- The Japanese yen was at 134.23 per dollar

- The offshore yuan was at 6.6915 per dollar, up 0.1%

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.04%

- Australia’s 10-year yield increased five basis points to 3.59%

Commodities

- West Texas Intermediate crude was at $122.30 a barrel, up 0.2%

- Gold was at $1,854.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge