U.S. Futures Dip; Stocks Rise on China Tech, Japan: Markets Wrap

(Bloomberg) -- Stocks rose in Asia on Wednesday, spurred by Chinese technology shares and a climb in Japan as yen weakness bolsters exporters.

Hong Kong’s Hang Seng Tech Index advanced after new video game approvals encouraged the view that China’s crackdown on internet firms is loosening. That helped an Asia-Pacific share gauge to add a little under 1%.

Still, the tech index and the broader Asian market came off session highs, suggesting some investors took the opportunity to bank profits. Equity futures were mixed, with those for the U.S. dipping and Europe’s pushing higher.

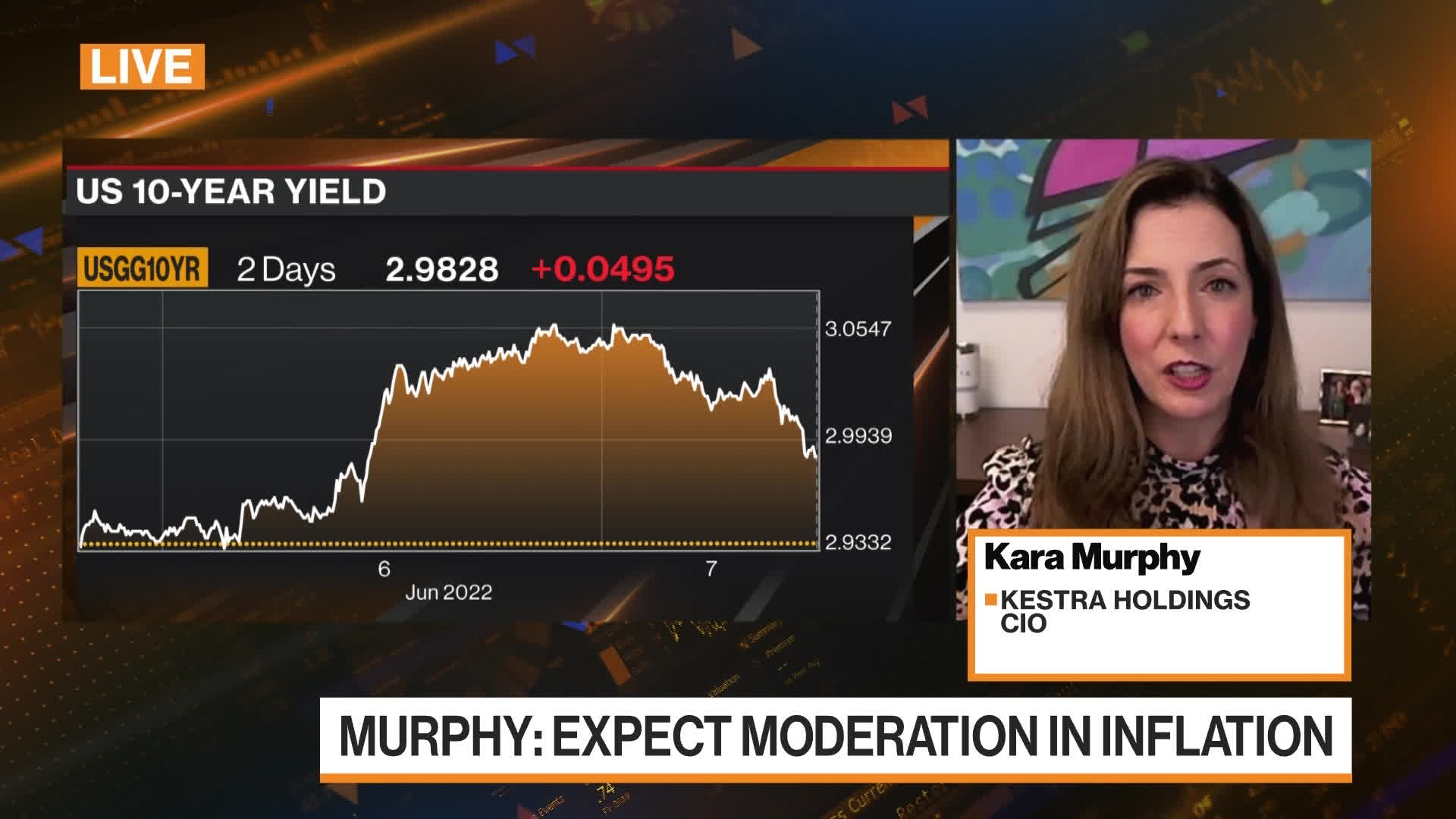

Treasury yields edged up, taking the benchmark 10-year rate back toward 3%. The yen slid to another two-decade low versus the dollar on the policy contrast between a super-dovish Bank of Japan and hawkish Federal Reserve.

Sentiment remains fragile on concerns that interest rates will need to go much higher to rein in inflation, stifling economic growth in the process. The Bloomberg Commodity Spot Index of raw materials is at a record peak, underlining global price pressures.

“There seems to be across all of the investing segments a lack of strong conviction in the direction of the market,” Kate Moore, head of thematic strategy for global allocation at BlackRock Inc., said on Bloomberg Television. “We are going to see a lot more investors remain on the sidelines, remain cautiously positioned.”

The World Bank again cut its forecast for 2022 global expansion, warning of several years of above-average inflation and below-average growth.

“When you look at the global growth backdrop, it’s certainly slowing and it’s slowing from very high levels and it’s going to feel uncomfortable,” Erin Browne, Pacific Investment Management Co. multi-asset strategies portfolio manager, said on Bloomberg Radio.

Billionaire hedge fund founder Ray Dalio said central banks across the globe will be required to cut interest rates in 2024 after a period of stagflation constrains their economies, according to a report.

Cryptocurrencies were on the back foot, with Bitcoin shedding about 4% and falling back to around $30,000.

Which commodities will outperform into year-end? Raw materials is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Key events to watch this week:

- Reserve Bank of India rate decision Wednesday

- OECD Economic Outlook, a twice-yearly analysis of major global economic trends and prospects for the next two years. Wednesday

- European Central Bank rate decision, Christine Lagarde briefing, Thursday

- China trade, new yuan loans, money supply, aggregate financing. Thursday

- US CPI, University of Michigan consumer sentiment Friday

- China CPI, PPI Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.4% as of 12:38 p.m. in Tokyo. The S&P 500 rose 1%

- Nasdaq 100 futures lost 0.4%. The Nasdaq 100 rose 0.9%

- Japan’s Topix index rose 1%

- Australia’s S&P/ASX 200 Index gained 0.5%

- South Korea’s Kospi index rose 0.2%

- Hong Kong’s Hang Seng Index climbed 1.6%

- China’s Shanghai Composite Index shed 0.7%

- Euro Stoxx 50 futures increased 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The Japanese yen dropped 0.3% to 133 per dollar

- The offshore yuan was at 6.6755 per dollar

- The euro traded at $1.0683, down 0.2%

Bonds

- The yield on 10-year Treasuries rose one basis point to 2.99%

- Australia’s 10-year yield fell four basis points to 3.52%

Commodities

- West Texas Intermediate crude rose 0.2% to $119.62 a barrel

- Gold was at $1,847.32 an ounce, down 0.3%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge