US Futures, Stocks Turn Gloomy on Recession Fears: Markets Wrap

(Bloomberg) -- A bounce in stocks reversed in Asia Wednesday and the dollar climbed amid ever-louder warnings about the risk of an economic downturn.

MSCI Inc.’s Asia-Pacific share index shed over 0.5%, with Chinese technology equities among the worst performers. US futures declined as brief optimism from a Tuesday jump in the S&P 500 and Nasdaq 100 petered out.

Treasuries and the yen -- traditional havens along with the greenback -- edged up. The Federal Reserve’s aggressive monetary tightening to tame inflation, and the attendant risk of recession, continue to unsettle investors.

Oil retreated further below $110 a barrel and iron ore slid. Bitcoin fell toward $20,000, though conditions were calmer than recent cryptocurrency turmoil.

Skepticism abounds about the outlook for risk assets in a year of steep drops across markets. Prognosticators from Morgan Stanley to Goldman Sachs Group Inc. warned stocks may face more losses amid dimming economic prospects.

“The quicker and the higher they need to hike, the higher the probability of a recession,” Christian Nolting, Deutsche Bank International Private Bank chief investment officer, said on Bloomberg Television, referring to monetary policy.

Deutsche Bank is underweight equities and further declines would offer an opportunity to “close the gap to a neutral position because even if there is a recession, it might not be a long lasting one,” Nolting said.

Powell Looms

Fed Bank of Richmond President Thomas Barkin said the central bank should raise rates as fast as it can without causing undue harm to financial markets or the economy. Chair Jerome Powell is expected to reinforce the commitment to fighting price pressures when he speaks in front of lawmakers Wednesday.

A backdrop of tightening financial conditions led delegates including Tesla Inc. Chief Executive Officer Elon Musk to warn the US is heading toward a recession. President Joe Biden plans call on Congress to enact a gasoline tax holiday to cool soaring pump prices and alleviate the pressure on consumers.

Officials in China intensified calls for economic support. The nation’s finance minister said more pro-growth policies are being studied, and a newspaper affiliated with the Cabinet urged banks to step up infrastructure lending.

How will the second half of this year play out for major asset classes? We are re-running MLIV’s 2022 asset survey from December to see how street views have evolved amid the turmoil and volatility in the past few months. Click here to participate anonymously.

What to watch this week:

- Fed Chair Jerome Powell semi-annual Senate testimony, Wednesday

- Powell US House testimony, Thursday

- US initial jobless claims, Thursday

- PMIs for euro zone, France, Germany, UK, Australia, Thursday

- ECB economic bulletin, Thursday

- US University of Michigan consumer sentiment, Friday

- RBA’s Lowe speaks on panel, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.9% as of 12:08 p.m. in Tokyo. The S&P 500 rose 2.5%

- Nasdaq 100 futures retreated 1%. The Nasdaq 100 rose 2.5%

- Japan’s Topix index increased 0.2%

- Australia’s S&P/ASX 200 Index fell 0.4%

- South Korea’s Kospi index fell 1.9%

- Hong Kong’s Hang Seng Index fell 1.2%

- China’s Shanghai Composite Index was down 0.5%

- Euro Stoxx 50 futures fell 1.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was at $1.0508, down 0.2%

- The Japanese was at 136.08 per dollar, up 0.4%

- The offshore yuan was at 6.7172 per dollar, down 0.4%

Bonds

- The yield on 10-year Treasuries fell two basis points 3.25%

- Australia’s 10-year bond yield fell seven basis points to 3.99%

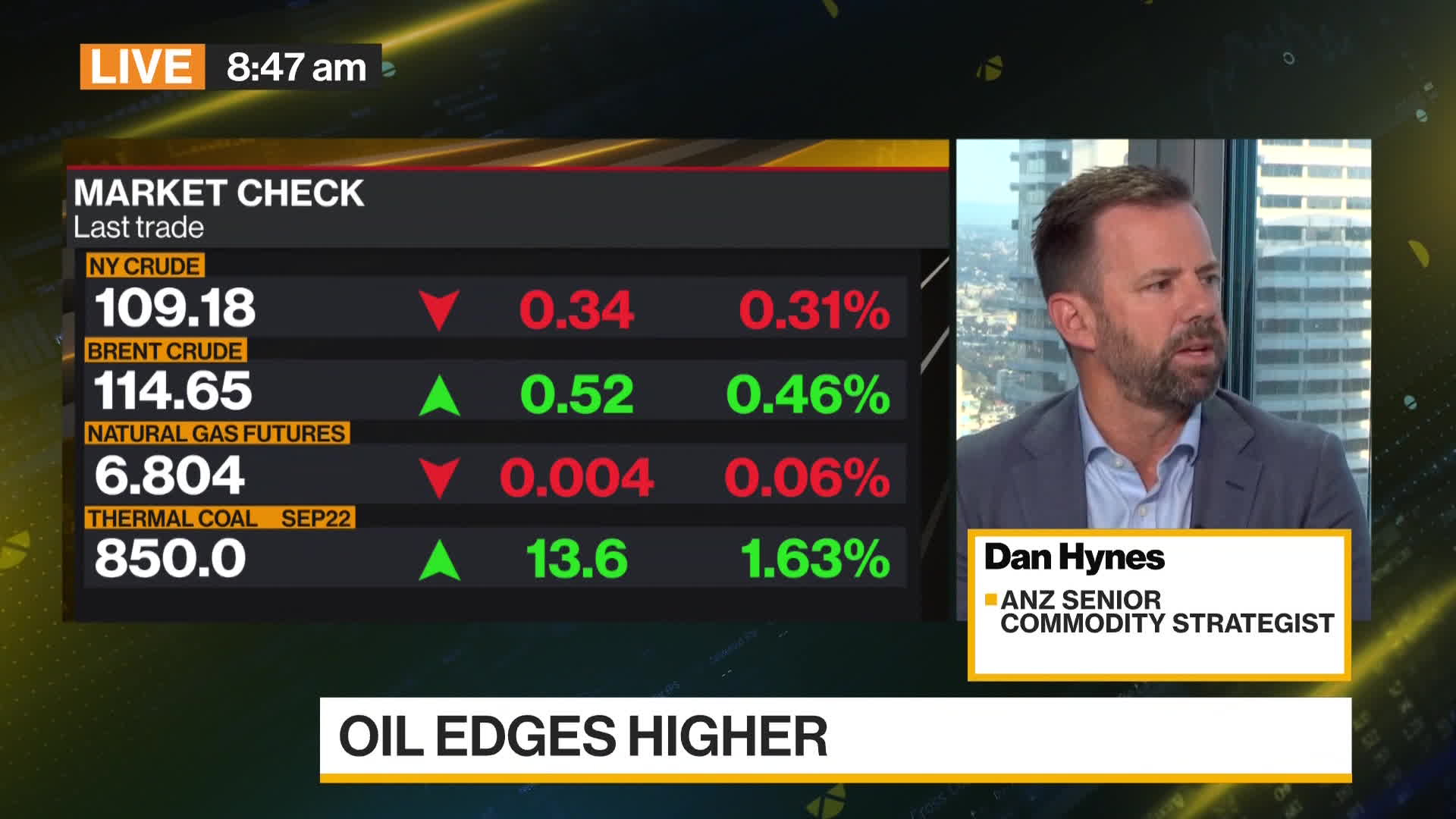

Commodities

- West Texas Intermediate crude was at $105.54 a barrel, down 3.7%

- Gold was at $1,828.33 an ounce, down 0.3%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge