Oil Heads for Fourth Weekly Gain on Outlook for Products Demand

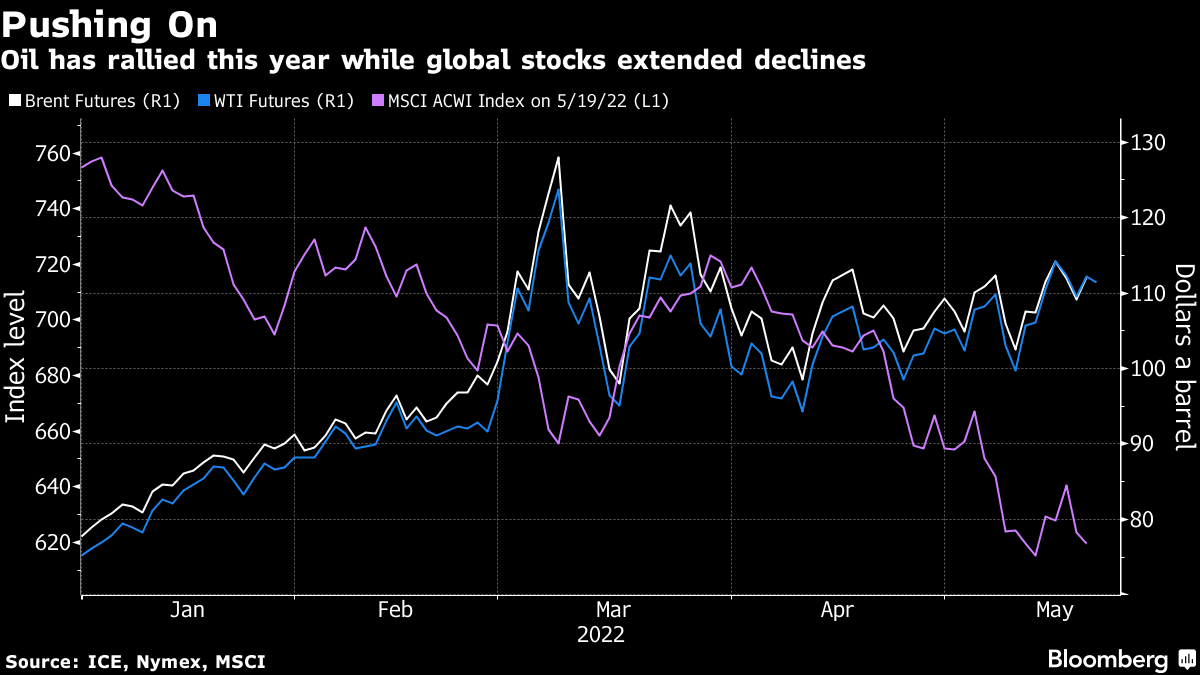

(Bloomberg) -- Oil headed for a modest weekly gain as optimism about the outlook for demand eclipsed concerns about tighter monetary policy and an economic slowdown that have combined to roil wider financial markets.

West Texas Intermediate eased below $111 a barrel after ending higher on Thursday, and is up 0.3% so far this week. It’s on course for a fourth consecutive weekly gain that would be the best run since mid-February.

Global fuel-product markets are tightening, especially in the US, where gasoline and diesel prices have risen to unprecedented levels in the run-up to summer driving season. Nationwide travel is expected to approach levels seen before the coronavirus pandemic, according to a forecast from auto club AAA.

Oil has surged almost 50% this year as demand recovered from the impact of the pandemic and Russia’s assault on Ukraine sent shock waves through global markets. While the US and UK have announced bans on Russian exports, flows to Asia have picked up. China is seeking to replenish strategic stockpiles with cheap Russian oil even as officials grapple to suppress Covid-19 outbreaks.

“The market’s focus now is tightening crude fundamentals,” said Zhou Mi, an analyst at Chaos Research Institute in Shanghai, which is affiliated with Chaos Ternary Futures Co. “With an easing of virus outbreaks in China, and peak-demand season in the US, risks are skewed to the upside.”

There were mixed signals from China on Friday. While banks cut a key interest rate for long-term loans by a record to bolster a slowing economy, Shanghai found the first cases of Covid-19 outside quarantine in six days, raising questions on whether the easing of the city’s lockdown will be impacted.

Oil’s jump has contributed to the fastest inflation in decades, prompting the US Federal Reserve to vow that it’ll go on raising interest rates until there are clear signs that price pressures are easing. That’s spurred wild shifts in investors’ appetite for risk, swinging equity, bond and commodity markets.

Oil markets remain in backwardation, a bullish pattern in which near-term prices trade above longer-dated ones. Brent’s prompt spread, the difference between its two nearest contracts, was $2.33 a barrel in backwardation compared with $1.80 a week ago.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge