Hong Kong Leads Asia Advance Before Rate Decisions: Markets Wrap

(Bloomberg) -- Stocks advanced during the Asian trading session amid higher bond yields and investor focus on central bank decisions and the pace of further interest rate hikes.

An Asian equity gauge surged for the second straight day as the sell-off in Hong Kong and China shares paused. Tech shares gained more than 5% and led a rebound in Hong Kong equities, which on Monday slumped to the lowest since 2009.

Japanese shares climbed as the yen’s weakness supported sentiment for the nation’s exporters. Technology and EV battery companies pushed South Korea’s benchmark index higher.

US equity futures rose after the S&P 500 declined, weighed down by big tech. US Energy shares had whipsawed on news that President Joe Biden would call on Congress to consider tax penalties for producers accruing record profits.

Australia’s central bank raised interest rates by a quarter point as expected. The ASX 200 Index extended gains and Australian sovereign bonds enjoyed a little bit of a relief rally.

The small increase in Australia’s policy rate contrasts with expectations for another jumbo hike from the Federal Reserve on Wednesday.

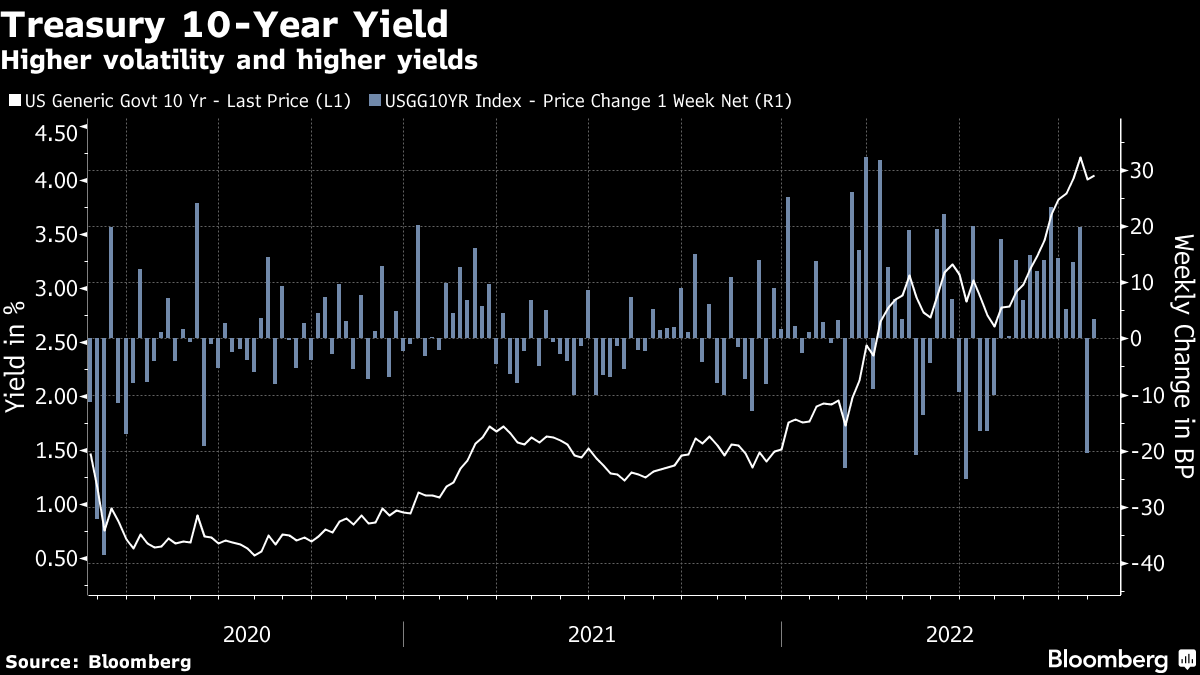

Treasury yields dropped despite two-year US yields remaining elevated at around 4.4%. Swap markets are pricing in a 75-basis-point hike this week amid the Fed’s most-aggressive tightening campaign in four decades.

“Some bottom fishing activities today after heavy sell-offs” led to the strong rebound in Chinese and Hong Kong stocks, said Banny Lam, head of research at CEB International Investment Corp. “The markets might be volatile in the coming days, however, as investors are waiting for Fed comments about rate outlook on Wednesday. So I’m still cautious at the moment.”

Still, strategists including JPMorgan Chase & Co.’s Marko Kolanovic believe the Fed’s aggressive hiking is nearing an end, providing the prospect of relief for markets. The US will likely raise rates by 50 basis points in December and pause after one more 25-basis-point hike in the first quarter, he said.

Indicators such as the inversion of the yield curve between 10-year and three-month Treasuries “all support a Fed pivot sooner rather than later,” wrote Morgan Stanley’s Michael Wilson.

Looking ahead, Bespoke Investment Group said November has historically been one of the strongest months of the year for US stocks. The S&P 500 has experienced an average gain of 0.82% with positive returns 69% of the time, according to data going back to 1983. Over the last 10 years, the gauge saw a median advance of 1.26% and gains nine out of 10 times.

In currency markets, the yen is back within reach of the 150 level versus the dollar. Japan spent a record 6.3 trillion yen ($42 billion) in October to counter the yen’s sharp slide against the dollar, as it tried to limit speculative moves adding to pressure on the currency.

The offshore yuan declined, edging closer to its weakest on record, as China signaled a looser grip on the currency by weakening the fixing.

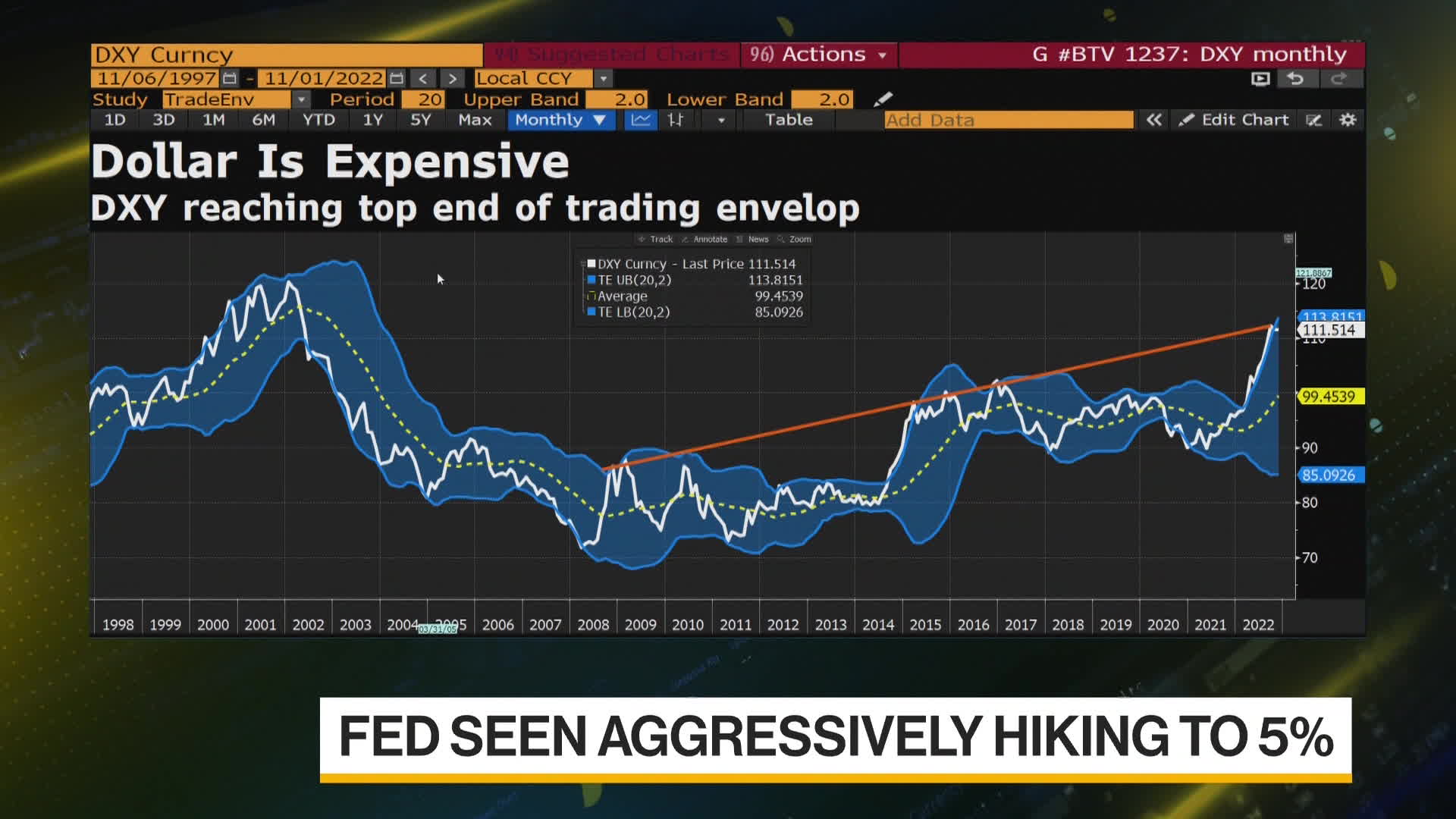

“We expect that strong dollar trend will continue at least into mid to early 2023,” Todd Jablonski, chief investment officer of asset allocation at Principal Asset Management, said on Bloomberg Television. “The strong US dollar likely correlates with peak US policy rates in early 2023.”

Elsewhere, oil gained and gold rose.

Key events this week:

- US construction spending, ISM manufacturing index, Tuesday

- EIA crude oil inventory report, Wednesday

- Federal Reserve rate decision, Wednesday

- US MBA mortgage applications, ADP employment, Wednesday

- Bank of England rate decision, Thursday

- US factory orders, durable goods, trade, initial jobless claims, ISM services index, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US nonfarm payrolls, unemployment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.4% of 12:37 p.m. in Tokyo. The S&P 500 fell 0.8% on Monday

- Nasdaq 100 futures rose 0.4%. The Nasdaq 100 fell 1.2%

- Japan’s Topix index rose 0.5%

- South Korea’s Kospi index rose 1.5%

- Hong Kong’s Hang Seng Index rose 2.7%

- China’s Shanghai Composite Index rose 0.9%

- Australia’s S&P/ASX 200 Index rose 1.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $0.9903

- The Japanese yen rose 0.3% to 148.24 per dollar

- The offshore yuan rose 0.1% to 7.3255 per dollar

Cryptocurrencies

- Bitcoin rose 0.7% to $20,556.5

- Ether rose 2.1% to $1,597.43

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.02%

- Yields on Australia’s 10-year bonds rose two basis points to 3.77%

Commodities

- West Texas Intermediate crude rose 0.8% to $87.20 a barrel

- Spot gold rose 0.3% to $1,638.26 an ounce

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge