Oil Sinks as China’s Struggle With Covid Blights Demand Outlook

(Bloomberg) -- Oil sank again following the biggest weekly decline since August as China tightened anti-Covid curbs, hurting the outlook for demand.

Global benchmark Brent fell below $87 a barrel after retreating by almost 9% last week. The country saw its first Covid-related death in almost six months on Saturday and another two were reported on Sunday, sparking fears of a further wave of restrictions in the world’s biggest oil importer just as a city of 11 million near the capital asked residents to stay home amid an outbreak.

Goldman Sachs Group Inc. lowered its fourth-quarter forecast for Brent crude by $10 a barrel to $100, according to a note, with the reduction driven in part by the possibility of further anti-virus measures in China as cases climb.

Crude has erased the gains made at the start of the quarter, when the Organization of Petroleum Exporting Countries and allies including Russia agreed to reduce production by 2 million barrels a day. A looming European Union ban on Russian seaborne flows and Group of Seven price-cap plan are clouding the outlook, with officials possibly set to announce the cap’s level on Wednesday as they step up their response to Moscow’s invasion of Ukraine.

“The market is right to be anxious about forward fundamentals due to significant Covid cases in China and a lack of clarity on the implementation” of the price cap, Goldman analysts including Callum Bruce said. Still, for longer-term investors, the drop provides an opportunity to add length, they said.

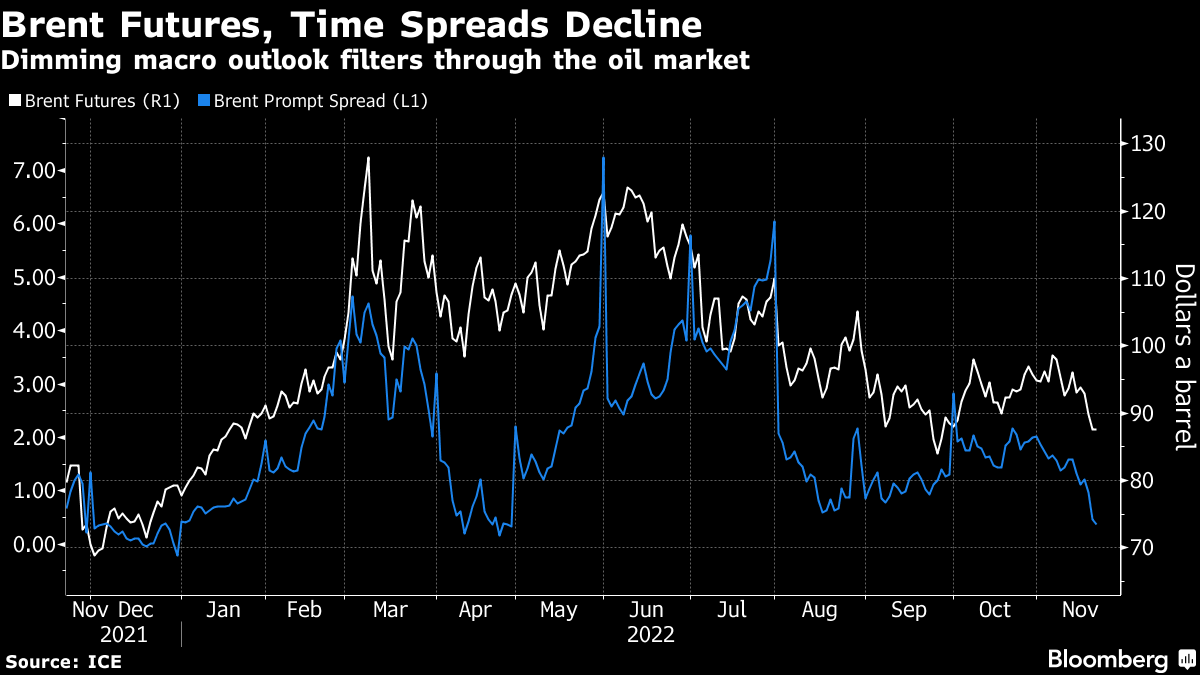

The market’s weakness is reflected in rapidly softening differentials. Brent’s prompt spread -- the gap between its two nearest contracts -- was 42 cents a barrel in backwardation, down from more than $2 a barrel a month ago. The same gauge for West Texas Intermediate has flipped into contango, a bearish signal that indicates ample near-term supply.

Commodity investors also are concerned that further aggressive monetary tightening will lead to a global economic slowdown, hurting energy consumption. Traders this week will look to minutes of the most recent Federal Reserve policy meeting for more clues on the course of rate hikes.

“With record high Covid cases and falling mobility data in China, it’s hard to find a bull in the paddock,” said James Whistler, managing director of Vanir Global Markets Pte. “Oil markets just can’t shake the bear.”

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge