Oil’s Rally Stalls on Concerns Slowdown to Erode Energy Demand

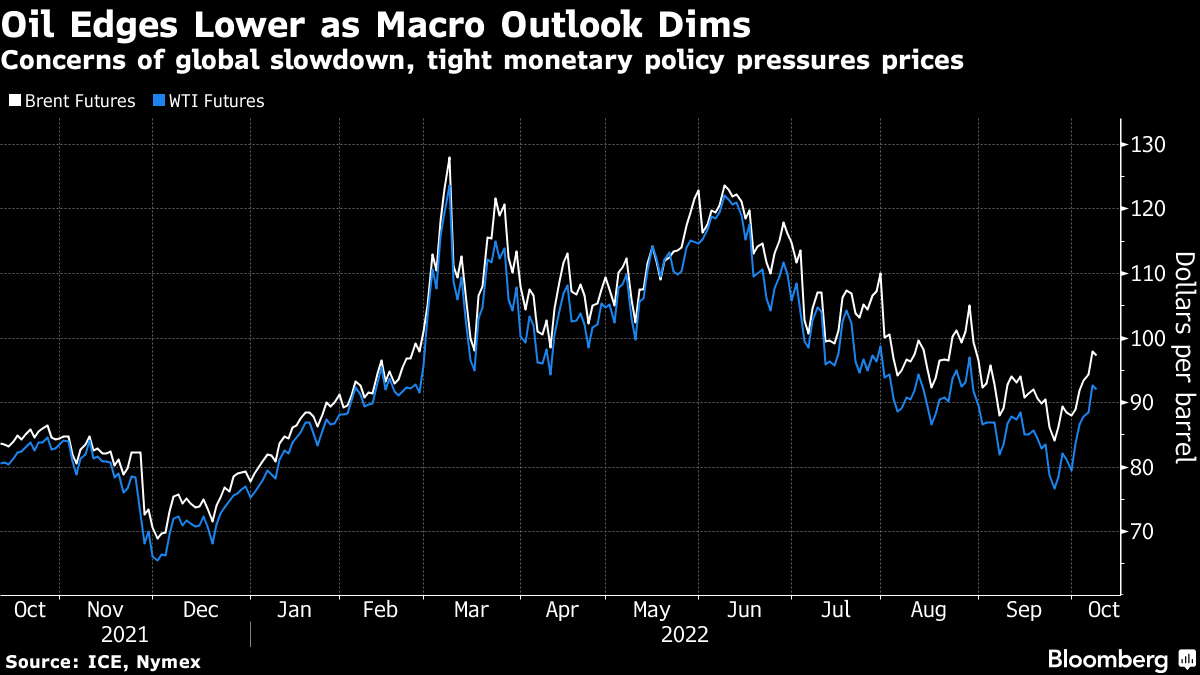

(Bloomberg) -- Oil fell as risks to demand from a global slowdown halted a powerful rally triggered by OPEC+’s decision to defy the US by cutting supply.

West Texas Intermediate sank below $92 a barrel on fears the Federal Reserve will have to go on hiking rates to quell inflation, ending a week-long, 17% rally that came as the Organization of Petroleum Exporting Countries and allies including Moscow cut output. In Asia, China’s markets reopened amid concern about persistent Covid-Zero curbs before a key government summit.

Oil along with other commodities and risk assets including equities remain pressured by the slowdown concerns, with crude giving up all of the gains triggered by Russia’s invasion of Ukraine. While the move by OPEC+ to reduce output drew a rebuke from the US, a slew of leading banks said it was a positive sign for prices heading into the year-end.

“The OPEC+ cuts have mostly been digested,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. “What’s less visible is the downside stickiness that OPEC has introduced by digging its heels in.”

After their break, traders in China are taking stock of the outlook as local virus cases persist, with authorities imposing curbs to tackle outbreaks, including some in the financial hub of Shanghai. On the horizon, the twice-a-decade Communist Party Congress is set to open Oct. 16.

On monetary policy, traders are concerned that major central banks including the Fed will push rates far deeper into restrictive territory to quell inflation. US data last week showed a still-robust labor market, fanning expectations that the Fed will deliver yet another 75 basis point rate next month. That could spur further gains in the dollar, blunting appetite for raw materials.

Widely-watched time spreads steadied after rising last week. Brent’s prompt spread -- the difference between the two nearest contracts -- was $1.94 a barrel in backwardation on Monday, little changed from a week ago.

While OPEC+’s decision “does hurt the US,” it shouldn’t have caught anyone by surprise, Mohamed El-Erian, Allianz SE chief economic adviser told CBS News, while blaming the Fed for a very high risk of a recession. “OPEC is looking to protect oil prices in the context of declining demand.”

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge