China’s Exports Weaken on Covid Disruptions, Global Risks

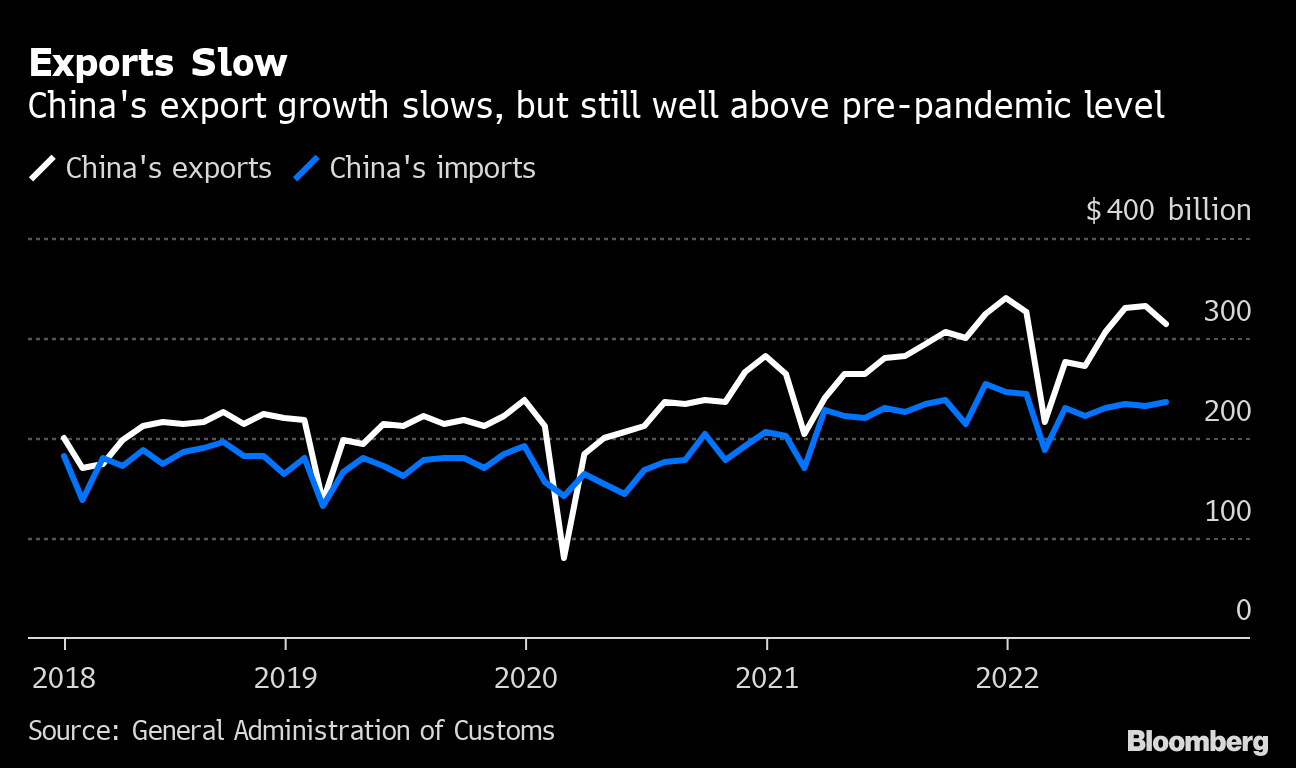

(Bloomberg) -- China’s export growth slowed more than expected in August as global demand weakened and Covid lockdowns disrupted manufacturing production. Imports barely grew as domestic demand continued to struggle.

Exports in US dollar terms expanded 7.1% last month from a year earlier to $314.9 billion, the General Administration of Customs said in a statement Wednesday. That was the slowest rise since April. Imports grew 0.3%, slower than a 2.3% increase in July, leaving trade surplus of $79.4 billion last month.

The data comes after factory activity in Europe and the rest of Asia slumped in recent months, reflecting slowing global economic momentum. That’s in part driven by dwindling consumer demand due to the surging prices of energy and other consumer goods and services. Meanwhile, Covid outbreaks worsened within China during August, resulting in lockdown in places like Yiwu in the eastern province of Zhejiang, a major manufacturing and exporting hub.

“China’s export growth is retreating to its more normal levels after two years of exceptional growth,” said Lu Ting, chief China economist at Nomura Holdings Inc. The trade surplus is elevated “due to low imports, pointing to China’s weak domestic demand,” he said.

What Bloomberg’s Economists Say ...

“August’s sharper-than-expected slowdown in China’s export growth is another sign that the recovery is losing steam -- and needs more policy support. We expect trade to remain under pressure for the rest of the year, due to base effects and a weakening global outlook.”

-- David Qu, economist

Read the full report here.

Weaker exports will weigh on the currency, which is close to breaching 7 to the dollar. The People’s Bank of China has taken several steps recently to slow the yuan’s depreciation, and set its reference rate for the currency at the strongest bias on record on Wednesday.

Container shipping costs that soared to a record earlier this year have declined in recent months, a result of some easing of port congestion around the world but also weakening demand globally. A gauge measuring the rates of exporting a container from Shanghai slumped by around 20% from a peak in February, falling to the lowest level since July 2021.

China’s exports to the US shrank 3.8% in August, reversing from a 11% gain in July and recording its first contraction since May 2020. Exports to Taiwan also contracted for the first time since January 2020. China halted some trade with the island in early August in retaliation to the visit of US House Speaker Nancy Pelosi to the island, which may have affected shipments. The growth of exports to the European Union slowed to 11.1% from 23.2% in July.

The export volume of smartphones, home appliances and semiconductors all contracted by around 10% in the first eight months of this year, falling from a high base as sales of those products were previously fueled by pandemic purchases. Car exports remained resilient, surging by 56% in value so far this year, making it one of the fastest growing export products along with rare earth and aluminium, according to customs data.

The volume of imports of crude oil, iron ore, coal, natural gas and soybeans all fell in the first eight months of this year, the data showed.

Domestic factory output contracted for a second month in a row in August, according to official data, due to power cuts, weak property demand and worsening Covid outbreaks and restrictions. Declining global demand bodes ill for China’s exports, which was an important driver for the economy since the pandemic and contributed to about a fifth of gross domestic product growth last year.

There are signs that export price inflation is beginning to play a bigger role than volume growth in driving exports -- about half of the headline export growth in July was due to the price effect, according to an estimate by Macquarie Group Ltd.

In real terms, import growth has turned negative since late in the first quarter, suggesting that the demand side is still facing headwinds, according to Zhou Hao, chief economist at Guotai Junan International Holdings Ltd. But the pricing effects will continue to cloud the picture for trade performance, he said.

A slowdown in exports would add further strain on the economy already suffering from a stop-start Covid reopening and a yearlong property market slump.

“Single-digit export growth is more likely” for the rest of the year, according to Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “Exports will continue to contribute to GDP growth in China but not as strongly as in the first half of the year,” so China will probably need to rely more on domestic demand, he said.

(Updates with additional details.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.