US Futures Extend Slide as Dollar Keeps Climbing: Markets Wrap

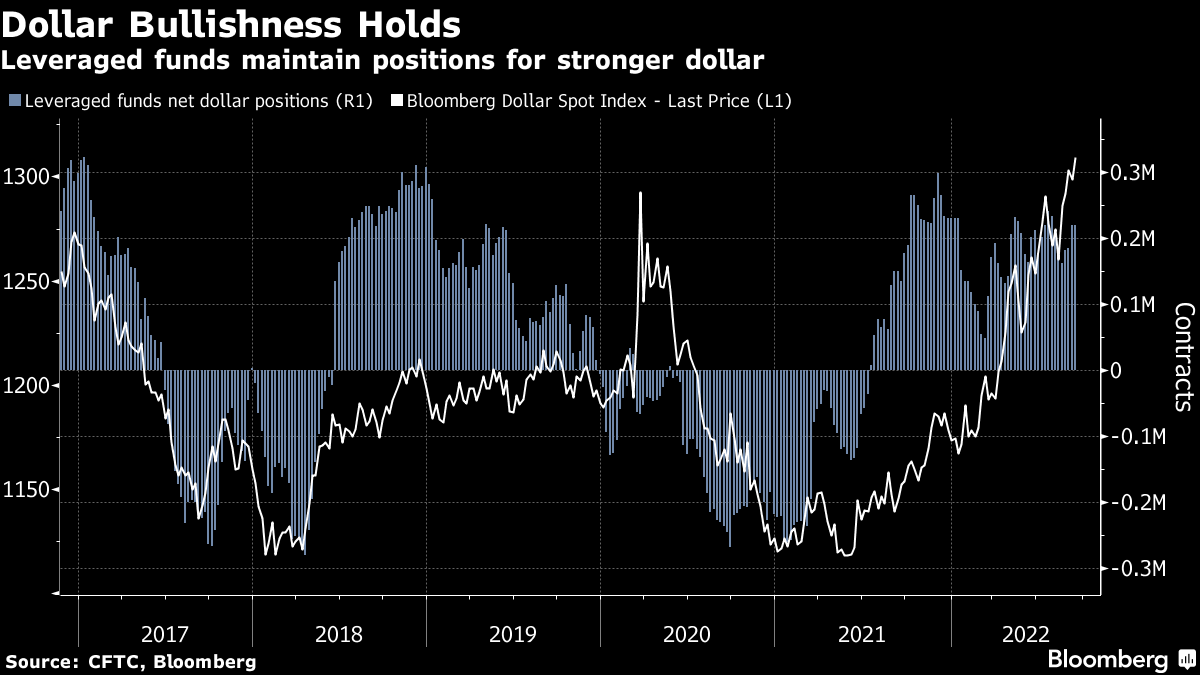

(Bloomberg) -- Equities extended declines on Friday, with an index of global stocks on track for the worst week since June, while a gauge of the dollar continued its ascent, reflecting bets for outsize Federal Reserve interest rate hikes.

US futures dropped, suggesting the selloff that drove the S&P 500 index to its lowest close in about two months on Thursday isn’t over yet. Europe’s benchmark share gauge headed for a fourth day of losses. Stocks slumped in Japan, Hong Kong and mainland China, with little impact on sentiment from Chinese industrial-production and retail-sales data that beat expectations.

Policy-sensitive two-year Treasury yields extended a rise to the highest since 2007, deepening the curve inversion that’s seen as a recession signal. The latest US economic data painted a mixed picture for the economy that backed the view for hawkish monetary policy. Swaps traders are pricing in a 75 basis-point hike when the Federal Reserve meets next week, with some wagers appearing for a full-point move.

“Everything points to another 75 basis-point rate hike by the Fed when it meets next week. The likelihood that it will have to go ‘big’ again in November is elevated, too,” said Raphael Olszyna-Marzys, an economist at Bank J Safra Sarasin. “What’s more, its new projections should indicate that the fight against inflation will be more painful than previously acknowledged.”

The market weakness follows data showing applications for US unemployment insurance fell for a fifth straight week, suggesting demand for workers remains healthy. Retail sales indicated spending on goods is moderating. University of Michigan data Friday will be parsed for clues on inflation expectations.

Adding to concerns about a slowing economy, package-delivery giant FedEx Corp. withdrew its earnings forecast, citing weakness in Asia and challenges in Europe as it pulled its prior outlook and reported preliminary results for the latest quarter that fell well short of Wall Street’s expectations. Business conditions could deteriorate further in the current period, FedEx said.

European mail and parcel delivery companies took a hit, led by Deutsche Post AG, down as much as 7.6%. The UK’s benchmark outperformed as the British pound sank to its weakest level against the dollar since 1985.

Triple Witching

Market participants could face additional volatility on Friday from the quarterly expiry event known as triple witching, with contracts for stock index futures, stock index options and stock options all expiring, while re-balancing of major equity indexes also takes place.

Meanwhile, the offshore yuan remained on the weaker side of 7 to the dollar, even as the People’s Bank of China set the reference rate for the currency stronger-than-forecast for a 17th straight day.

“While China activity showed some improvement this morning, equity investors really want to see substantial easing in China’s policies related to Covid to turn a bit more constructive,” said Chetan Seth, Asia-Pacific equity strategist at Nomura Holdings Inc. in Singapore. “That has not happened.”

Oil was poised to fall for a third week amid the deteriorating global economic backdrop, which has fueled demand concerns at a time when the buoyant dollar makes crude more expensive for most buyers.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.8% as of 6:36 a.m. New York time

- Futures on the Nasdaq 100 fell 1.1%

- Futures on the Dow Jones Industrial Average fell 0.7%

- The Stoxx Europe 600 fell 0.9%

- The MSCI World index fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $0.9977

- The British pound fell 0.6% to $1.1399

- The Japanese yen rose 0.2% to 143.23 per dollar

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.47%

- The yield on two-year Treasuries advanced four basis points to 3.91%

- Germany’s 10-year yield advanced two basis points to 1.79%

- Britain’s 10-year yield was little changed at 3.17%

Commodities

- West Texas Intermediate crude rose 0.2% to $85.27 a barrel

- Gold futures fell 0.4% to $1,669.80 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge