A Golden Week for China Air Travel May Stem Drop in Oil Prices

(Bloomberg) -- Global oil traders are fixated on the next milestone in China’s economic recovery, when travelers pack their bags and head to the airport for the Golden Week holiday in early May.

Some 170 million Chinese holidayed abroad in 2019, before the pandemic struck. That figure sank to less than 9 million last year at the height of China’s lockdowns. The likelihood of dramatically more air travel explains why jet fuel consumption in China is widely seen as the single biggest driver of world oil demand growth this year, according to JPMorgan Chase & Co.

The signs are encouraging. Overseas ticket searches for Golden Week are 120% of the level in 2019, state media reported, citing an estimate from Trip.com. As of April 18, actual bookings were more than 10 times that of last year, the Securities Daily reported.

“Mainland China’s domestic jet fuel demand has almost fully recovered, while international jet fuel demand has recovered to close to 70% of pre-Covid levels,” said Fenglei Shi, a director covering Chinese oil markets at S&P Global Commodity Insights. As such, it’s possible that Golden Week could mark a near-complete recovery in China’s total consumption of the fuel, she said.

The global oil market has been caught between two competing themes this year: advanced economies teetering on recession, and the promise that China’s reopening could dramatically lift demand after a three-year blight on consumption due to Beijing’s Covid restrictions. Crude has fallen in recent days as the US economy stalls and the prospect of more interest rate hikes adds to headwinds for prices.

If Golden Week delivers a big boost to air travel, it will signal that demand is back on track and support some of the more bullish views on prices. But too few passengers will be further evidence of a relatively muted Chinese reopening that has disappointed commodities markets craving a return to normality in their biggest buyer.

The latest economic data augurs well for a rebound. Retail sales shot higher in March as households opened their wallets to spend on services, and Golden Week is likely to unleash more pent-up demand for tourism. While domestic trips have shown a strong recovery, outbound flights have lagged due to fewer planes, expensive fares and residual restrictions on international travel.

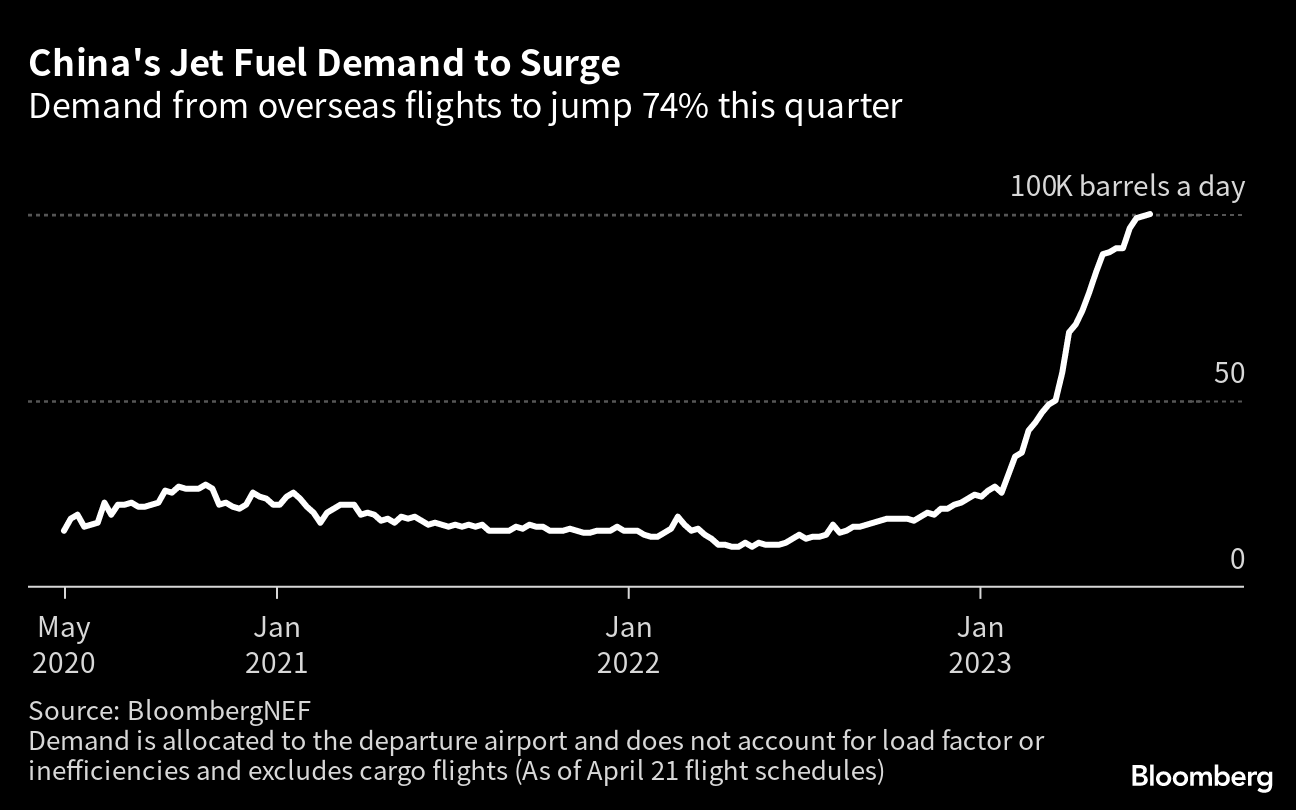

The mainland’s total number of passenger flights should nearly equal pre-pandemic levels in the second quarter, according to a forecast from the China Air Transport Association. But the international component of that will still be less than half what it was — and overseas flights account for about 30% of the nation’s jet fuel consumption, according to BloombergNEF.

Jet fuel will be the biggest component of China’s demand recovery this year because “it was a laggard and it was the one that has not caught up,” said Macquarie Group strategist Vikas Dwivedi, although he cautioned that Chinese consumption could end up being “good enough but not great.”

Macquarie estimates that Chinese jet fuel demand will rise by 430,000 barrels a day this year over last. That’s almost half of the increase of 900,000 barrels forecast for Chinese oil demand as a whole as its vast economy reopens. And it’s more than a third of the global demand growth for jet fuel of 1.2 million barrels predicted by the International Energy Agency.

One executive at a multinational in Shanghai, who asked to be identified only by her first name, Weichen, said she can’t wait to resume her routine of twice yearly overseas trips during the upcoming holiday.

First up, a trip with friends to Java in Indonesia to see a famous Hindu temple there; then later in the year it’ll be shopping in Bicester Village near London with her parents.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions