Oil Falls a Second-Straight Week Even With Macro Price Boost

(Bloomberg) -- Oil fell for a second consecutive week even as an earnings-driven rally on Wall Street pushed prices higher.

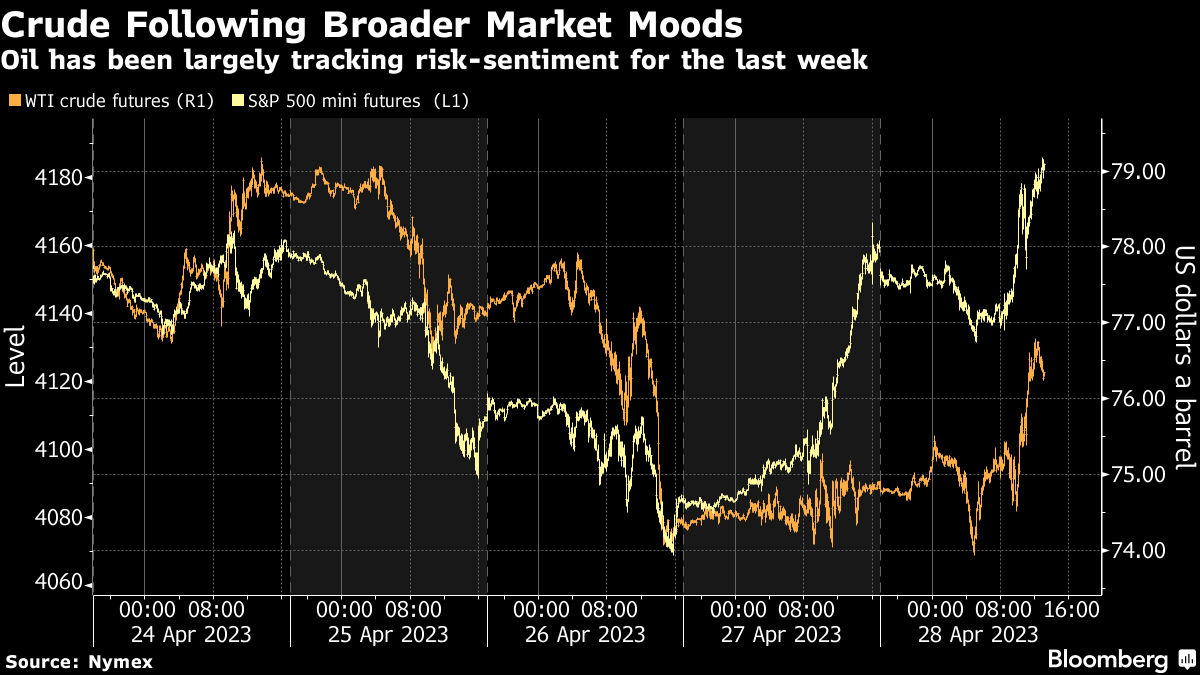

West Texas Intermediate rose the most in almost four weeks Friday, boosted by risk-on sentiment that benefited commodities across the board. Oil tracked broader market trends this week as many traders avoid staking big positions while they await the next US central bank decision.

Crude swung sharply in April, surging to a 15-month high after the Organization of Petroleum Exporting Countries and its allies announced an output cut. Prices then gave up those gains amid technical pressures and a deteriorating outlook.

Recent economic data shows that US inflation continues to accelerate, bolstering expectations the Federal Reserve will keep raising rates and heightening the chances of a demand-sapping recession. Meanwhile, supply from Russia has remained resilient despite Group of Seven sanctions, and China’s rebound has been slower than some anticipated.

Falling profit margins for refiners in Asia are already flashing weakness in the biggest oil-importing region, but China’s recovery is starting to take hold. Top Chinese refiner Sinopec said the nation’s rebound will boost demand growth for refined oil products by more than 10% this year.

First-quarter earnings for oil blew out expectations with industry giants Exxon Mobil Corp. and Chevron Corp raking in profits not seen since oil topped $145 a barrel in 2008, nearly double the current price it’s hovering near $75.

(An earlier version corrects headline to say tailwinds boost price.)

©2023 Bloomberg L.P.