Oil Steadies Ahead of US Figures on Outlook, Crude Stockpiles

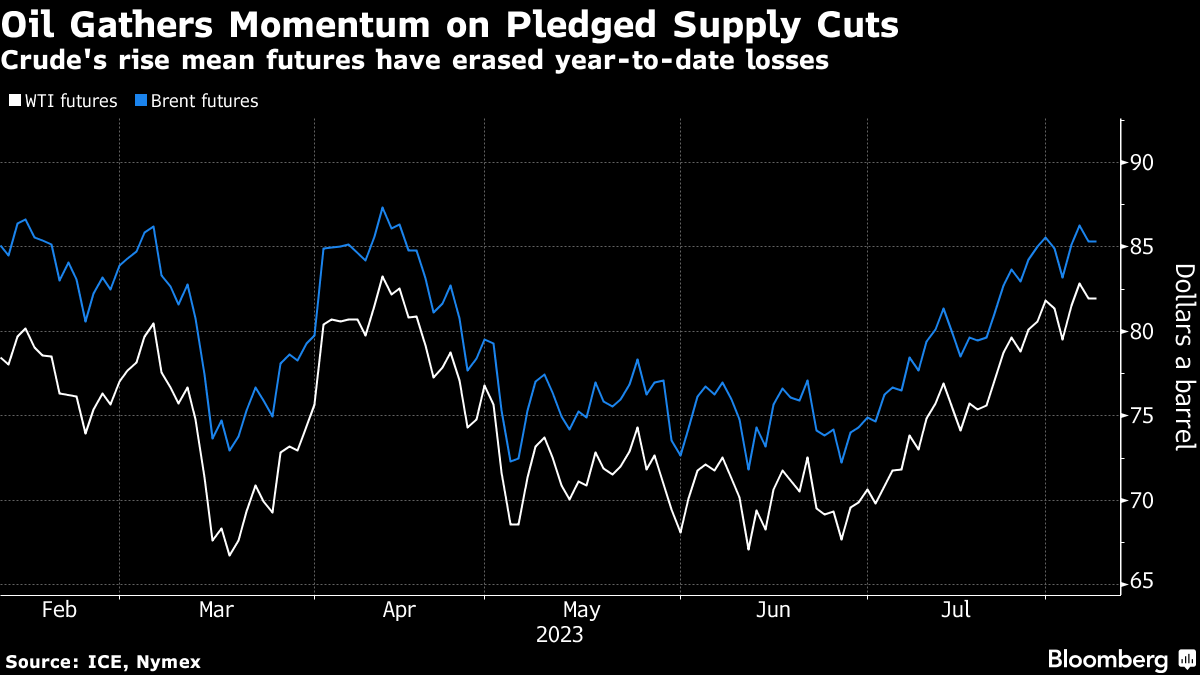

(Bloomberg) -- Oil was steady ahead of US data on the energy outlook and stockpiles as the global market tightens amid OPEC+ supply cuts.

West Texas Intermediate traded near $82 a barrel after closing 1.1% lower on Monday. The Energy Information Administration will release its monthly Short-Term Energy Outlook later Tuesday, which will be followed by stockpile data for crude and gasoline from the industry-funded American Petroleum Institute.

Oil’s drive higher has gathered steam after Saudi Arabia and Russia pledged supply cuts to prop up the market, overshadowing persistent concerns around China’s economic recovery. The risk to Russian flows from the Black Sea remains in focus after escalating tensions over the weekend.

The International Energy Agency and OPEC will release reports later this week that will provide snapshots on the oil market. Investors will also be watching US consumer price index data on Thursday for clues on the path forward for monetary tightening. Interest-rate hikes have weighed on commodities.

“The crude oil market remains underpinned by ongoing supply concerns,” said Charu Chanana, a market strategist at Saxo Capital Markets Pte in Singapore, referring to reductions by Saudi Arabia and Russia. “Traders are also bracing for the CPI release on Thursday.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions