Asia Shares Drop After November Jump, Dollar Falls: Markets Wrap

(Bloomberg) -- Shares in Asia slipped Friday after the MSCI All Country World Index finished November with its third-largest monthly gain in the past decade. The dollar edged lower.

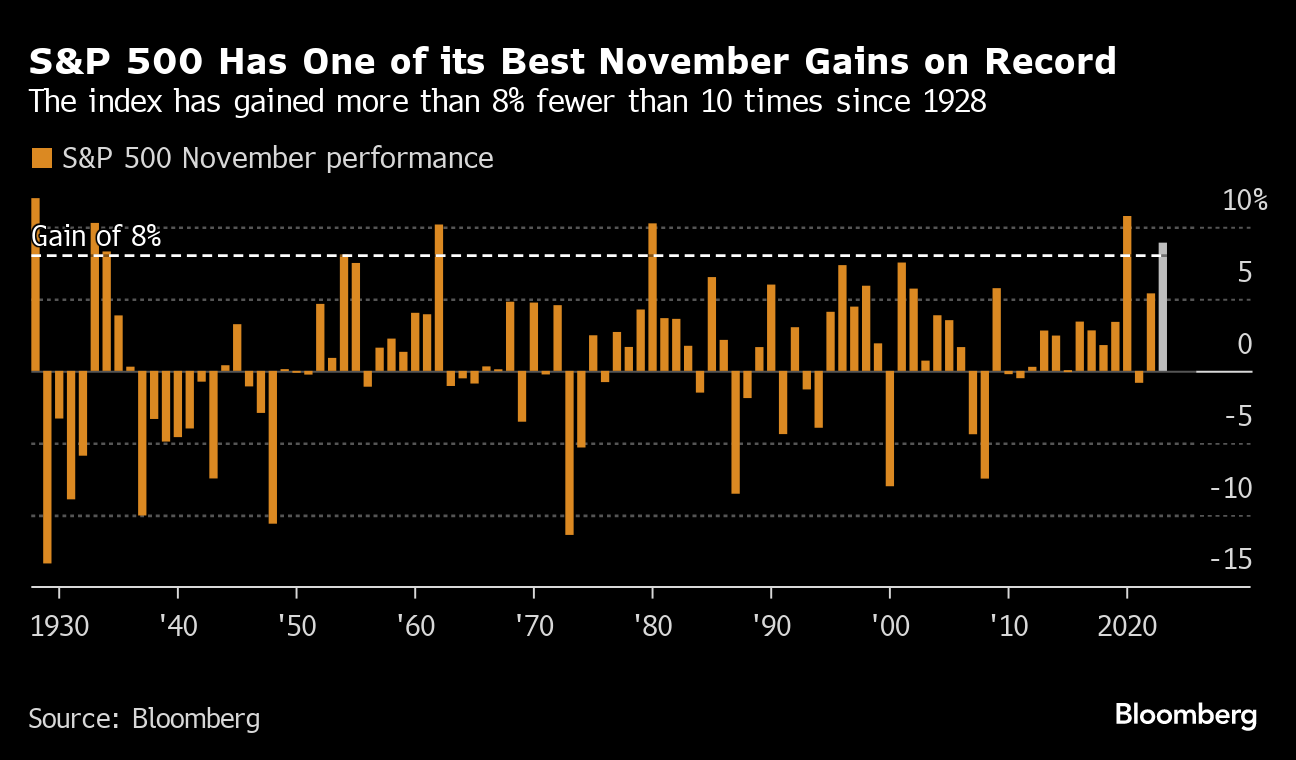

Chinese stocks opened down, sending a benchmark of mainland shares to its lowest level for the year. Equities in Australia and South Korea also fell, weighing on a gauge of Asian shares. Japanese benchmarks rose. US futures were also slightly lower after the S&P 500 climbed 0.4% Thursday, rising nearly 9% for the month to notch one of its best Novembers on record. The all-country gauge posted its best month since 2020.

The US currency weakened against all its major peers as a measure of inflation eased, fueling bets on an end to the Federal Reserve tightening cycle, continuing the narrative which helped US and global stocks surge last month. Attention now turns to Chair Jerome Powell’s comments later Friday for more clues. The Bloomberg Dollar Spot Index fell Friday after rising in the previous two sessions.

“Data prints seem to highlight that the US economy may be slowing down,” OCBC analysts including Selena Ling said a treasury outlook note. “Cooler demand may reinforce the notion that the Fed is likely done tightening for the current cycle and help build expectations for the Fed to start cutting rates” in the second quarter.

Still, the November rally caught many off guard — including Wall Street strategists, who as of mid-October expected the S&P 500 to end the year at 4,370. It closed Thursday at 4,567.80.

“Almost everyone was offsides coming into November,” said Ryan Detrick, chief market strategist at Carson Group. “So there’s still a big opportunity for traders to chase gains in December, too.”

Meanwhile, China’s Caixin manufacturing PMI data beat estimates to suggest an expansion in activity, easing concerns after data Thursday showed the recovery losing momentum. Korean exports — seen a bellwether for global trade due to its early release — rose more than expected in November.

In a rare move, Alibaba Group Holding Ltd. received a downgrade from Wall Street on the same day it lost its crown as China’s most valuable e-commerce firm to one of its main rivals. Morgan Stanley cut its rating on Alibaba’s American depositary receipts to equal-weight from overweight, lowering its price target to $90 from $110.

In Japan, Seven & i Holdings Co. rose the most since February 2022 after the nation’s largest retailer said it will buy back up to ¥110 billion ($748 million) of shares and conduct a 3-for-1 stock split.

Treasuries were steady Friday after declining Thursday. The 10-year yield dropped about 60 basis points in November to 4.33%.

Gold was on track for a third weekly gain. Crude prices fell even as the OPEC+ group of petroleum producing nations agreed to a supply cutback of about 900,000 barrels a day, in a sign traders are skeptical it will be implemented.

Key events this week:

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 12:30 p.m. Tokyo time

- Nikkei 225 futures (OSE) were little changed

- Japan’s Topix rose 0.4%

- Australia’s S&P/ASX 200 fell 0.3%

- Hong Kong’s Hang Seng fell 0.4%

- The Shanghai Composite fell 0.3%

- Euro Stoxx 50 futures rose 0.5%

- Nasdaq 100 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.0906

- The Japanese yen rose 0.1% to 148.01 per dollar

- The offshore yuan was little changed at 7.1431 per dollar

- The Australian dollar was little changed at $0.6610

Cryptocurrencies

- Bitcoin rose 0.7% to $38,006.18

- Ether rose 2.2% to $2,090.46

Bonds

- The yield on 10-year Treasuries was little changed at 4.33%

- Japan’s 10-year yield advanced four basis points to 0.700%

- Australia’s 10-year yield advanced eight basis points to 4.49%

Commodities

- West Texas Intermediate crude fell 0.3% to $75.71 a barrel

- Spot gold rose 0.2% to $2,041.26 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge