Oil Limps Into 2024 as OPEC, War Fail to Prevent Drop

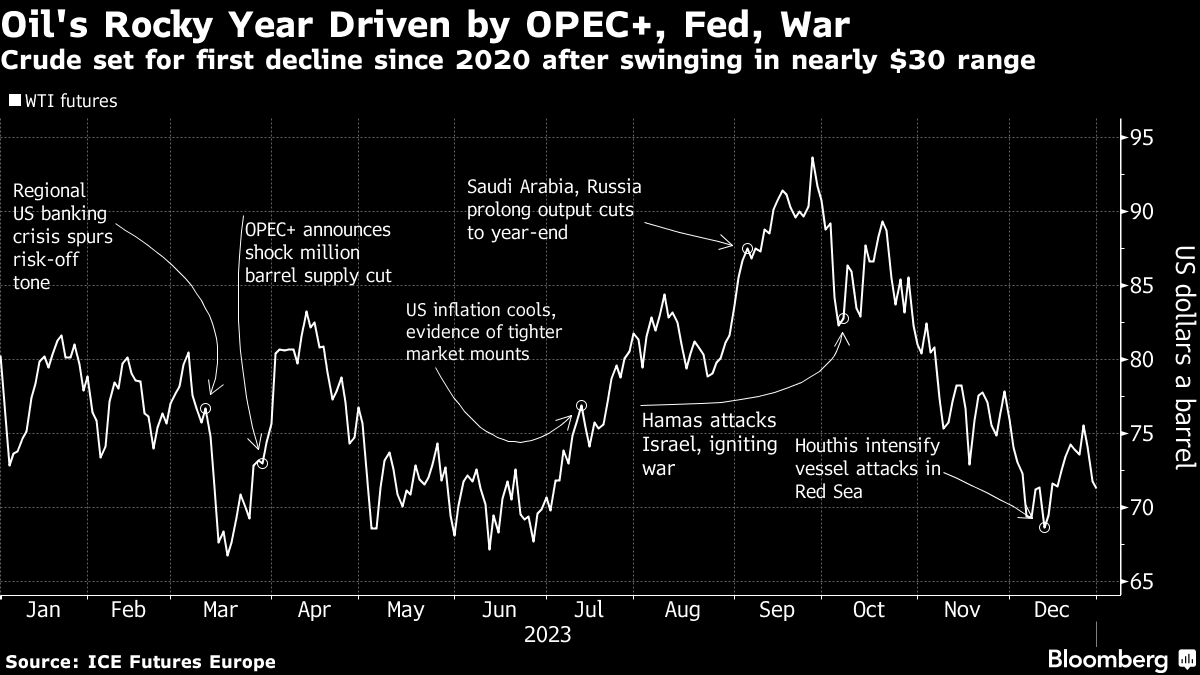

(Bloomberg) -- Oil posted its biggest annual drop since 2020 as war and OPEC+ production cuts failed to propel prices higher in a year dominated by supply growth outside of the grouping.

West Texas Intermediate declined 0.2% to settle just under $72 a barrel Friday, closing 2023 at almost $9 below where it started the year. A broader Bloomberg gauge of commodities has dropped by about 10% over the past 12 months.

Oil ended lower on Thursday after official US data showed that stockpiles at the key Cushing, Oklahoma, storage hub expanded for the 11th week to hit the highest since August. US crude production has been running at a record clip.

Crude is capping a tumultuous year, with prices aided by the outbreak of the Israel-Hamas war, as well as speculation that the Federal Reserve is done with hiking interest rates as inflation wanes. Still, despite repeated cuts to supplies from the Organization of Petroleum Exporting Countries and its allies, rising production from nations outside the cartel, coupled with concerns about slowing demand growth, have combined to drive crude futures lower.

“A lot of traders and speculators have been badly hit this year because trading hasn’t been easy, it’s been very choppy,” Amrita Sen, co-founder and director of research at Energy Aspects said in an interview with Bloomberg Television. “We need sustained stockdraws. We had big stockdraws in the DOE numbers yesterday, if we see a continuation of that I do think confidence is going to come back.”

This month, traders have contended with rising tension in the Red Sea after vessel attacks by Houthi rebels in Yemen. Half of the world’s container-ship fleet that regularly transits the waterway are now avoiding the route, and crude tankers have also been diverted, lengthening voyages.

(Corrects spelling in chart)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge