Oil Steadies After Glut Fears Drove Worst Losing Run Since 2018

(Bloomberg) -- Oil steadied after its longest weekly losing streak in five years, driven by signs that supply is starting to run ahead of demand.

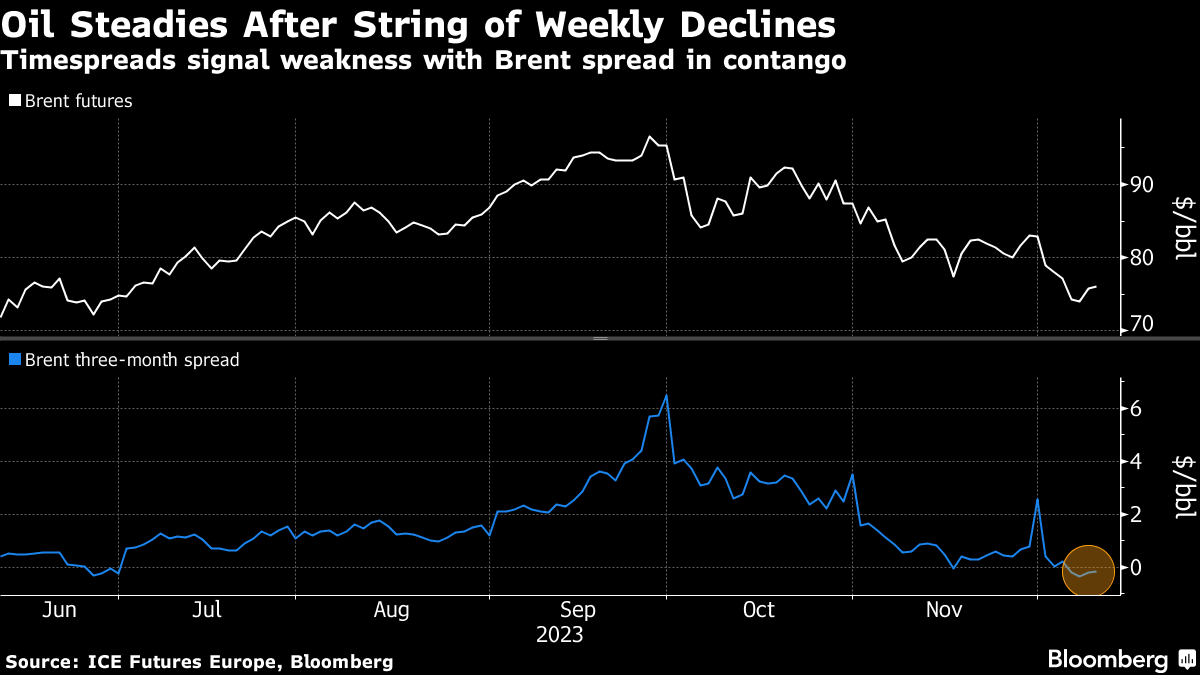

Global benchmark Brent traded above $76 a barrel after logging seven weeks of declines, while West Texas Intermediate was near $71. A stronger-than-expected US jobs report and plans to refill the Strategic Petroleum Reserve helped crude snap a six-day losing streak on Friday.

Oil has fallen about fifth since late September, with even additional output cuts from OPEC+ and statements by Saudi Arabia and Russia that curbs could be extended beyond March failing to stem the slide. Production from outside the alliance, particularly the US, has been surging, Chinese demand growth is set to slow next year and there’s a chance of a recession in the US.

“Gains are still somewhat capped into the new week on China demand concerns,” said Yeap Jun Rong, market strategist for IG Asia Pte. “The current price level may prompt some replenishing of the US Strategic Petroleum Reserve stockpile, but whether this marks the ‘true’ floor for oil prices remains to be seen.”

This week, monthly reports from the International Energy Agency, the Organization of Petroleum Exporting Countries and the US Energy Department may provide some clarity on supply and demand fundamentals. Investors will also be monitoring the Federal Reserve’s final rate decision of the year.

Consumers including airlines and utilities have taken advantage of the recent rout to lock in cheaper barrels. A flurry of call spreads traded in Brent, which limits the impact to buyers of a rebound in crude prices.

Timespreads, meanwhile, continue to flash signs of weakness. The three-month spreads for both Brent and WTI remain in a bearish contango structure — when later-dated contracts trade at a premium to nearer ones. Brent’s three-month spread was 17 cents in contango, compared with 86 cents in the opposite, bullish backwardated structure a month ago.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge