US Stocks Weekly Rally Intact Despite Fedspeak: Markets Wrap

(Bloomberg) -- The Nasdaq 100 climbed , poised to close at an all-time high after Jerome Powell signaled the Federal Reserve’s aggressive hiking campaign is nearing its end.

Microsoft Corp., Amazon.com Inc. and Nvidia Corp. led a tech-fueled advance even as pockets of doubt opened up elsewhere in the markets at the tail end of this week’s everything rally. The S&P 500 and Dow Jones Industrial Average benchmarks were little changed in Friday afternoon trading. US Treasuries were mixed while the dollar rebounded as comments from Fed officials threw cold water on traders’ bets for imminent and deeper cuts.

New York Fed President John Williams told CNBC it was “premature” to be thinking about a March rate cut on Friday while his Atlanta counterpart, Raphael Bostic told Reuters he was only penciling in two quarter-percentage-point rate cuts in the latter half of 2024.

“We view his comments as an effort to guide to a slower slope of normalization over several years as well as a challenge to the strong market bets on March for the first cut,” Krishna Guha, vice chairman at Evercore ISI, said after Williams’ comments. He views the first rate cut as more likely to come in May or June.

While US stock benchmarks wavered on Friday, they remained on track for a seventh week of consecutive gains after the Fed ignited a speculative frenzy on Wednesday when it affirmed it’s ready to pivot to rate cuts.

“The S&P 500 has rallied more than 10% in less than two months so some digestion of the rally is needed,” Tom Essaye, the founder of The Sevens Report newsletter, wrote. That “likely will come in the near term, especially if Fed officials rhetorically push back on the market’s enthusiasm in the next week or two.”

The dollar advanced snapping a three-day slide. The yield on the 10-year bond — the benchmark for everything from mortgages to corporate debt — broke below 4% for the first time since August. The rate on the two-year hit %.

“Bond yields have been markedly volatile this year as market participants try to determine what the new normal for interest rates will be,” Carol Schleif, chief investment officer of BMO Family Office wrote. “We suspect the longer term new normal for the 10-year Treasury yield to range between 4% and 4.5%.”

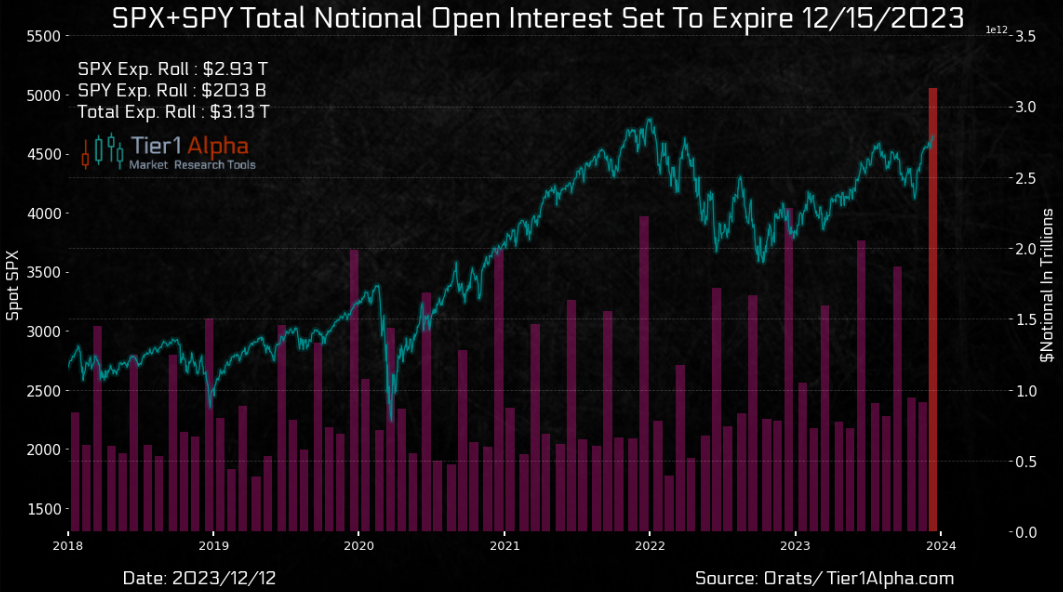

As the week draws to a close, traders also have to contend with the year’s largest quarterly options and futures expiry and its potential to spark volatility. A staggering $5.4 trillion of contracts tied to stocks and indexes go off the board today, according to an estimate from Rocky Fishman, founder of derivatives analytical firm Asym 500.

Even with Williams squelching some of the market’s ebullience, the Fed’s tone this week was more dovish than that from European peers. European Central Bank Governing Council member Madis Muller said Friday that markets are getting ahead of themselves in betting that the ECB will start cutting interest rates in the first half of next year. On Thursday, ECB President Christine Lagarde said the bank had not discussed rate cuts at all.

“The contrast between the resilient US economy adopting a dovish stance and faltering European economies holding on to a hawkish position gives the impression that something is amiss,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note to clients.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 1:33 p.m. New York time

- The Nasdaq 100 rose 0.5%

- The Dow Jones Industrial Average was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.8% to $1.0904

- The British pound fell 0.6% to $1.2689

- The Japanese yen fell 0.2% to 142.14 per dollar

Cryptocurrencies

- Bitcoin fell 2.5% to $41,933.7

- Ether fell 2.7% to $2,238.73

Bonds

- The yield on 10-year Treasuries was little changed at 3.93%

- Germany’s 10-year yield declined 10 basis points to 2.02%

- Britain’s 10-year yield declined 10 basis points to 3.69%

Commodities

- West Texas Intermediate crude fell 0.2% to $71.44 a barrel

- Spot gold fell 0.7% to $2,021.14 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge