Oil Climbs as Russia Follows Through on Threat to Cut Production

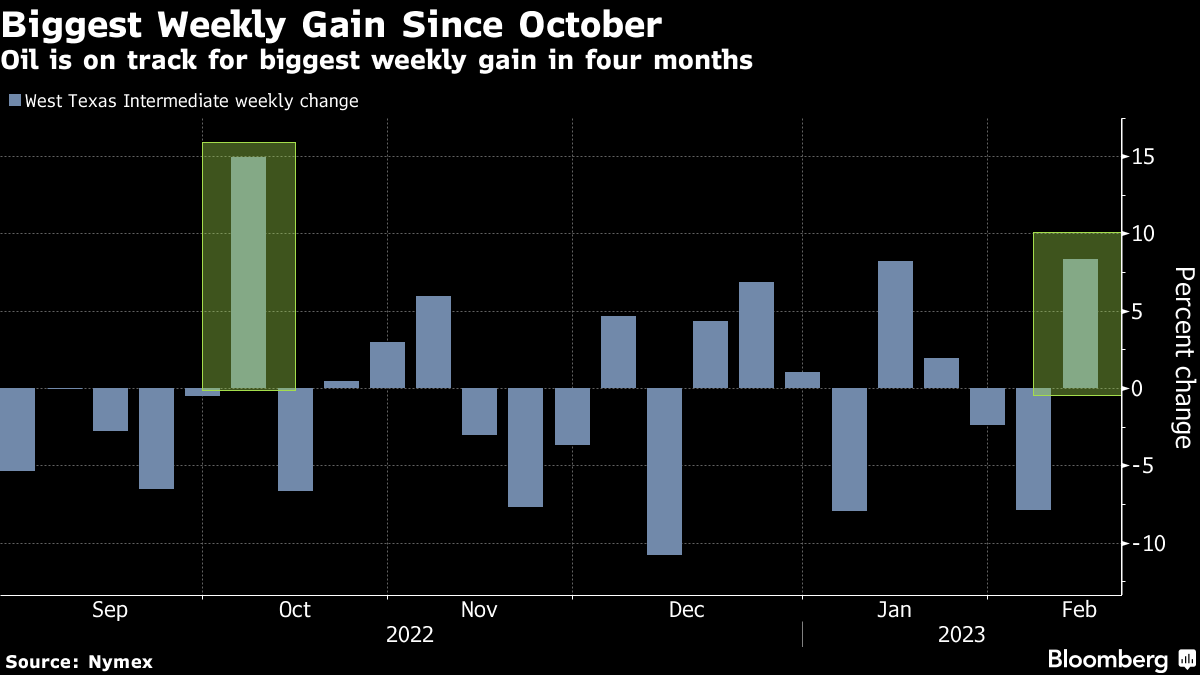

(Bloomberg) -- Oil headed for its biggest weekly gain in four months after Russia followed through on threats to reduce production in response to western energy sanctions.

West Texas Intermediate rallied above $80 a barrel after the announcement. The cut was the first major effect on Russian production from the swath of sanctions that have been placed on the country’s output.

Even before the announcement, crude was set for a weekly gain as a host of bullish drivers emerged this week. Saudi Arabia raised prices on the barrels it sells to Asian countries, showing confidence in China’s oil demand recovery, while disruptions in Turkey, Norway and Kazakhstan hampered supplies.

Russian Deputy Prime Minister Alexander Novak said the production cut is voluntary and a response to western price caps. Meanwhile, other members of the OPEC+ coalition signaled they won’t boost output to fill in for the reductions announced by Moscow.

Read more: Russia Retaliates for Sanctions by Announcing Oil Output Cut

“Most analysts out there expected some output losses to follow the recent sanctions announcements,” said Daniel Ghali, a commodity strategist at TD Securities. “It is possible that Russia is portraying these output losses as a decision to cut their oil production when they might have occurred regardless.”

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.