Oil Extends Gain as Saudi Arabia Bets on Demand Rebound in Asia

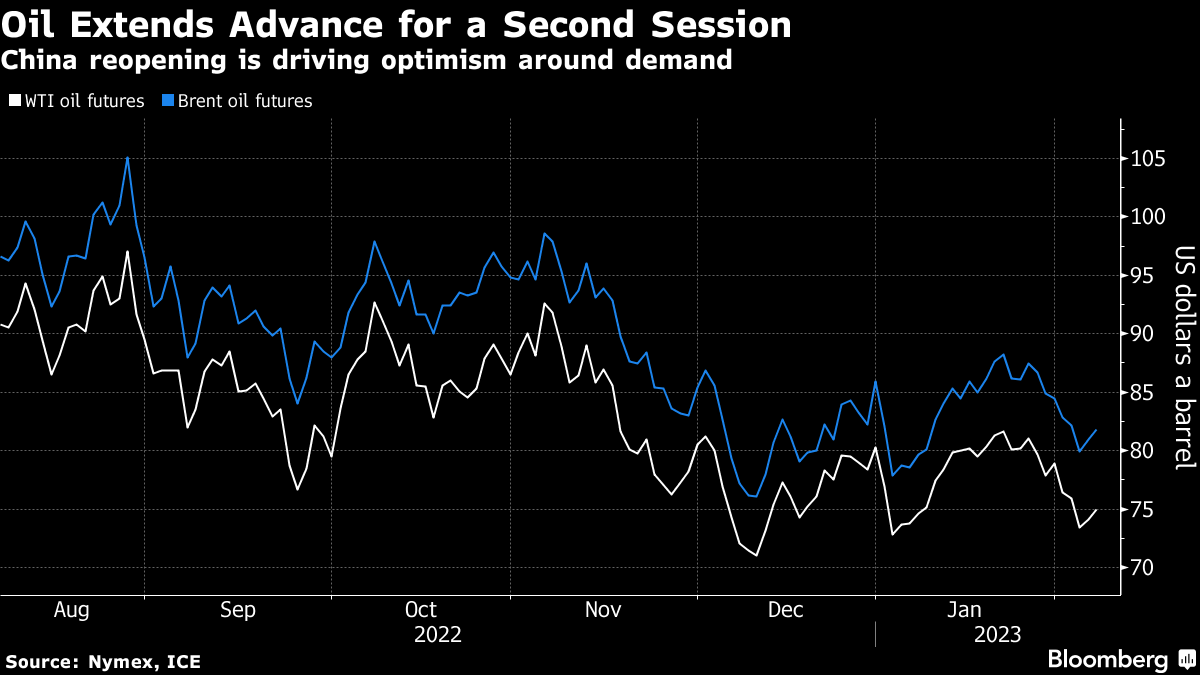

(Bloomberg) -- Oil rose for a second session after Saudi Arabia unexpectedly raised its crude prices to Asia, signaling confidence in the demand outlook.

West Texas Intermediate futures climbed toward $75 a barrel after closing 1% higher on Monday. Saudi Aramco increased most of its prices for crude that will be shipped to its main market of Asia in March, amid growing optimism over a robust demand rebound in China following the end of Covid Zero.

Supply outages also added to bullish tailwinds for oil. Turkey halted flows to the Ceyhan export terminal after a major earthquake, while output at Norway’s giant Johan Sverdrup field was lower due to a power disruption.

Oil has endured a choppy start to the year, whipsawed by optimism around China’s reopening and fears over the prospect for a global economic slowdown. The market is also assessing the potential fallout from fresh European Union sanctions on Russian refined products and how that will impact trade flows.

“The market has been a bit tentative about China’s return,” Vandana Hari, the founder of Vanda Insights in Singapore, said during a Bloomberg Television interview. “The main challenge for the market right now is at what pace the economy will come back and how smooth it will be.”

The Brent futures curve is still signaling tight near-term supply, despite the outages in Turkey and Norway. The prompt spread — the difference between its two nearest contracts — was 33 cents a barrel in backwardation.

Investors will be watching for commentary on the outlook for US monetary policy from Federal Reserve Chair Jerome Powell when he’s interviewed at the Economic Club of Washington later Tuesday.

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies With Surging Dollar and Chinese Demand to the Fore

Oil Steadies Near November Lows With Outlook for Demand in Focus

Oil Holds Biggest Drop in Two Weeks on Demand Concern and Dollar

US Will Stay in Global Climate Fight Despite Trump, Podesta Says

Oil Drops for Second Day With China Outlook and Demand in Focus

Petroperu’s New Board Is Unraveling as Two Directors Quit

Can Brazil Save the Amazon Rainforest? Marina Silva Is Trying

Oil Falls on China Demand Woes Even as Market Remains Rangebound

Asian Shares Pare Gains as Focus Switches to China: Markets Wrap