Woodside to Hunt for Gulf of Mexico M&A After Record Profit

(Bloomberg) -- Woodside Energy Group Ltd., Australia’s biggest oil and gas producer, says it will review potential acquisitions in the Gulf of Mexico after reporting its highest-ever profit.

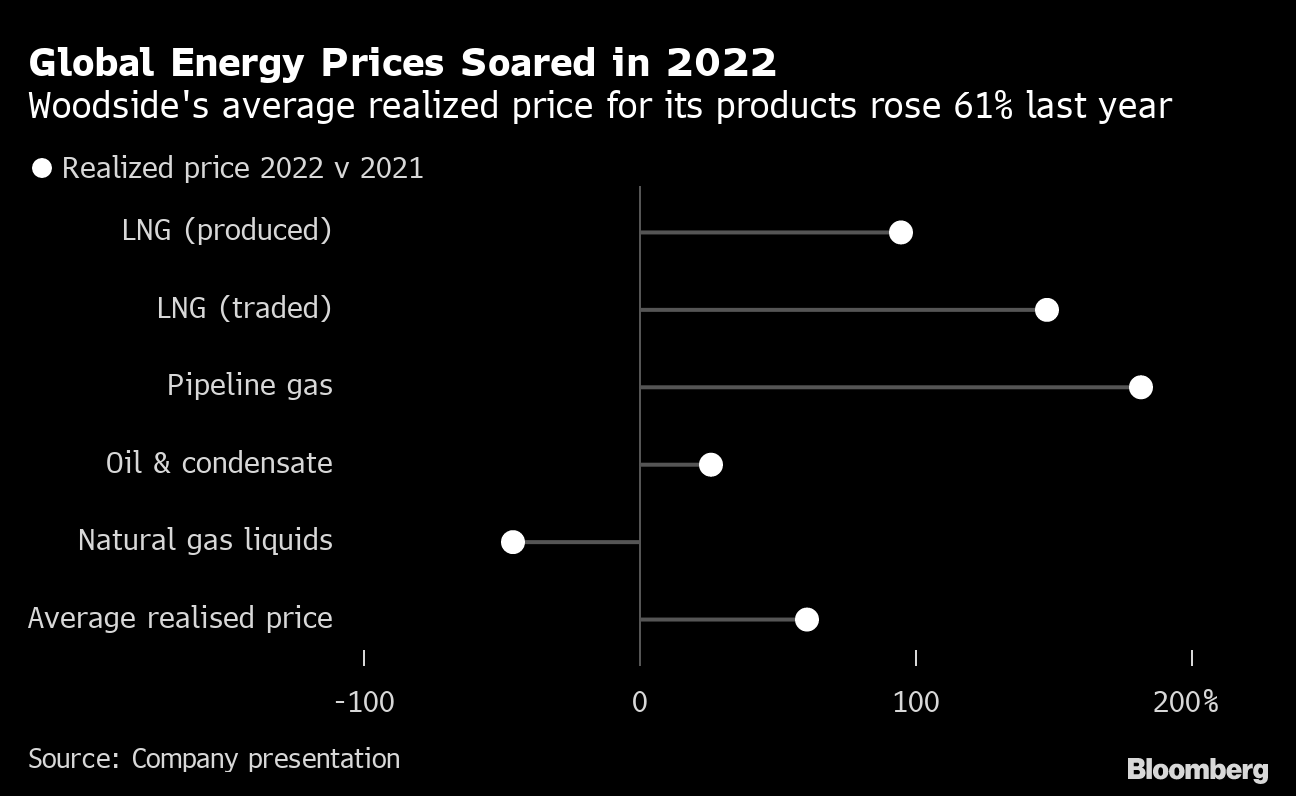

Underlying earnings more than tripled to $5.2 billion in 2022 on soaring energy prices and output that jumped more than 70% after the purchase of BHP Group Ltd.’s energy unit, the company said Monday. The result follows a run of bumper profits for global oil and gas producers, including Australia’s Santos Ltd., BP Plc and Shell Plc.

The acquisition of BHP assets increased Woodside’s presence in the Gulf of Mexico, and the firm will “continue to be looking for opportunities there,” Chief Executive Officer Meg O’Neill said in a phone interview. The location is a “very attractive basin” that has “all the right ingredient for success,” she said.

Woodside is focusing on further growth with industry investment in oil needed to meet medium-term demand and additional liquefied natural gas projects required to ensure there’s adequate supply from the late 2020s, the Perth-based producer said in its statement.

Work is taking place this year to prepare options including the Trion oil project in the Gulf of Mexico and a liquid hydrogen project in the US for a final investment decision.

The company forecasts capital expenditure to rise to as much as $6.5 billion in 2023 as it advances growth projects. That remains a fraction of the potential $23 billion to $27 billion annual spending flagged by Shell, and BP’s targeted range of $14 billion to $18 billion.

Natural gas benchmarks in Europe and Asia soared to unprecedented levels last year as European nations usually dependent on Russian fuel hunted for alternatives following the invasion of Ukraine. Woodside, which supplies about 5% of the world’s LNG to mainly Asian buyers, was among the beneficiaries, even sending a rare cargo all the way to the Netherlands from Australia.

LNG benchmarks have now fallen back to levels seen before the invasion, and the near-term outlook is uncertain, according to O’Neill.

Demand from China is yet to pick up after Beijing abandoned its Covid Zero policy, though is expected to do so this year, she said in the interview. That would help make up for “less buying” from European customers after a mild winter kept stocks of the fuel relatively high, O’Neill said.

Woodside will pay a final dividend of $1.44 per share, bringing the full-year dividend to $2.53 per share.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge