South Korea Trade Data Show Export Slump Persisting

(Bloomberg) -- South Korea’s early trade data showed a decline in exports persisting this month in the latest sign of a global economic slowdown.

Average shipments that exclude working-day differences decreased 8.8% in the first 20 days of January from a year earlier, the customs office said. That follows a 9.6% decline for the full month of December. Headline exports fell 2.7% through Jan. 1 to 20.

Chip sales dropped 34% and shipments to China fell 24.4%.

Weakening exports are among the biggest headwinds to Korea’s economy this year. The decrease in overseas shipments began in late 2022 as the world economy slowed under the combined pressure of Russia’s war on Ukraine, Covid troubles in China and global central bank tightening.

Waning semiconductor demand is at the heart of the decline in Korea and analysts surveyed by Bloomberg expect the country’s economy to have probably contracted last quarter, partly due to falling exports.

Trade performance has far-reaching implications for Korea as the economy relies heavily on global commerce to drive growth. Bank of Korea Governor Rhee Chang-yong said on Wednesday that declining exports were among his three biggest concerns for the year, along with renewed oil-price strength and a property slump.

The outlook remains uncertain. While the BOK expects a recovery in exports in the second half of the year, Trade Minister Ahn Duk-geun told reporters earlier this week that it’s still hard to estimate how long the decline will last.

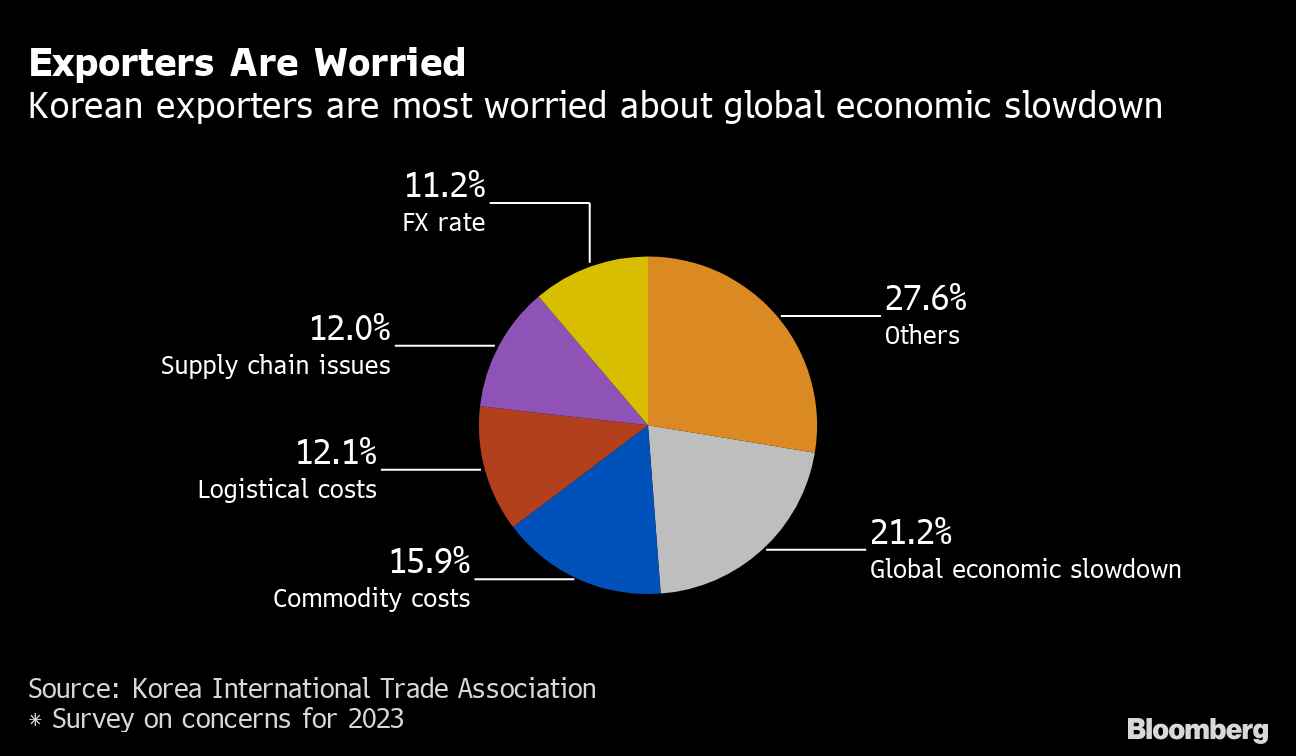

Korea’s exports will probably be 4% lower this year than in 2022, while imports will decline 8%, according to a Korea International Trade Association forecast.

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Swings as Traders Eye Next Moves in US-China Trade Tumult

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus