Oil Edges Higher After Saudi Arabia and Russia Curb Supplies

(Bloomberg) -- Oil edged higher as traders assessed the latest salvo from OPEC+ linchpins Saudi Arabia and Russia to prop up prices by curbing supply.

West Texas Intermediate rose above $70 a barrel, clawing back some of the 1.2% loss in the previous session even as the cuts were announced. Saudi Arabia said that it will prolong a unilateral 1 million barrel a day supply reduction into August, a move traders had expected. Also, Russia announced a fresh reduction, while Algeria planned to make more modest curbs.

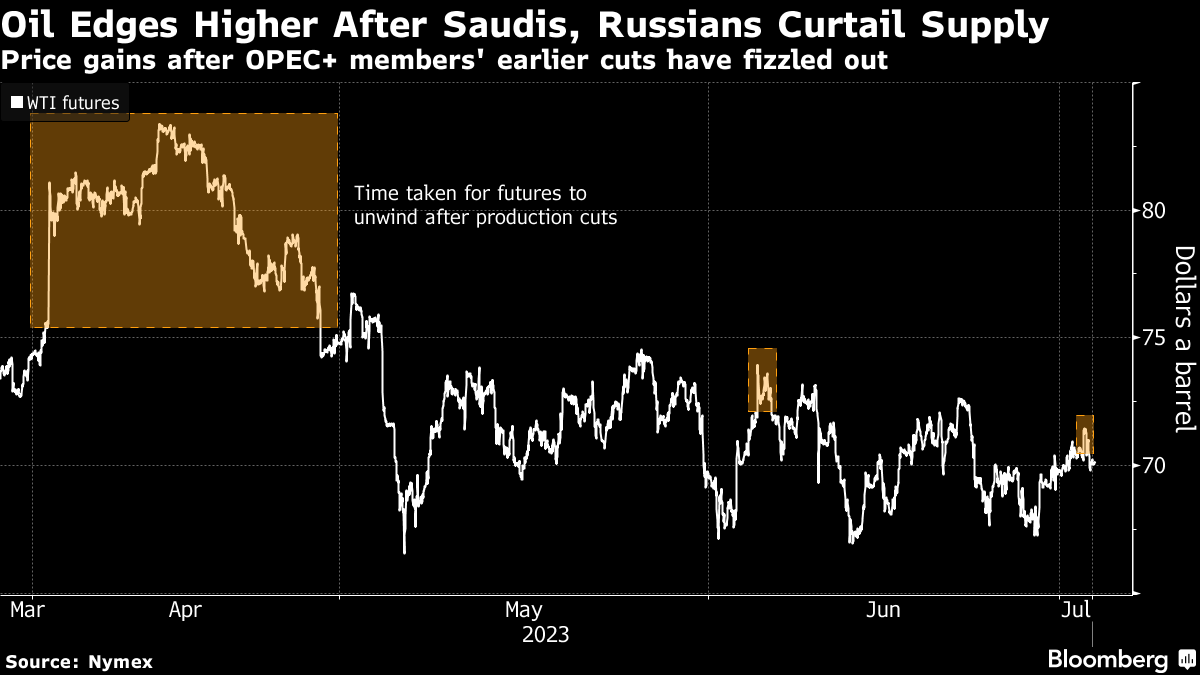

The latest price action echoes recent patterns after previously announced cuts, but has been even swifter this week. The lift from a surprise OPEC+ curtailment in early April lasted for about a month, while the boost following a unilateral cut by Saudi Arabia in June disappeared after just a day.

Oil has lost 11% this year despite repeated efforts by the Organization of Petroleum Exporting Countries and its allies to buttress prices — and take the fight to short sellers betting on losses — by curtailing output. The drop has been driven by a souring macroeconomic outlook in the US, China and Europe, as well as still-healthy supplies from Russia and other nations including Iran.

“It was not too surprising that Saudi Arabia decided to roll over its additional, voluntary cuts,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Fundamentals are not having as much influence on price direction as one would expect. Instead, the uncertain macro outlook is what the market is focused on.”

Although OPEC+ supplies have been pared back, the US oil benchmark remains in contango, a bearish pattern in which near-term prices are cheaper than those further out. WTI’s prompt spread — the difference between its two nearest contracts — was 11 cents a barrel in contango compared with 5 cents in backwardation, the opposite pattern, two months ago.

Still, there’s widespread expectation among banks that the crude market should show signs of tightening up this half, including from Standard Chartered Plc. The shift may be driven by the moves from OPEC+, a US push to start replenishing the nation’s depleted Strategic Petroleum Reserve, and higher energy consumption in major Asian importers China and India.

©2023 Bloomberg L.P.