Oil Edges Higher on Cooling US Inflation Ahead of IEA Report

(Bloomberg) -- Oil extended gains as softening US inflation prompted optimism the rate-hiking cycle may be nearing an end, improving the demand outlook.

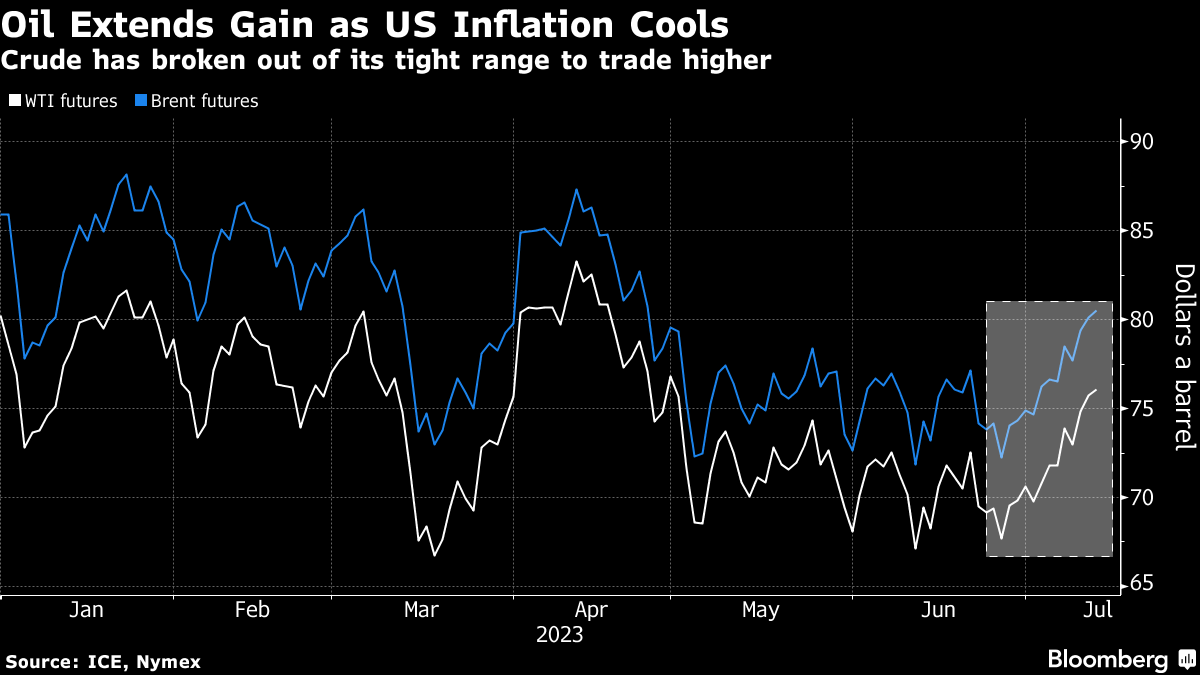

West Texas Intermediate rose above $76 a barrel after closing 1.2% higher on Wednesday as consumer price inflation dropped to the lowest in more than two years and the dollar weakened. That overshadowed a 6-million-barrel increase in US crude stockpiles, the biggest jump in four weeks.

The International Energy Agency and OPEC will release reports later Thursday that will provide snapshots on the oil market, which is expected to tighten through the second half of the year, buoying prices. Global benchmark Brent closed above $80 a barrel on Wednesday for the first time since April.

Oil remains marginally lower this year, in part due the lackluster recovery in China, but OPEC+ heavyweights Saudi Arabia and Russia have pledged supply cuts to prop up the market. Russia’s flagship Urals crude has breached a price cap set by the Group of Seven, a possible economic win for Moscow.

Crude prices still have “some room to run with the oil balance looking increasingly tight for the remainder of the year,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. The bank sees Brent averaging $85 a barrel in the fourth quarter.

©2023 Bloomberg L.P.