Oil Drifts Lower on Concern Chinese Stimulus Will Come Up Short

(Bloomberg) -- Oil edged lower on concern that stimulus to revive China’s flagging economic recovery may fall short of expectations.

West Texas Intermediate for August fell from Friday and was trading near $71 a barrel. There was no settlement on Monday in the US due to a holiday. Global benchmark Brent dipped again after losing 0.7% in the week’s opening session.

While China reduced policy rates on Tuesday, it’s gradual roll-out of broader measures for its ailing economy is fueling a debate among traders over how far authorities will go to aid growth. The nation is the top crude importer.

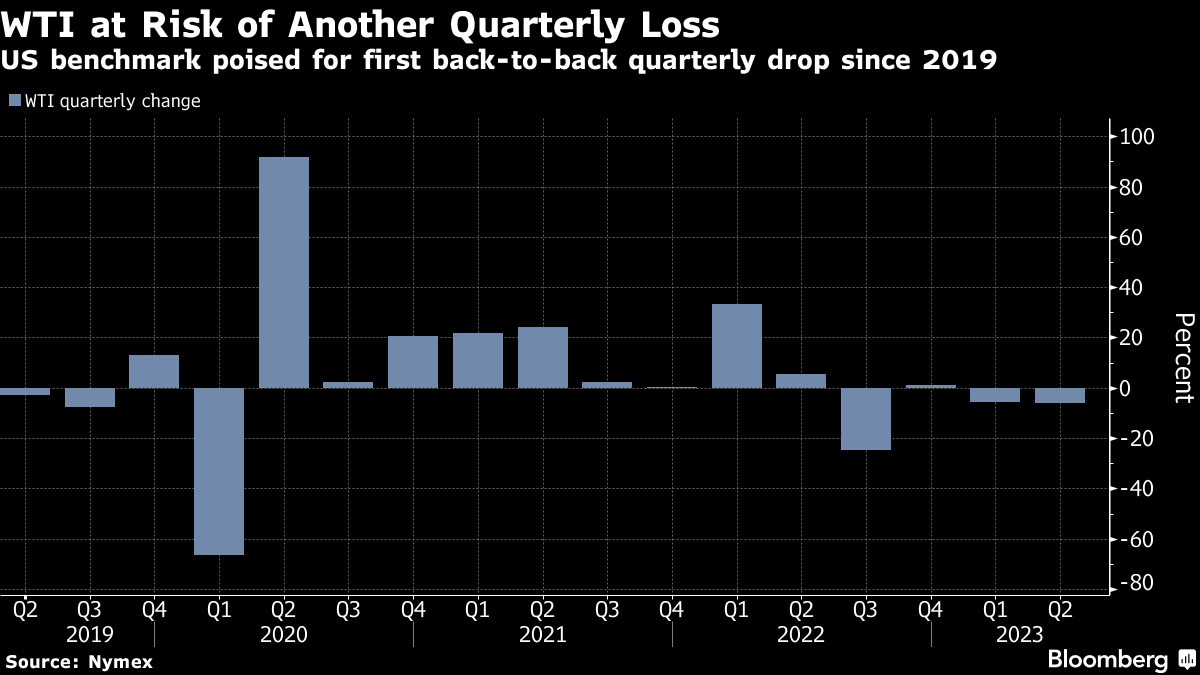

WTI is on course for its first back-to-back quarterly loss since mid-2019. Crude has been under downward pressure amid ample supplies, including from Russia, coupled with slowing global growth as central banks hike rates to quell too-hot inflation. To try to arrest the drop, the Organization of Petroleum Exporting Countries and its allies have scaled back production.

“There’s a growing sense we will see the impact of slowing demand,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd., based in Singapore. While China’s stimulus may benefit oil in the short term, the underlying market appears bearish, he added.

Supplies from the Middle East were also in focus. Iraqi and Turkish officials had been due on Monday to discuss a possible resumption of piped Iraqi oil flows through to the port of Ceyhan. The conduit can carry 500,000 barrels a day.

©2023 Bloomberg L.P.