Oil Dips Ahead of Fed Rate Decision After Two-Day Relief Rally

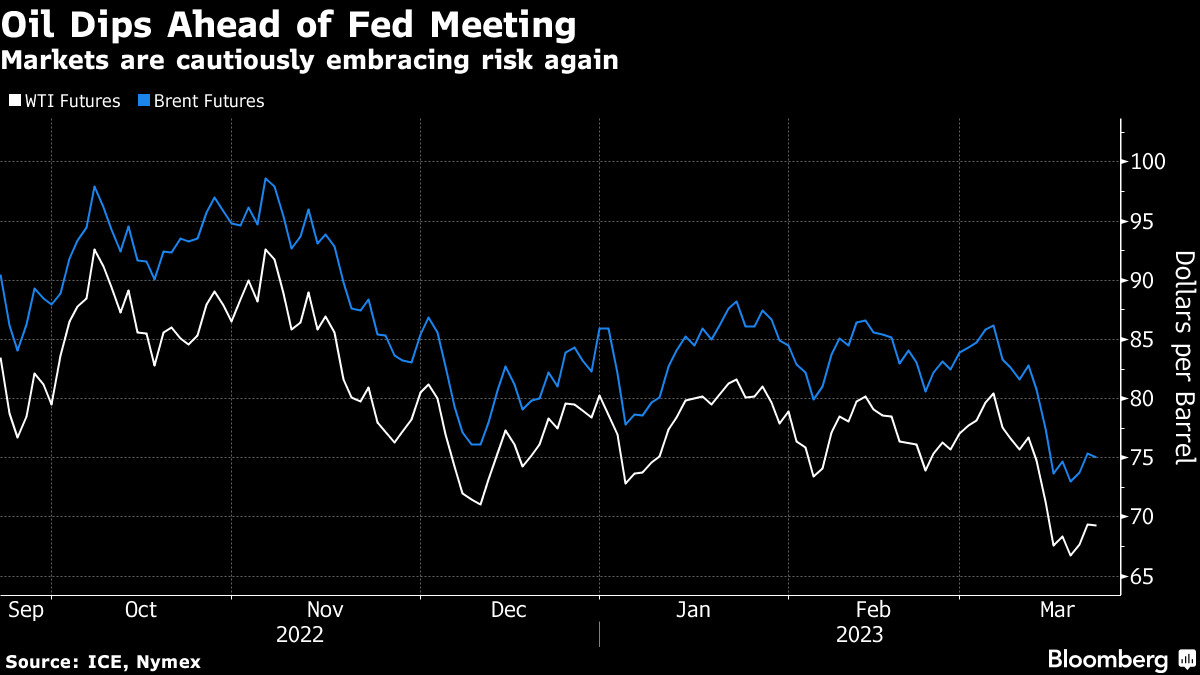

(Bloomberg) -- Oil dipped ahead of an interest-rate decision from the Federal Reserve following a two-day rally that was driven by an easing of concern over banking crises in the US and Europe.

West Texas Intermediate futures traded near $69 a barrel after rising almost 4% over the previous two sessions, as US officials studied ways they might temporarily expand protection for all deposits. Markets are pricing in a roughly 80% chance that the Fed will hike rates by a quarter point on Wednesday.

The banking turmoil drove oil to a 15-month low last week and whipped up volatility across global markets. A raft of market watchers remain bullish on the outlook, in part due to China’s rebound from Covid curbs, with predictions for prices in the second half ranging between $80 and $140 a barrel.

Russian has decided to keep its output at a reduced level through June, taking into account the current situation, Deputy Prime Minister Alexander Novak said. The nation pledged to cut its production by 500,000 barrels a day in March.

“The rally in crude oil prices is taking a breather ahead of the FOMC announcement,” said Charu Chanana, a market strategist for Saxo Capital Markets Pte. Still, futures remain supported by US measures toward covering all deposits and Russia extending its output cut, she added.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions