Oil Holds Loss as Hawkish Powell Spurs Flight From Risk Assets

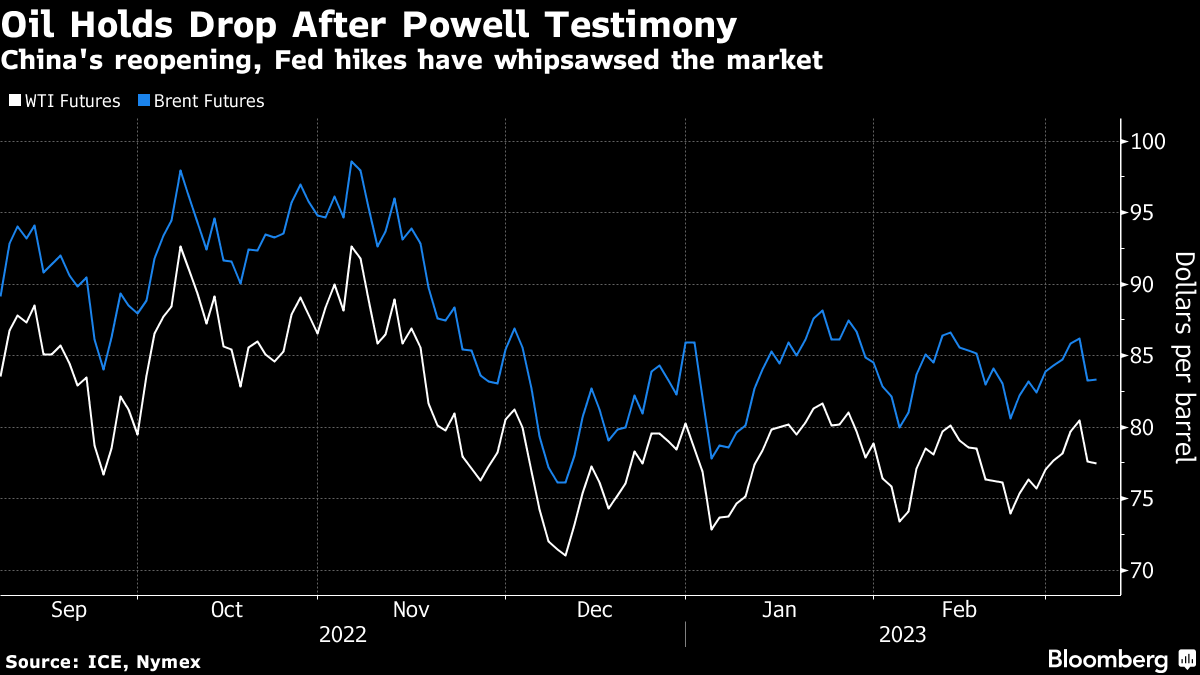

(Bloomberg) -- Oil held a deep loss after Federal Reserve Chair Jerome Powell signaled the central bank is likely to boost interest rates higher and potentially faster than previously anticipated, raising concerns over a drag on demand.

West Texas Intermediate traded above $77 a barrel after closing 3.6% lower on Tuesday, the biggest one-day decline since early January. The remarks, made during a testimony before Congress, opened the door to the Fed lifting interest rates by half a percentage point at the next meeting this month.

Adding to the bearishness, OPEC Secretary-General Haitham Al-Ghais said that slowing oil consumption in Europe and the US poses a concern for the market, even as Asia experiences “phenomenal” growth. Citigroup Inc. also said that global supply is ample and demand remains low.

Oil has had a choppy year as concerns over further monetary tightening from the Fed competed with a bullish outlook for China after the end of Covid Zero. However, the world’s top crude importer this week set a cautious economic growth target for 2023, denting some of the optimism.

“The prospect of rates rising, and to a potentially higher endpoint, may see demand come under pressure,” said James Whistler, managing director of brokerage Vanir Global Markets Pte. “This will most likely offset any bullishness caused by stronger Chinese demand.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions