Oil Advances With Broader Markets on Fed Interest-Rate Signal

(Bloomberg) -- Oil rose along with broader financial markets after the Federal Reserve hinted it might be done with raising interest rates, buoying a shaky demand outlook.

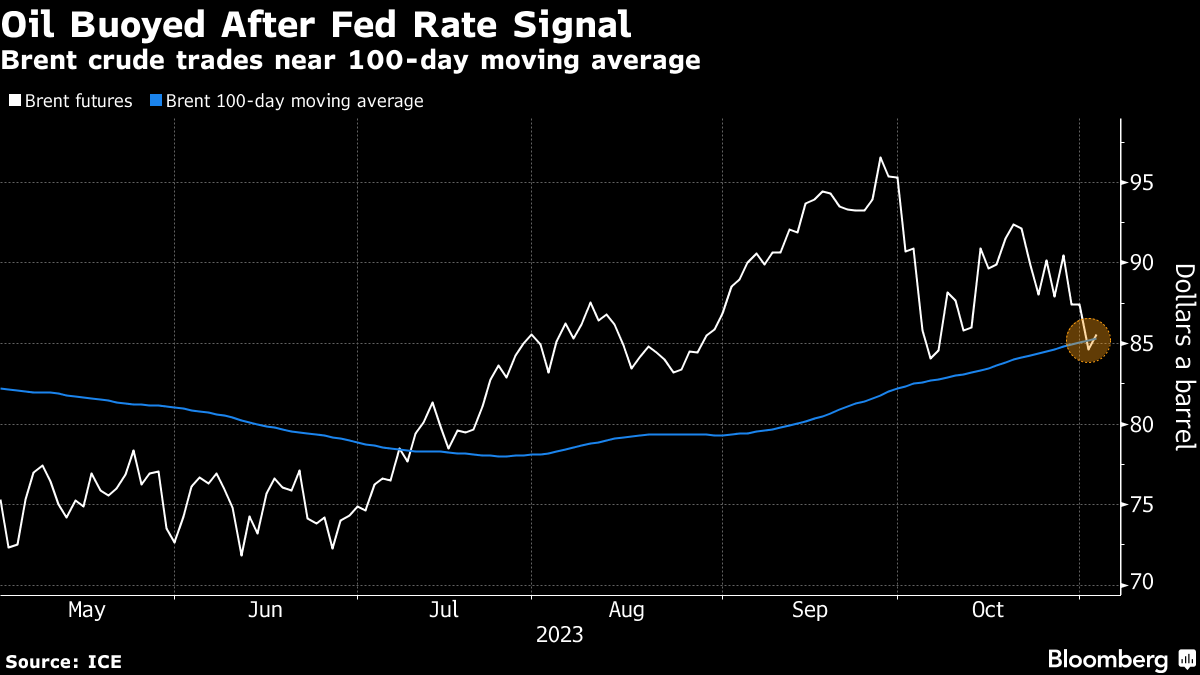

Global benchmark Brent rose past $85 a barrel after falling about 5% over the previous three sessions, while West Texas Intermediate was near $81. The Fed held off raising borrowing costs for a second time on Wednesday and signaled that a recent rise in longer-term Treasury yields reduces the impetus to hike again.

The Israel-Hamas war remained contained. Some refugees were allowed to flee the fighting in Gaza and cross into Egypt. The Qatar-mediated deal required agreement between Israel, Egypt and Hamas. US President Joe Biden called for a pause in fighting to free hostages being held in Gaza but stopped short of supporting a full cease-fire.

Crude has now given up its war premium as fears the conflict would spread across the wider region and disrupt oil supplies have so far failed to eventuate, with oil options pricing in a smaller risk of escalation. That’s spurred a shift in attention to signs the global demand outlook is weakening. Manufacturing in China, the biggest crude importer, moved back into contraction last month.

While oil still faces an overhang from the Israel-Hamas war, “the Fed’s less hawkish message supports the growth outlook,” said Charu Chanana, a market strategist with Saxo Capital Markets Pte in Singapore. “As major central banks take a dovish turn, crude oil prices may find some support, but no one is ready to talk about rate cuts yet.”

US nationwide stockpiles rose for a second straight week, expanding by 773,000 barrels, according to Energy Information Administration data. Inventories at the Cushing, Oklahoma oil storage hub, also increased.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions