Oil Dragged Lower as OPEC+ Discord Forces Delay to Key Meeting

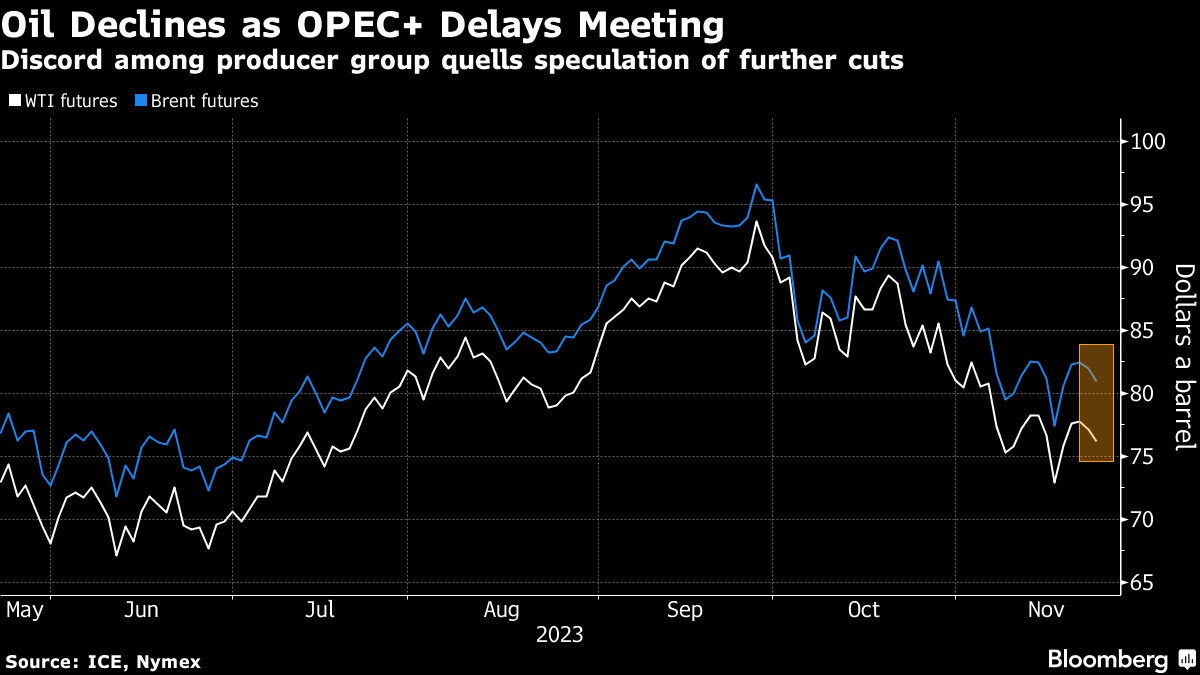

(Bloomberg) -- Oil fell as discord within OPEC+ forced the group to delay an upcoming meeting, quelling speculation of further production cuts by the Saudi-led alliance just as US data showed a hefty rise in stockpiles.

Global benchmark Brent sank below $81 a barrel after a volatile session on Wednesday that saw prices swing by more than $4. OPEC+ delayed the meeting to the end of the month as disputes arose over quotas for African members including Angola. Trading on Thursday will likely be thin due to the US Thanksgiving holiday.

The looming OPEC+ meeting has been clouded by indications that output outside of the group is expanding, prompting speculation the cartel would decide to extend production cuts or possibly deepen them. Amid signs of abundant supplies, Europe is contending with a glut due to a combination of lackluster demand and an influx of US cargoes.

The OPEC+ meeting delay “heightens the drama, probably not the outcome,” Citigroup Inc. analysts including Eric Lee said in a note. Saudi Arabia is still expected to roll a 1-million-barrel voluntary cut into 2024, while other members broadly commit to existing quotas through next year, they said.

The pre-meeting volatility saw options markets take a bearish turn. Traders were paying the biggest premiums in several months for contracts that profit from falling prices. That’s a sharp reversal from a month earlier, when the war between Israel and Hamas sent traders scrambling for bullish call options.

©2023 Bloomberg L.P.