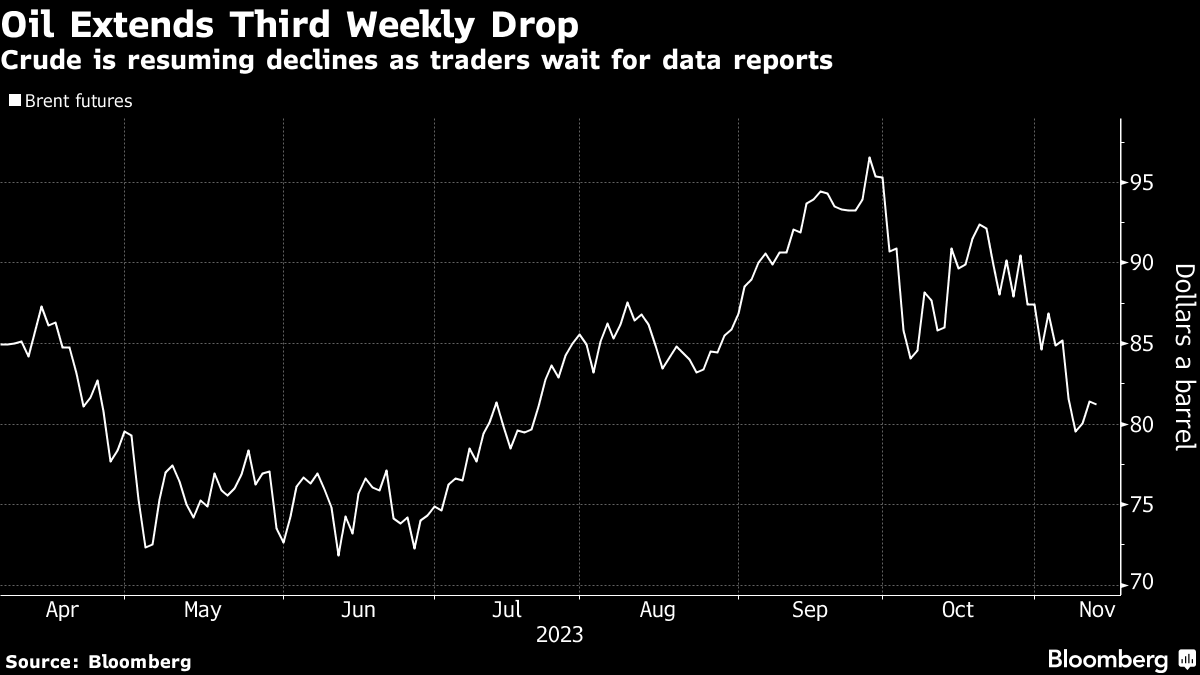

Oil Extends Three Weekly Drops With Focus on Demand Outlook

(Bloomberg) -- Oil extended three weeks of declines as traders wait for industry reports to confirm whether the recent run lower has been overdone.

Brent crude dropped below $81 a barrel, after losing about 12% over the past three weeks on growing concerns over global demand and the unwinding of the Israel-Hamas war’s risk premium. West Texas Intermediate traded near $76. OPEC will publish its monthly market report on Monday, followed this week by the International Energy Agency and two weeks’ worth of US inventory data.

“The release of several oil market reports this week will be the focus,” ANZ Group Holdings Ltd. analysts Brian Martin and Daniel Hynes said in a note. “Any signs of tightness may shift sentiment that has been weakened by easing geopolitical tensions.”

Oil rebounded slightly at the end of last week after Wednesday slipping below $80 for the first time since July, with bearish consumption signals from China, the US and Europe prevailing. Supply from the Middle East — the source of about a third of the world’s crude — has remained unaffected by the conflict between Israel and Hamas, while shipments from Russia and the US are increasing.

Over the weekend, Israeli jets struck Hezbollah targets in Lebanon in another sign a second front could open in the conflict. Senior officials in Israel and the US suggested that talks on securing the release of Hamas-held hostages are intensifying.

Meanwhile, Iraqi Oil Minister Hayyan Abdul Ghani is visiting the Kurdistan region to discuss the resumption of exports via Ceyhan in Turkey. The major pipeline has been halted since March because of a dispute between Turkey and Iraq and was also damaged by an earthquake.

Increased supply was one of the factors that led Goldman Sachs Group Inc. to cut its average Brent price forecast for next year by $6 to $92 a barrel. The bank still remains bullish on demand, expecting growth of 2.5 million barrels a day in 2023 and 1.6 million barrels a day in 2024, analysts including Samantha Dart and Daan Struyven wrote in a note dated Nov. 12

Prompt spreads are signaling a wait-and-see attitude, with the price difference between WTI’s two nearest contracts holding near parity on Monday. That compares with a bullish backwardation structure of $1.34 a month ago.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets