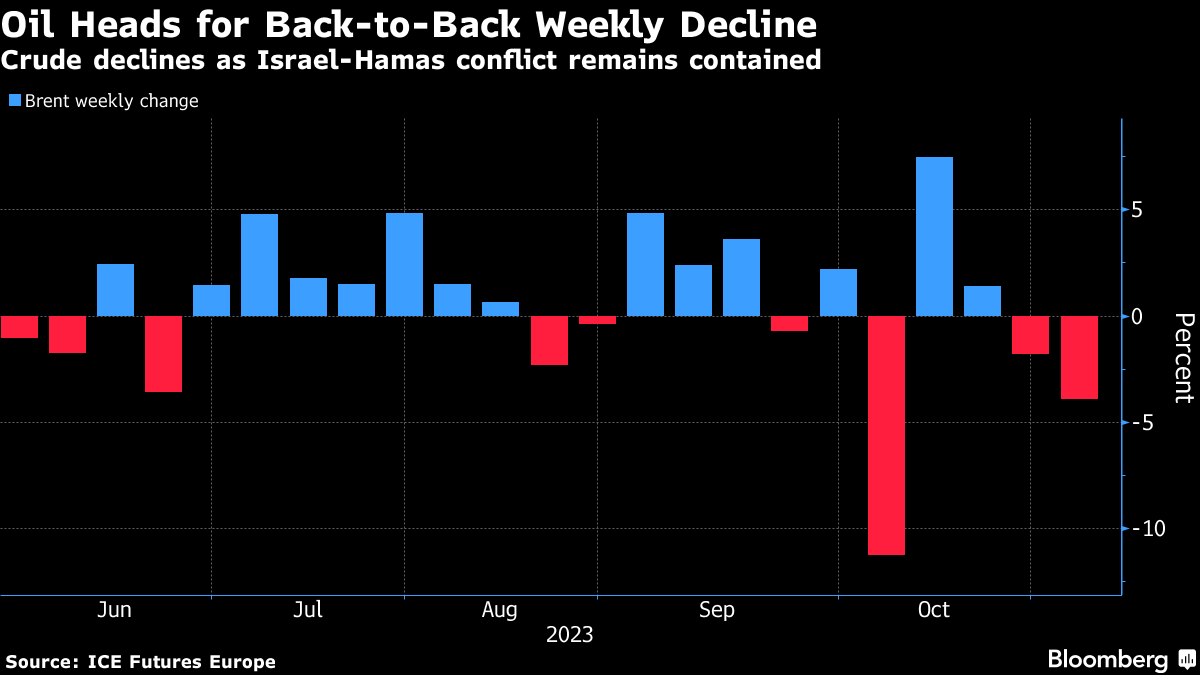

Oil Heads for Second Weekly Drop as Israel War Still Contained

(Bloomberg) -- Oil was set for a second weekly loss as the Israel-Hamas war remained contained and clouds appeared on the demand horizon.

Global benchmark Brent held near $87 a barrel, after jumping 2.6% on Thursday amid dollar weakness and hints the Federal Reserve is done with tightening. West Texas Intermediate traded above $82. Israel said its troops encircled Gaza City and that a cease-fire wasn’t on the table, even as US President Joe Biden called for a pause to allow time to free more hostages.

There are still risks the conflict could spread and affect oil markets, however. Iran-backed Houthi rebels in Yemen have launched rockets and drones at Israel, while Saudi Arabia’s military is also clashing with the militant group.

“The fact that Israel’s ground invasion of Gaza has commenced without expanding the Israel‑Hamas war has given hope that disruptions to oil supply and trade can be avoided,” Vivek Dhar, an analyst at Commonwealth Bank of Australia, said in a note. Still, “any direct involvement of Iran in the Israel‑Hamas war will initially take Brent oil futures to $100 a barrel.”

Crude has mostly given up its war premium as the conflict hasn’t endangered supplies from the region, the source of about a third of the world’s oil. That’s brought demand concerns back to the fore. Factory activity in China, the biggest importer, moved back into contraction last month, according to data released this week, while US fuel demand remains low and crude stockpiles are rising.

There are also signs of weakening diesel demand in some European countries, with sales slumping in Spain, the UK, Italy and France in September.

Elsewhere, the US stepped up pressure on the United Arab Emirates, a key OPEC producer, in the latest round of Russia-related sanctions. The measures are aimed at entities which trade goods that can be used as dual-use items for President Vladimir Putin’s war in Ukraine and financial services firms.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions