Oil Set for Third Weekly Drop as Demand Fears Outweigh War Risk

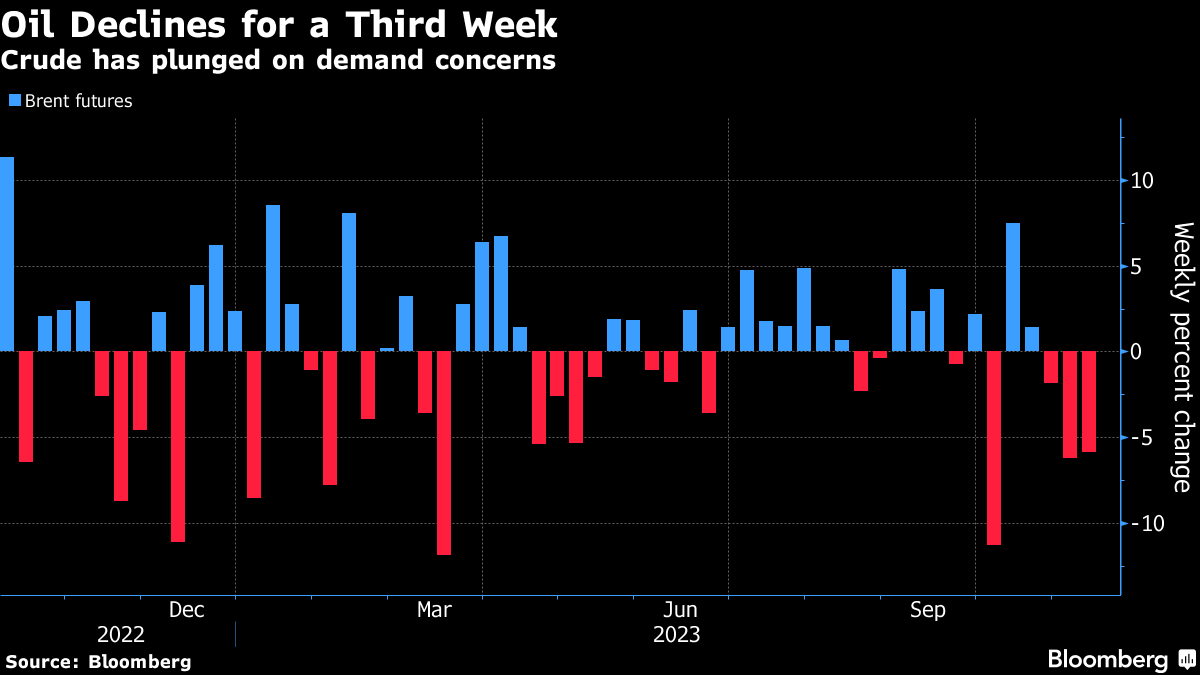

(Bloomberg) -- Oil headed for a third straight weekly drop on growing concerns over global demand and the unwinding of the war-risk premium, while Saudi Arabia blamed speculators for the decline.

Global benchmark Brent crude edged higher past $80 a barrel on Friday, but is down around 5% this week. West Texas Intermediate was close to $76. Prices rose Thursday after comments by Saudi Energy Minister Prince Abdulaziz bin Salman that were similar to his criticism of speculators in May, weeks before the kingdom cut output.

Brent has plummeted around 13% over the past three weeks on bearish demand signals from China, the US and Europe, while flows from the Middle East remained unaffected by the Israel-Hamas war. Hedge fund manager Pierre Andurand also pointed to larger-than-expected supplies — citing high production in the US and Iran — as a catalyst for the recent retreat.

It’s a sharp reversal from late September, when Brent flirted with $100 a barrel and the Organization of Petroleum Exporting Countries projected an unprecedented decline in inventories amid record fuel demand and the Saudi cuts. Attention has now shifted to a refining downturn in China and stubbornly high interest rates in the US.

“Investors are wary of a global economic slowdown possibly denting demand for fuel, and that’s completely negating the fear of conflict escalation in the Middle East,” said Priyanka Sachdeva, a market analyst at Phillip Nova Pte. The recent plunge is unwarranted and “prices are likely to find support on reduced supply and potential bottlenecks in the Persian Gulf,” she said.

Diesel — a key fuel powering the economy — is becoming the latest drag on oil, with US futures slumping about 8% this week. That echoes softness in Europe, where declines in industrial and economic activity in Germany, France and Spain have driven a sharper retreat of fuel consumption.

The rapidly souring sentiment has caused WTI’s prompt spread to flip to a bearish contango structure, where near-term prices are below longer-dates ones, for the first time since July. The turnaround comes as American production rises to a record and stockpiles at the nation’s top storage hub come off critically low levels.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz